Harbour Energy, the operator of the Viking CCS CO2 transportation and storage network, has announced that the Planning Inspectorate has accepted for examination its application to build the Viking CCS onshore CO2 transportation pipeline in the UK.

The 55 km pipeline will transport captured CO2 from the Immingham industrial area to the former Theddlethorpe Gas Terminal site. From there, it will be sent to the depleted Viking gas fields, located 2.7 km under the seabed for permanent storage.

The pipeline is considered a key component to decarbonise and rejuvenate the industries of the Humber, potentially unlocking UK£7bn of investment across the full CO2 capture, transport and storage value chain over the next decade. The acceptance by the Planning Inspectorate is the next stage in the process to acquiring a Development Consent Order (DCO) for the pipeline and follows a comprehensive programme of consultation and engagement with local communities and stakeholders.

“This is another critical step forward towards delivering our Viking CCS project, which will create thousands of jobs in the Humber region and is targeting 10 million tonnes per annum of CO2 emissions reduction by 2030, vital for the UK to deliver its climate ambitions,” remarked Viking CCS Project Director Graeme Davies.

McDermott, a fully-integrated provider of engineering and construction solutions to the energy industry, has been awarded an engineering, procurement, removal and disposal contract by Santos for the full removal and disposal of the Campbell platform structure.

The platform is part of the Varanus Island Hub offshore Western Australia. McDermott has agreed to provide project management and engineering services for the removal and transportation of the platform topsides, structure and associated items to an onshore facility. There to be dismantled and disposed.

Mahesh Swaminathan, McDermott's Senior Vice President, Subsea and Floating Facilities, remarked, “Our successful, proven track record of project delivery spans the entire energy value chain. This decommissioning award reflects the commitment we share with Santos to timely, safe, and environmentally responsible removal of infrastructure at the end of its operational life cycle. We look forward to continuing to be part of delivering their sustainability commitments while also contributing to the circular economy for a lower carbon future.”

The contract is regarded as ‘sizeable’ by McDermott, being between US$1mn and US$50mn. The project management and engineering will be conducted by the company’s team in Perth with support from Indonesia and Malaysia. It represents the fourth decommissioning contract executed by McDermott in the country in the last two years.

The Offshore Well Intervention Australia 2023 Conference was carried out earlier this month as a host of industry experts and key stakeholders in the offshore community arrived in Perth for two days of engrossing seminars, presentations, panel discussion and (of course) extensive networking.

There were many highlights from the conference which provided an extensive ranging of talking points for those in attendance. A presentation by a NOPSEMA representative was an early point of interest which provided an insight into where the Australian regulator saw gaps in technology within the industry and what are the requirements for bringing new technology into the fold.

Attendees were also invited to hear how ExxonMobil has been creating a culture of innovation and improvement, where biases can be challenged and leadership teams are more receptive to new ideas. The ExxonMobil presenter noted and reviewed why this culture is so important and how it can help in upcoming campaigns as every participant’s ideas are valued, allowing for the continuous development of techniques and ideas to complete projects efficiently and effectively.

Then, in a memorable panel discussion that was described by a later presenter as one of the most memorable on the subject he had ever seen, participants from CCS Energy, NOPSEMA, Asia Pacific Energy Solutions and CO2Tech sat down to provide their thoughts on the CCS market in Australia. In the session, the speakers provided a detailed insight into the challenges and opportunities posed by the CCS market in the region, what are the advantages and disadvantages of repurposing ageing wells for CO2 storage, and how regulatory pressures are shaping the environment. Read more about what was said in the session here: https://offsnet.com/content/australia/meeting-emission-reduction-targets-through-ccs

Stringing the two days together was a myriad of presentations from technology providers and service providers outlining how their solutions were ready to support Australia’s offshore community for its well intervention requirements. In this vein, on the exhibition floor stood the likes of TAM International, Oilenco, Impact Selector and WELLVENE ready to display their wares to the gathered delegates. The onsite representatives provided some thoughts to Offshore Network on how their organisation was perceiving the Australian market:

Alastair McGregor, Business Development Manager at TAM International, remarked, “For Australia I think there's a lot of potential growth. The legislative, government and regulatory bodies have perhaps worked against themselves somewhat and lobbyists have perhaps been able to derail some projects that actually didn't have a lot of risk but were perceived as high risk.

