The CX-2 bridge plug, a solid and tested base for cement plugs designers to deliver enhanced efficiency and reliability, has been successfully deployed for the 1,000th time by Coretrax, a global leader in oil and gas well integrity and production optimisation.

The milestone was achieved for a project in the North Sea, with Coretrax revealing the CX-2 has now been deployed for more than 40 customers across 12 regions since its initial launch in 2012.

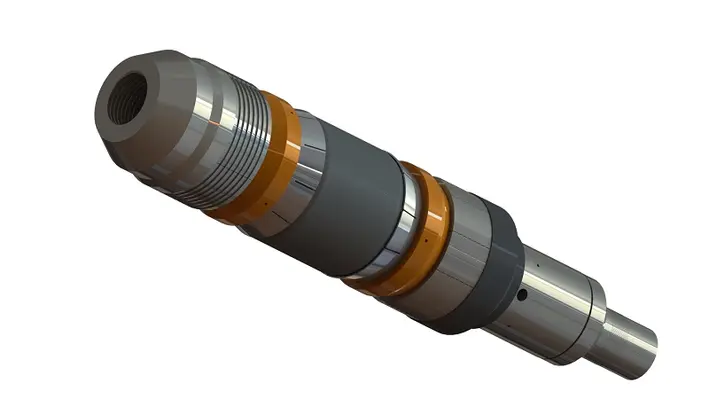

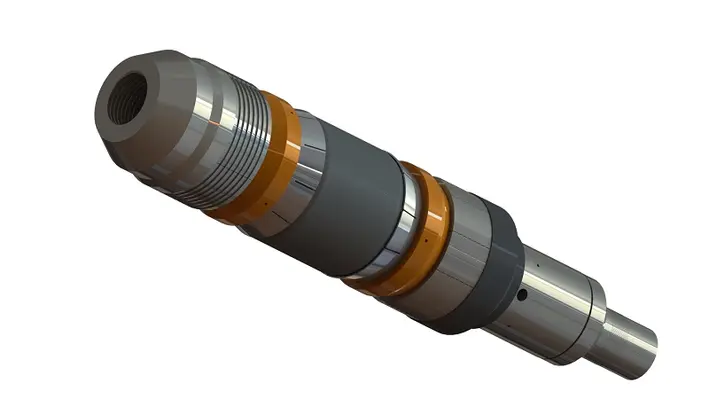

The CX-2 permanent cast iron bridge plug is constructed of drillable materials and features a built-in setting mechanism. It is set with both hydraulic pressure and mechanical pull and has an innovative release system, with a slim outer diameter (OD), a large inner diameter (ID). This allows cementing operations to be completed as part of the one trip system whilst minimising cement disturbance, ultimately eliminating the need for a dedicated cementing trip and further reducing rig time.

According to Coretrax, the solution has saved an average of three hours per run and so far delivered 3,000 hours of rig time savings for operators.

John Fraser, Coretrax CEO, remarked, “Coretrax has a long history and proven track record in the UKCS, so it is fitting that we achieved this milestone deployment in the North Sea. Our CX-2 bridge plug is a staple in our portfolio and has built an unrivalled reputation for delivering cost and time efficiencies in P&A operations.

“As the decommissioning sector continues to ramp up, our innovative technology combined with our experienced personnel allows us to remain at the forefront of well abandonment and able to tackle to most complex well challenges, while delivering greater efficiencies.”

Expro, a provider of energy services, has expanded its portfolio of cost-effective, technology-enabled services and solutions within the subsea well access sector by completing the acquisition of PRT Offshore.

Based in Houston, US, PRT Offshore is the only company to provide a complete Hook-to-Hanger solution which enables comprehensive well completions, interventions and decommissioning services from surface to subsea.

In completing the acquisition, Expro expands its portfolio within the subsea well access sector in the North and Latin America. On the other hand, it will help accelerate the growth of PRT Offshore’s surface equipment offering in Europe, sub-Saharan Africa and Asia Pacific.