“However, we have definitely seen a massive uptick in the whole P&A space but also routine well intervention here. P&A is definitely a major part of what we do and plugs and packers are integral to some of the operations around P&A. We are also seeing a bit of an uptick in people understanding how to apply them in the drilling phase as well. But, overall, P&A is definitely a large scope of what we do and is a large area of growth for us here.

“We've attended a few OWI AUS now and this one has certainly been very engaging with regards to the attendees; people definitely want to connect and learn a bit more about each other. We like to participate at events like this because it allows us to talk to more people and engage with them individually. There has definitely been a lot of interest in having those conversations during this event and I think we have at least four or five new leads from this conference.”

Colin Mackie, Country Manager at WELLVENE, said, “The main changes over the last six years for our company in Australia has been utilisation of equipment that is tried and tested in remedial intervention and utilising them in the P&A space. There has been more focus from operators on robust barriers and making efficiencies in deploying those barriers, which is where we've been able to help. As you go through P&A operations you have to consider every possible obstacle you may encounter on these older wells and try and plan contingencies that are efficient yet allow for the unknown, the fact that we are a smaller and more flexible company allows us to provide solutions a lot faster when the unknown does occur, and have a short turnaround on equipment that is bespoke to that particular problem. I think that will remain a big part of what we do in Australia over the next 10 years as well as the building of core products.

“Major growth areas for us as a company over and above the P&A and remedial intervention market would be service, we have some new technologies that allow for significant efficiencies in the Intervention space, and we are keen to work alongside the operators and indeed the contracted service companies to improve the safety and overall efficiency of interventions going forward.

“As a company that is established in Australia already, OWI AUS allowed us to reconnect with some people that we don’t necessarily get to see on a regular basis that have flown in for the event and meet some of the overseas service companies that are coming in to try and introduce their products into our market. It has allowed us to share our story of growth in Australia over the last six years. Furthermore, it allows us to showcase our understanding of Australian market to the clients and operators that are here.”

David Fisher, Business Development Manager at Oilenco, commented, “Oilenco have a strong track record in the North Sea and have been completing abandonment workscopes in this space since 2018. As Australia is becoming increasingly active in this area, we recognise that our technologies are transferable to this market.

“The OWI AUS conference provided us with the opportunity to showcase not only our capabilities but for attendees to see first-hand some of the projects we have completed. From safety valve remedial projects for well intervention workscopes to creating well-barriers for multi-well campaigns for an abandonment workscope. But also, how we deal with the unexpected, creating bespoke solutions to solve parted tubing challenges as an example, and our ability to manufacture, design and engineer these solutions to meet the specific challenges our clients face. It also allowed us to demonstrate how we can become an extension to a project team, with early engagement sometimes being the difference between getting a solution and getting the right solution. When speaking with operators they recognise how our solutions can support their needs.

“From the work we have completed in Australia so far, the feedback we have been getting from clients is very positive, so we look forward to continuing to support this region.”

Steve Irvine, Region Manager Australia-New Zealand-PNG at Impact Selector International, surmised, “This last year has been pretty slow because there's been a lot of projects been pushed back due to various factors such as the regulator and the government just told him things back a bit. So it has been a bit slow but I think it appears that it is going to fruition next year and in the years ahead. This is because these plans will likely now get passed and the major operators are getting their EPs together and better than they have been. So I would say I am optimistic for the future in this region, especially in regards to P&A which appears will be the next big thing here with lots of projects kicking off for that. So that will certainly be a focus for us.

“OWI AUS 2023 was very much what we wanted to happen. The audience was very much in our own line of business, which is good and it has been a while since I've been to conference which has had the right people as this did.”

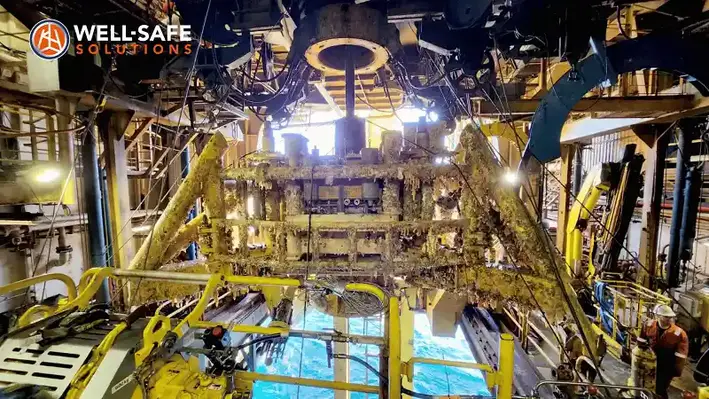

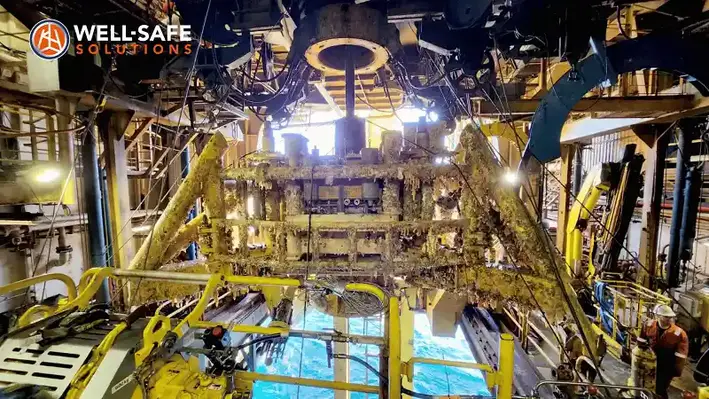

Well-Safe Solutions, a global P&A company, has agreed a global master agreement with bp wherein the decommissioning specialist will provide the operator with project management, well engineering, engineering design and well decommissioning services.

Well-Safe Solutions, a global P&A company, has agreed a global master agreement with bp wherein the decommissioning specialist will provide the operator with project management, well engineering, engineering design and well decommissioning services.

The agreement will last until at least September 2026, with two one-year contract extension options available.

Matt Jenkins, Chief Operating Office at Well-Safe Solutions, said, “Following on from our work with bp decommissioning wells in the North Sea’s Kate field earlier in the year, we are delighted to have been awarded this agreement. This multi-year contract will see us deploy our Well Decommissioning Delivery Process (WDDP), which guides operators through the well plug and abandonment process efficiently and safely.

“Our commitment to safe, smart and efficient decommissioning well enable us to deliver bespoke solutions tailored to bp’s well stock, including the possibility of utilising the Well-Safe Guardian, Well-Safe Protector or Well-Safe Defender plug and abandonment rigs.”

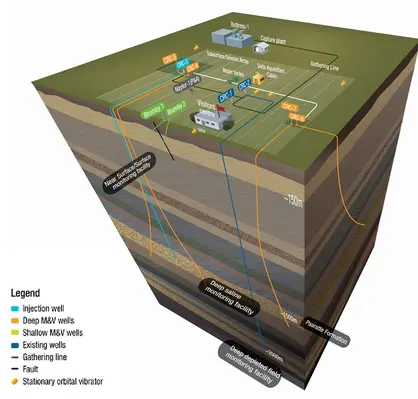

At the recently concluded Offshore Well Intervention Australia 2023 conference held in Perth, a panel of industry experts convened to explore the outlook for the CCS market in Australia.

Together, they considered the ambitious goal of significant emissions reduction by 2030 and how the industry can overcome the time constraints by implementing CCS projects, what opportunities exist or could be put in place to facilitate industry stakeholder collaboration, and how can the industry share knowledge to accelerate CCS adoption and address common challenges effectively.

In the session, Diego Vazquez Anzola, CCS Specialist at APES Energy Evolution, explained, “Acceleration can indeed benefit from industrial and governmental collaboration. Collaboration is important and necessary, but it is not indispensable.

“There are those who point at regulations, or sometimes the lack of them, as the reason for the slow progress of CCS projects in Australia. Australia has the opportunity to not reinvent the wheel and analyse closely the history of other successful projects in other jurisdictions. The few successful commercial scale CCS projects around the world, in or nearing execution, were matured in various timeframes. However, those projects with the most compressed maturation timelines have common denominators, which, contrary to the general belief, are not particularly technical.

“The acceleration of CCS projects around the world has been attained by prioritising simplicity in storage development planning, with phased and calculated strategies for growth and scalability. Furthermore, acceleration has been truly attained by having first a clear understanding of the value generating models, with clear strategies on revenue generation and maximisation. This is indispensable.

“It is when commercial models are clear that industrial collaborations thrive – with a solid strategy towards job creation and workforce re-skilling and with regulators incentivising an environment of knowledge sharing and communication that naturally results in simpler and more streamlined approval processes.