Michael Jardon, Expro Chief Executive Officer, remarked, “This is an exciting day for both PRT Offshore and Expro as we strengthen and expand our subsea well access technology offering while continuing to deliver value to our customers across the life of their wells.

“Our subsea well access portfolio has a well-established global footprint, especially in the ESSA and APAC regions. We believe this will offer significant growth opportunities for PRT Offshore in these attractive markets. Simultaneously, Expro plans to leverage PRT Offshore’s strong position in deepwater offshore well completion and intervention across the NLA region to provide integrated solutions to our customers.”

PRT Offshore President, Patrick Place, added, “We are looking forward to embarking on this next phase of our journey with Expro. This agreement is an exciting development for PRT Offshore as we integrate our technology, solutions, and expertise with Expro’s market-leading subsea well access portfolio.

“We are excited to continue our best-in-class responsiveness and service quality, as well as leverage the resources of a more robust platform. Our employees, vital and valued, are at the forefront of this transaction, and we are committed to fostering their growth and success in this new chapter. Building on the foundation we have created, this acquisition will open new opportunities for growth, innovation, and success for our company, customers, and employees.”

Well-Safe Solutions, a well plug and abandonment specialist, has strengthened its commercial team by hiring Paul Simpson as Business Development Manager in a bid to continue its international growth strategy.

Simpson has more than 25 years’ experience in global well intervention management and business development, including time spent as part of a multi-skilled well abandonment team tasked with delivering the safe abandonment of bp’s North West Hutton project in the North Sea.

Simpson remarked, “I’ve watched with interest the continuing growth of Well-Safe Solutions over the past few years, with the creation of Well-Safe Solutions and the Well-Safe Resources service line underlining the company’s continued expansion this year.

“Throughout my career, I’ve prided myself on successfully integrating service lines to boost efficiency and answer specific challenges facing clients, building mutually-beneficial relationships in the process.

clients, building mutually-beneficial relationships in the process.

“I’m looking forward to contributing to the company’s continued growth as we target clients across the land and offshore well decommissioning markets in a number of geographies worldwide.”

Chris Hay, Director of Strategy and Commercial, commented, “I’m delighted to welcome someone of Paul’s calibre to Well-Safe. Paul’s arrival comes at an exciting time for the business, as we continue the implementation of our international growth strategy as well as strengthening our position in the North Sea market.

“Building on his considerable experience and skills in client management, Paul will work closely with our customer base to identify new opportunities and develop solutions for safe and efficient well decommissioning.”

Getech, a world-leading locator of subsurface resources, has completed a geothermal study for Angus Energy, outlining significant potential in a UK development.

Getech, a world-leading locator of subsurface resources, has completed a geothermal study for Angus Energy, outlining significant potential in a UK development.

Angus Energy is committed to utilising its oil and gas drilling and engineering expertise to develop geothermal energy projects. To achieve this, the company enlisted Getech’s subsurface proficiency to locate and access promising areas for geothermal energy production in southwest England.

Getech delivered an in-depth geoscientific interpretation that included structural mapping, depth estimation and heat flow analysis. The assessment enables Angus Energy to make informed decisions regarding future development projects.

Richard Bennet, Acting Ceo AT Getech, said, “Given the drive for new was to decarbonise operations and provide consistent heat and power, investment in alternative energy sources such as geothermal is ramping up. Getech’s subsurface and geoscience expertise is helping Angus Energy take an important step toward developing sustainable energy solutions that bolster the UK’s energy security and advance decarbonisation efforts.”

Richard Herbert, CEO of Angus Energy, commented, “We are pleased to have made good progress in bringing some of our traditional skills and focus on subsurface assessment out of the world of hydrocarbons into that of alternative energies. We are grateful to Getech for their professionalism which will assist in de-risking future geothermal drilling programmes by all players in this developing sector.”

Baker Hughes has been awarded two contracts from Vår Energi in order to expand its regional presence in the North Sea for exploration logging, well intervention technology and subsea production systems.

Baker Hughes has been awarded two contracts from Vår Energi in order to expand its regional presence in the North Sea for exploration logging, well intervention technology and subsea production systems.