“In summary, industrial and governmental collaboration and knowledge sharing would indeed be beneficial for acceleration. However, commercial clarity is what enables true collaboration towards acceleration.”

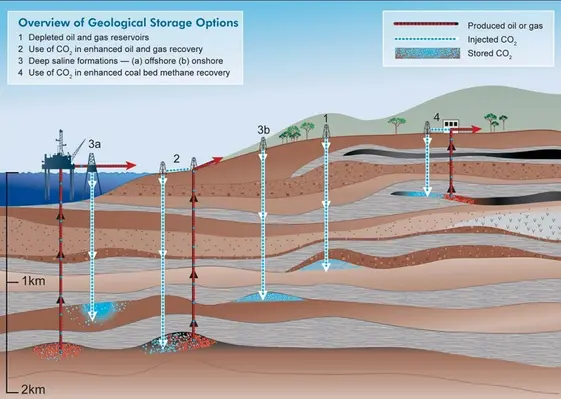

Adding his voice here, Jason McKenna, CCS Strategic Advisor at CO2Tech/CO2CRC, commented, “If I had to choose one word to describe the goal of achieving significant GHG emissions reductions by 2030, it would be ‘challenging’. In Australia, the LNG and gas industries are likely to be the first movers as the capture component is already built in to the CCS value chain. The rate limiting step for significant emissions reductions is likely to be the development of cost-effective large-scale capture technologies for the hard-to-abate sectors. In terms of storage, depleted fields may offer reduced project development timelines in comparison to green-field saline aquifers by avoiding the need for lengthy appraisal programmes and the possible re-use of existing infrastructure.

“Currently, there seems to be more of a competitive rather than a collaborative environment amongst the oil and gas companies in terms of access to geological storage. There is the possibility for the Australian CO2 storage capacity to be ‘over-subscribed’ at the moment due to the number of gazetted GHG permits. It would be disappointing to see a number of individual small-scale CCS developments fail the commerciality test (i.e $/tonne) to the detriment of more commercially efficient hub-scale collaborative CCS developments.

“Another area of collaboration to facilitate timely project development timelines is early and regular engagement with stakeholders, particularly NOPTA and NOPSEMA. CCS is an emerging industry globally and regulators will likely have more confidence to provide timely project approvals if they feel informed and engaged at key project milestones.”

Ageing Wells for CO2 Storage

On exploring the advantages and disadvantages of repurposing ageing wells for CO2 storage, Vazquez Anzola continued, “It is well known that engineers prefer to build from scratch rather than modify existing tools, machines or gadgets. Well engineers around the world concur that newly built wells result in the most effective and safest designs.

“On the other hand, general perception dictates that reutilising infrastructure, including aged oil and gas wells, is the simplest and the most cost efficient solution for CO2 storage development plans that can be matured in the shortest time frame. This is not always the case, and it is rarely the case for scalable CO2 storage hubs.

“Although injecting CO2 in depleted fields is a valid option for commercial scale CCS projects, especially in early phases for CO2 storage hubs, this does not come without technical challenges and can result in extremely complex and/or expensive solutions.

“Traditional oil and gas professionals need to soon understand the concept of ‘permanent storage’ when commerciality of CCS projects is directly dependent on demonstrating to authorities, regulators, shareholders, and the market in general, that every molecule that has been injected is expected to remain sequestered for centuries. A small percentage of leakage after 100 or 200 years or more is considered acceptable in various jurisdictions. The general expectation is that by then, CO2 sequestration would not be as necessary to tackle global warming as it is today.

“As a consequence of these radically different timeframes, risks of loss of containment and mitigation plans embedded in the much needed Measure, Monitoring and Verification (MMV) plans of any CO2 storage project directly affect the design and material selection of future P&A campaigns, as well as all steps required for transforming other infrastructure for CO2 manipulation, conditioning and transportation.

“In a nutshell, initial scale and future scalability of the future CO2 storage hub determines whether or not depleted fields are suitable options. Long term containment risks need to be managed in a cost-efficient but also pragmatic fashion founded on a thorough understanding of these containment risks, their likelihood and their consequence severity.

“However, even when legacy wells are not re-used as CO2 injectors or monitors, they may need to be abandoned more adequately as they will eventually be exposed to the CO2 pressure and/or saturation plumes. The challenge reaches its peak when some of the riskiest legacy wells abandoned years ago following traditional O&G standards, might not even be accessible for adequate re-abandonment. Costs but most importantly containment risks determine whether or not a specific storage site is adequate to the required CO2 injection scale. This is of particular importance in depleted fields.

Picking up this thread, McKenna added, “The perceived advantages of using legacy petroleum wells (and legacy petroleum facilities for that matter) are reduced project timelines and reduced cost (CAPEX). However, this perception may be a false economy as retrofitting a brownfield development may not deliver on these perceived benefits and may pose increased safety risk. Furthermore, the operational efficiency (up-time) and OPEX costs (well interventions and facility maintenance) for brownfield developments may offset and negate any commercial benefit over a greenfield CCS development. There is the added risk of extended monitoring periods post-injection to achieve site closure and relinquish liability for the storage site. A key technical risk I foresee for legacy wells is related to the thermal shock the wells may experience from Joules-Thomsen cooling effects when high pressure CO2 is injected into pressure depleted reservoirs or when a CO2 injection well is shut-in and there is a pressure drop in wellbore.

“There also seems to be somewhat of a double standard developing between greenfield versus brownfield CCS developments. Well designs for greenfield developments are generally being built with several layers of redundancy to ensure well integrity over geological time. In contrast, well integrity issues related to legacy wells which were designed for a completely different purpose may be seen through ‘rose coloured’ glasses by some operators.”

Regulatory and environmental pressures

Across all the issues discussed at OWI AUS, a common thread throughout was the impact of regulatory and environmental pressures and this held true when it came to CCS. On reaching this topic, the panellists sought to understand how these were reshaping and influencing the CCS landscape and what strategies operators can adopt to proactively address the concerns in their future campaigns.

Providing his perspective here, Vazquez Anzola noted, “Communication is key. The operator should provide the regulator with a holistic perspective of how their CCS projects would not only help their own decarbonisation plans, but also how they fit into a deeper and wider plan that not only results in net-zero or even negative emissions, but is directly linked to value generating models that would positively impact the community.

“A key role of the regulator is to ensure that no industrial activity causes irreversible harm to natural resources, flora and fauna as well as human life.

“When the operator genuinely seeks guidance from the regulator to enable a project that visibly generates value (and revenue) for everybody, all pieces start falling into place and true collaboration enables quality projects adhering to the highest safety and environmental standards.”

Continuing the discussion, McKenna added, “With respect to NOPTA approvals, there is an additional approval required for CCS projects in comparison to petroleum developments. This relates to approval from the Responsible Commonwealth Minister (RCM) for any Key GHG Operations (ie seismic surveys, geotechnical surveys and drilling wells). The guidance provided for these approvals is three months for NOPTA review and one month for RCM approval. If the GHG activity overlaps an existing petroleum title, the GHG Operator is required to demonstrate there will not be a ‘A Significant Risk Of A Significant Adverse Impact’ (SROASAI) on a discovered or undiscovered petroleum resource or an associated increase in costs to develop the resource.

“To facilitate timely approval of a Key GHG Operation, it is preferable for the overlapping petroleum titleholder to agree in writing that there is no significant risk posed by the GHG activity. However, if such agreement cannot be achieved, the RCM can form an independent view of the SROASAI assessment. This additional approval and the requirement to engage with overlapping titleholders has the potential to increase project development timelines. There is also the possibility that CCS proponents may have to declare force majeure if they cannot obtain RCM approval to undertake the activities related to their permit commitments. The unfamiliarity of the regulator to approve a Declaration Of Identified Storage Formation (DISF) and subsequent Injection License may increase uncertainty in project timelines for early adopters of CCS technology.

“Brownfield developments may suffer from project delays related to achieving approval of safety cases to from NOPSEMA to re-use legacy petroleum infrastructure. In terms of environmental approvals, the recent litigation against NOPSEMA approvals for petroleum activities poses similar risk for CCS activities. Furthermore, the CCS industry may be seen by activists as extending the life of the fossil fuel industry.

“I agree with Diego that communication is pivotal. A strategy of early and regular engagement with stakeholders who have high interest and high influence is Stakeholder Management 101. Education will also be a key enabler for the public acceptance of CCS technology.”

Shell has awarded a sizeable contract to Subsea7, a subsea engineering, construction and services company serving the offshore energy industry, for the decommissioning of subsea infrastructure offshore Brazil.