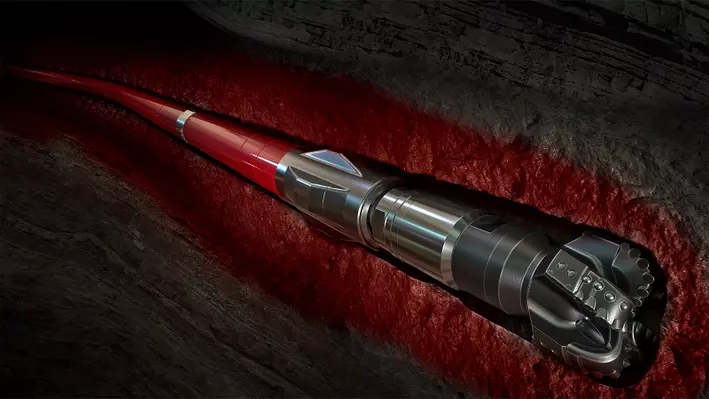

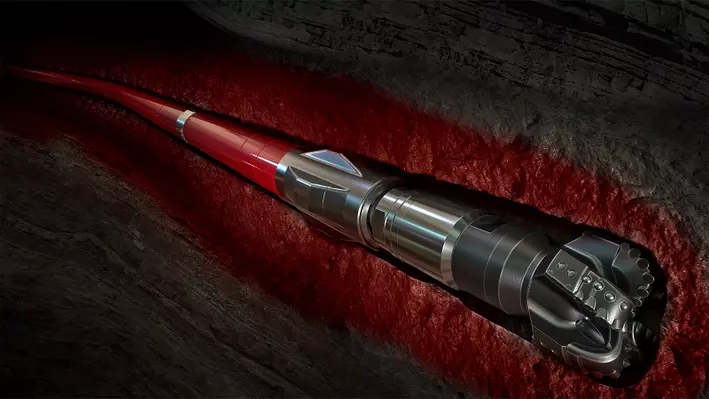

The first contract is a nine-year engagement that will utilise Baker Hughes’ well intervention capabilities gained through the acquisition of Altus Intervention back in April.

Alongside the intervention scope, Baker Hughes will supply all exploration logging solutions to help Vår Energi further develop its prospects on the Norwegian Shelf. The contract allows for a seamless integration of Baker Hughes’ technologies into the wider operations of Vår Energi, enabling a powerful impact of its efforts to reduce carbon emissions.

The second contract is for the delivery of a bespoke Balder field vertical tree system, a Baker Hughes’ specialist technology suitable for the complexities of this field. The agreement will span 15 years, and includes the support for existing Balder legacy wells and future developments in the Balder area.

Maria Claudia Borras, Executive Vice President, Oilfield Services & Equipment at Baker Hughes, said, “Baker Hughes has an extensive and successful history of creating value for customers in Norway and the North Sea. The two long-term contract awards from Vår Energi enable us to deploy our superior portfolio not only in well intervention, but also in exploration logging and subsea production.

“Combining our technology, our exceptional regional expertise, and our dedication to a world-class customer experience ensures successful outcomes for both companies.”

MB Century (MBC), an engineering and maintenance specialist for the geothermal and hydro sector, has partnered with GNS Science (GNS), a research institute, to support the geothermal industry in the Philippines and across the globe.

The agreement, which was announced on the eve of the 4th Philippine International Geothermal Conference (PIGC), focuses on supporting the Philippines geothermal sector in achieving the decarbonisation goals set by the Government. The two will combine their expertise to support international partners in their efforts to achieve efficient and sustainable solutions in geothermal development for the country and other key international markets such as Indonesia, Taiwan and Japan. Further plans are in place to expand into the USA, Kenya, Tanzania, Ethiopia, Djibouti, Turkey, Italy and South America.

Gary Wilson, General Manager of Research, Strategy and Partnerships at GNS Science, remarked, “This partnership is a great example of New Zealand companies working together to leverage New Zealand expertise globally. Both MB Century and GNS Science have worked at the forefront of geothermal energy development and optimisation for decades.