The infrastructure in question is that associated with the FPSO Fluminense in the Bijupirá and Salema fields of the Campos Basin, at 700 m water depth.

Yann Cottart, Subsea7 Brazil Vice-President, remarked, “Twenty years ago, Subsea7 installed the flexibles and umbilicals for Shell’s Bijupirá and Salema fields and, two decades later, we’re proud to be one of Shell’s chosen contractors to take part in the completion of this field’s life cycle.”

The scope of work for Subsea7 includes the disconnection, recovery and disposal of 10 flexible risers, three umbilicals and nine mooring lines.

The works in question are expected to get underway in December 2023.

PT Pertamina Geothermal Energy (PGE) has announced its cooperation with Chevron New Energies International (Chevron) and Mubadala Energy to embark on a Joint Study Agreement (JSA) to explore the geothermal potential in Indonesia.

PT Pertamina Geothermal Energy (PGE) has announced its cooperation with Chevron New Energies International (Chevron) and Mubadala Energy to embark on a Joint Study Agreement (JSA) to explore the geothermal potential in Indonesia.

The JSA aims to capitalise on the companies’ strengths and experience, namely bringing together PGE’s scale as the largest geothermal producing company in Indonesia, Chevron’s expansive capabilities as a multinational energy company committed to providing cleaner energy, and Mubadala Energy’s record in delivering reliable and efficient energy to the region while playing a continuous active role in the energy transition.

The agreement provides a comprehensive framework to conduct a joint study into developing the Kotamobagu Geothermal Working Area (WKP). The agreement falls in line with the Indonesian government’s recent announcement that the region will target an addition of 3.3 GW of installed geothermal capacity by 2030.

President Director of PT Pertamina Geothermal Energy, Julfi Hadi, said, “Our Joint Study Agreement this time aims to utilise the complementary strengths of the three parties in developing geothermal in Kotamobagu.”

Wahyu Budiarto, Chevron Indonesia Country Manager, commented, “This is Chevron’s fifith collaboration with Pertamina and we are excited about the addition of Mubadala Energy in the Kotamobagu WKP. We look forward to bringing into the partnership Chevron’s technical expertise and new geothermal technologies to explore renewable energy resources to support Indonesia’s energy transition goals.”

Mansoor Mohamed Al Hamed, CEO of Mubadala Energy, concluded, “With our track record of delivering strategic energy resources in Indonesia for over a decade, we are excited about this partnership with PGE and Chevron to explore the expansion of geothermal energy, an important segment of Indonesia’s clean energy growth ambitions. The opportunity to explore such projects is embedded in Mubadala Energy’s commitment to playing an active role in the energy transition as we continue to support Indonesia’s Net Zero targets.”

Welltec sees great prospects in the Middle East for its recently launched Welltec Expandable Anchor (WEA).

The Welltec Expandable Anchor (WEA) was a key focus at the company’s stand at ADIPEC 2023, where Completion, Intervention, and New Energy & Climate Technology solutions were showcased, all with optimisation and efficiency as core design principles.

Engineered and rigorously tested over the past couple of years, the WEA is a 4-in-1 life-of-well completion system for anchoring in cased hole. Firmly rooted in proven metal expandable packer technology, it provides industry-leading reliability, efficiency, and flexibility, as explained by Kevin Wood, Sales Director for Completions in the Middle East.

“The WEA has three key benefits. It is reliable, with essentially no moving parts; it’s basically a metal expandable sleeve that is secured onto a casing. It is efficient, as it is slimline and full bore, so operators can circulate fluids or cement at high rates compared to other products. It can also be rotated when run in hole making for efficient installation in deviated and challenging wells. And it is flexible; one particular size of WEA can cover multiple casing grades and we can also add or take away modular parts, depending on the environment in the well.”

The product is available in a full range of sizes, with key completion applications as a liner hanger, tieback liner, inner-string packer, and casedhole plug. All versions of the product are qualified to the API 19LH V1 standard and are fully compatible with Welltec’s Metal Expandable Packer (MEP) portfolio.

The WEA clearly addresses a market need, as illustrated by several installations taking place immediately after qualification, with a requirement from one Middle East operator for product delivery within eight weeks. Facilitated by its in-house design and manufacturing capabilities, Welltec was able to deliver the solution in seven weeks.

Prospects in the region are very encouraging, Wood said, “ADIPEC has been big for us; we signed a two-year call-off contract with ADNOC Onshore for the WEA technology which can address several of the challenges they face on some wells.

“The products covered under the call-off agreement are for the prevention of sustained casing pressure – this is annular casing pressure that can makes its way back to surface, a challenge which has cost the industry around US$75bn since 2009,” he continued. “Around 35% of wells globally exhibit gas pressure in the annulus, and the only way to deal with that is to flare it off, or vent it off, both of which are harmful to the environment. That’s where this anchor and our technology come in. It’s a life-of-well solution, providing a barrier in the well. It’s important that when a well comes to the end of its life, it is decommissioned correctly. The problem with cement is that over the life of the well it expands and contracts, which creates leaks through the cement. Using the Welltec Annular Barrier, which the anchor is incorporated with, gives you a fully qualified barrier that you can abandon above, thereby future-proofing the well for abandonment.”

This in effect helps reduce emissions. The emissions reduction angle certainly chimes with ADIPEC’s central theme of decarbonisation. Wood stressed the company’s commitment to the energy transition, which is “in our DNA – it’s not just a buzzword for us”. He explained that Welltec is playing a key role in Project Greensand, which involves the long-term storage of CO2 by injecting it into depleted reservoirs in Denmark. To support this, and similar projects, Welltec’s New Energy & Climate Technology segment has already constructed an advanced testing facility in Denmark that enables full-scale downhole components to be tested against real-world CO2 well-type environments including high pressures, temperatures, and flow rates.

“The test loop and background to Project Greensand have opened up a lot of conversations here, especially with COP28 coming up,” he said.

Elsewhere in the Middle East, Welltec is active in Qatar and Saudi Arabia, the latter of which provides a manufacturing hub supporting regional activity, and keeping lead times to a minimum. Wood commented that this has been a “huge success”, and expansion of the hub is on the cards. “We can not only deliver quickly compared to our peers, we can also manufacture in the region.”

As far as future product development goes, Welltec has a couple of technologies in the field-trial phase. One is the Isealate Springblade Patch, a unique relining and repair solution for downhole applications. The first in-field deployment successfully took place in Europe in October.

“We also provide a service that can radially expand an existing casing string: the Saturn Expander. This can be utilised in wells where there is casing pressure,” said Wood.

“It expands the casing, compresses the cement on the outside, and cures any microannuli or leaks you might have.

“These solutions are coming to fruition now, and there is a lot of interest in the region, particularly given that many wells here suffer from casing pressure.”

Plexus Holdings PLC, an AIM quoted oil and gas engineering service business, has announced a rental contract award for Exact Adjustable Wellhead and Centric Mudline Suspension Equipment with Neptune Energy UK.

The contract is for Adjustable Surface Wellhead equipment and Mudline Tooling to allow for the permanent abandonment of a UK North Sea well, with operations planned to commence during Q2 2024.

Plexus’ CEO, Ben Van Bilderbeek, commented, “The number of wells that must be permanently plugged and abandoned is fast growing, particularly in mature offshore locations such as the North Sea. We are therefore delighted that Plexus’ reputation is strengthening within this sector, and that our range of customers is broadening.

“Furthermore this contract continues our progress back into Adjustable Wellhead and Mudline equipment market as an expert in this field and ‘go-to’ company for this type of equipment.”

The contract is valued in excess of £175,000 and is an example of the growing rental wellhead market for jackup rigs engaged in plug and abandonment operations.

Aberdeen-based industrial data and engineering consultancy, Imrandd, has reported its most significant six-month growth period.

Aberdeen-based industrial data and engineering consultancy, Imrandd, has reported its most significant six-month growth period.

The firm has secured a record UK£2mn in topsides asset integrity awards with new and existing clients, amplifying its agile data-driven intelligence services further across the UK.

The firm has won 11 contracts indicating a 27% increase in revenue in Q3 of 2023 compared to the same period last year. As a result, 13 data scientists and multi-discipline engineers have been recruited, ramping up its headcount to 63.

Established in 2015, the company specialises in industrial data solutions helping clients in energy and other sectors to make fast and efficient business decisions in line with commercial and ESG strategies.

The new North Sea campaigns include extracting data from six of Ithaca Energy’s offshore installations, a one-year integrity management contract extension with long-term client Dana Petroleum; a 12-month pipework/ vessel risk-based assessment, and technical integrity scope for Harbour Energy; plus assessing the integrity of the Excalibur Floating Production Storage and Offloading facility for first-time client Ping UK, using Imrandd’s unique data gathering and analysis capability in collaboration with digital asset management specialist, GDi Ltd.