“We are motivated to share our collective experience with other countries globally to maximise the potential of this renewable energy resource.”

Greg Thompson, CEO MB Century, added, “This agreement provides a robust framework for our geothermal cooperation, encompassing joint investigations, international projects, scientific and technical exchanges, and personnel growth and development.

“We are excited about the possibilities that lie ahead and look forward to a fruitful partnership with GNS Science as we pioneer innovative solutions in the field of energy.”

Shearwater GeoServices, a global provider of marine geophysical services, has successfully completed a carbon storage survey project for TotalEnergies.

The survey covers a CO2 geological storage license in the Danish North Sea which was awarded to TotalEnergies in February 2022.

Irene Waage Basili, CEO of Shearwater, commented, “Carbon capture and storage is key to achieving net zero targets and Shearwater is committed to playing its part in enabling this technology to scale. We are pleased to be working with a number of clients on seismic for storage projects. Together with our clients we are learning what this emerging market requires in terms of data. Shearwater brings its extensive operational experience and technology tool kit to this dialogue.

“With each project we expand our understanding and build on our capabilities and experience. We will continue to deploy our expertise and our technology in this emerging market to provide our clients the data they need to make better decisions about their reservoirs.”

The completion of the project marks yet another successful survey the company has conducted within the field, adding to a growing list. In the last two years the company has secured multiple seismic for storage acquisition projects across multiple projects. These have been diverse and require different solutions to achieve the high-resolution imaging needed for evaluating reservoirs for storage application.

Shearwater has successfully utilised hybrid methods with both towed streamers and nodes, new acquisition geometries and worked closely with third party bathymetric service providers for high-resolution data to analyse the seabed and shallow geology in shallow water environments. In addition to acquisition, Shearwater has secured several projects processing and reprocessing data for storage applications.

Halliburton has introduced the BaraFLC Nano-1 wellbore sealant, a nanocomposite suspension that boosts wellbore stability.

The new sealant works with Halliburton’s existing conventional and high-performance water-based fluid systems to create a tighter, more secure seal that decreases fluid loss into the formation. It uses nanoparticles to reduce interaction between filtrate and reactive shale formations, preventing pore pressure transmission. This helps strengthen wellbore integrity.

“In many areas around the world, our customers require high-performance water-based fluid systems to maximise the value of their wellbore,” said Toby Dixon, Senior Vice President, Halliburton Baroid. “We developed nanotechnology that results in a step change compared to conventional sealants and rivals the performance of oil-based fluids.”

Sold as a liquid, BaraFLC Nano-1 sealant reduces bag waste and airborne dust. It comes in ready-to-inject form and easily mixes with water-based fluids, which can reduce non-productive time.

BaraFLC Nano-1 was used in Oman, where it reduced dilution rates, lowered fluid viscosity, and tightened filtration rates during a 22-day interval with maximum downhole temperature >300ºF.

Fervo Energy, a leader in geothermal technology, has marked the start of exploration drilling at its Cape Station, US, with a groundbreaking ceremony.

The next-generation geothermal energy project is expected to deliver 400MW of 24/7 electricity after it reaches full scale production in 2028.

Principal Deputy Assistant Secretary for Land and Minerals Management, Laura Daniel Davis, commented, “At the Interior Department, we have been moving quickly to meet President Biden’s goal of achieving a carbon pollution-free power sector by 2035. The Cape Station geothermal energy project we are celebrating today is an important milestone in our effort to make that goal a reality.”

The project will likely be the first of many designed to exploit the vast geothermal potential Utah is home to. It is estimated that just the southwest portion of the state contains more than 10GW of high-quality geothermal reserves.

Utah Governor, Spencer Cox, remarked, “Geothermal innovations like those pioneered by Fervo will play a critical role in extending Utah’s energy leadership for generations to come.”

Light Structures AS, a leading supplier of fiber optic condition monitoring systems based on Fiber Bragg Grating (FBG) technology, has signed an MoU with independent energy expert, DNV, to develop new methodologies and solutions around structural health monitoring and digital twins.