Imrandd founder and CEO Innes Auchterlonie, said, “This record period of growth demonstrates the competitive edge our data solutions and expert engineering guidance is delivering. Particularly where there are facilities operating beyond their original life span, companies are seeking fast, optimal answers to harness their assets’ performance safely and sustainably.

“R&D remains core to our strategy, and we continually reinvest 20% of our efforts into evolving the next generation of our propriety AI and digital software services to help our clients stay ahead of the curve. This has ensured we are well positioned to leverage our expertise to safeguard the effectiveness of our clients offshore and onshore assets as they navigate the energy transition.”

A range of Imrandd’s suite of digital solutions will be utilised across the new campaigns. These include EXTRACT, which digitises legacy asset information and EXACT, which maps and predicts engineering, inspection and maintenance activities to deliver actionable insights which have proven to reduce Opex costs.

Energy services provider Expro has completed a well cement placement project for a prominent operator from the US, Gulf of Mexico, delivering an inner-string cementing on a subsea well's 22" surface casing in a water depth of approximately 2,000 m in the Mississippi Canyon area

Energy services provider Expro has completed a well cement placement project for a prominent operator from the US, Gulf of Mexico, delivering an inner-string cementing on a subsea well's 22" surface casing in a water depth of approximately 2,000 m in the Mississippi Canyon area

When integrated with Expro’s other well construction technologies, the company’s innovative Cure technology range, including SeaCure, QuikCure, and CoreCure, offers a comprehensive package for ultimate cement placement and provides a complete 'head-to-shoe' solution.

Expro's Cure technologies allowed the operator to overcome ongoing offset well challenges. These included prolonged wait on cement (WOC) periods when transitioning directly from the jet string to the 22" surface casing, and tasks associated with drilling out a 22" shoetrack.

Jeremy Angelle, Expro’s Vice President of Well Construction, commented, “Our integrated cementing solution helped save approximately 18 hours of cement related drill-out, clean-out, and WOC time when compared to offset wells. By using our Cure technologies, we removed the requirement for a shoetrack to be left in the casing string, helping to avoid previously experienced cement sheath-related challenges. In addition, the QuickCure solution reduced WOC time. This latest project highlights Expro’s commitment to provide solutions that empower our clients to overcome operational challenges and achieve excellent results.”

The Cure technology range was added to Expro’s portfolio of cost-effective, innovative solutions within the company’s well construction product line as part of the Company’s acquisition of DeltaTek in February. The DeltaTek range of low-risk open water cementing solutions help increases clients’ operational efficiency, delivers rig time and cost savings, and improves the quality of cementing operations.

Amplus Energy, a provider of economically-viable global field development solutions, has marked its entry into carbon capture with a significant investment into Carbon Circle AS of Norway and support the establishment of Carbon Circle UK in Aberdeen, UK.

Amplus Energy General Manager, Steve Gardyne, will lead Carbon Circle UK, supported by a team of carbon capture specialists from Norway. Further senior Carbon Circle UK personnel are currently being recruited.

The company has made the multi-million-pound investment in light of the emerging carbon capture market in the UK and how this is impacting the UK Government’s net-zero ambitions. Carbon Circle UK is currently working on front end engineering and design (FEED) studies for the decarbonisation of two major industrial sites in the UK. These projects will have a positive impact on the UK Government’s net zero ambitions.

Amplus Managing Director, Ian Herd, remarked, “We are excited by this opportunity to participate within the Energy Transition in the UK through bringing our client focused, innovative approach to project delivery coupled with the ‘best-in-class’ domain knowledge and significant EPC experience already assembled within Carbon Circle. The creation of Carbon Circle UK brings a new, innovative Carbon Capture EPC partner into a UK market with huge potential.”

Aslak Hjelde, CEO of Carbon Circle, added, “We are excited by our partnership with Amplus Energy, a collaboration set to enhance the growth and innovation of the carbon capture sector in the UK. The UK Government’s significant commitment of UK£20bn to Carbon Capture and Storage is a testament to the strategic importance of CCS technologies in achieving national net-zero ambitions. With the support and expertise of Amplus Energy, Carbon Circle is ready to be a major contributor in the UK’s carbon capture sector."

Page 62 of 118