The two companies share a vision to advance solutions with the two technologies in order to improve safety at sea as well as achieving new operational efficiencies and reducing asset lifecycle maintenance costs.

DNV and Light Structures will leverage the value in structural integrity monitoring data acquired through the latter’s SENSFIB systems for complex marine and offshore projects. They will collaborate on diverse areas including customer requested project and solutions design, modelling and hydrodynamic analysis, hybrid twin databases, interfacing, instrumentation, installation and commissioning, and co-marketing.

Niklas Hallgren, CEO of Light Structures, commented, “Digitalisation in the maritime sector has streamlined our ability to widen the scope of applications that structural integrity data can benefit, so we are looking forward to exploring new workstreams and project implementations through our work with DNV.”

Brice Le Gallo, Vice President and Regional Director for Energy Systems, APAC, DNV, added, “Our collaboration with Light Structures unlocks the potential to boost digital twin fidelity, resulting in new levels of operational insight for our engineers and customers.”

GreenFire Energy Inc. (GreenFire) has partnered with Stoic Transitional Resources Inc. (Stoic), to jointly develop geothermal projects through the utilisation of abandoned assets in New Zealand and Western Canada.

GreenFire Energy Inc. (GreenFire) has partnered with Stoic Transitional Resources Inc. (Stoic), to jointly develop geothermal projects through the utilisation of abandoned assets in New Zealand and Western Canada.

GreenFire will utilise its patented closed-loop technology, GreenFire’s GreenLoop, to transform idle oil and gas wells into productive geothermal assets, with Stoic will provide its expertise and access to geothermal resources in New Zealand and oil and gas resources in Western Canada.

GreenLoop is a closed-loop Advanced Geothermal System (AGS) which can economically access the entire spectrum of geothermal and certain oil and gas resources, with the technology enabling operators and developers to retrofit idle wells, expand existing fields with new wells and de-risk the development of new geothermal resources quickly.

Steven Brown, VP Project Development for GreenFire Energy, said, “GreenFire Energy is implementing our patented GreenFire’s GreenLoop technology in geothermal projects across the globe. This partnership has the potential to accelerate geothermal energy developments in New Zealand and Western Canada and expand our reach to bring clean energy and economic vitality to new regions.”

Phil Keele, COO for Stoic’s Calgary branch, commented, “We firmly believe that the alliance between GreenFire Energy and Stoic Transitional Resources encapsulates a transformative energy philosophy that will resonate with the global public. Together, we’re positioned to usher in an era defined by carbon-free, green electricity, that generates gigawatt hours of power while championing environmental stewardship.”

The developer of ocean robots for autonomous services, Nauticus Robotics, Inc., has announced its entry into a service contract with Shell plc for inspection services on a Shell subsea field development in the Gulf of Mexico.

The developer of ocean robots for autonomous services, Nauticus Robotics, Inc., has announced its entry into a service contract with Shell plc for inspection services on a Shell subsea field development in the Gulf of Mexico.

Aquanaut, Nauticus’ flagship autonomous robot, will serve as the project’s main machine and perform noncontact and contact inspections across the subsea complex. This project will feature Nauticus’ first-to-market method of autonomous subsea manipulation on live subsea assets in water depths exceeding 1,000 m.

The project will also feature a ‘force multiplier’ solution, boasting multiple scopes of work to be executed simultaneously from a smaller class service vessel that would not normally engage in IMR services. This agreement will see both Nautiucs and Shell take a major step in maturing a novel joint approach to underwater operations that could lead to a significant change in technology and service delivery for the offshore sector.

Nicolaus Radford, CEO of Nauticus, said, “I am incredibly pleased with the progress the team has made in our collaboration with Shell and to embark on this new project with one of the world’s leading energy companies. Nauticus now has visibility long term IMR services work for Shell and the opportunity to become the preferred supplier for this advanced work.

“We recognise the significance of this opportunity with Shell and look forward to the execution of this project work.”

Page 64 of 118