Plexus Holdings, an oil and gas engineering services business, has completed an agreement with SLB, a global technology company driving energy innovation for a balanced planet, to replace their existing surface production wellhead licence.

The new licence has a wider field of use for a cash consideration of US$5.2mn. It will provide SLB a perpetual royalty free licence for Plexus’ POS-GRIP technology and HG seal technology along with any improvements or derivates to the technology for surface wellhead production applications. The scope of this includes oil and gas production and storage applications, CO2 storage, hydrogen storage and water and cuttings reinjection.

In addition, the agreement includes a non-exclusive licence to SLB for Adjustable Surface Production Wellheads, and HG Trees with the potential to generate royalties for Plexus from such special applications of the POS-GRIP technology.

"SLB's leading technology position will be further enhanced by this new technology, providing our customers with additional rig time savings through ease of installation and enhanced seal integrity assurance for onshore and offshore applications, commented Badri Mani, Director of Surface Production Systems, SLB. “We are very excited about the prospects for this technology."

According to Plexus, the combination of its technology with SLB’s manufacturing quality, technical expertise, innovation and global support structure will ultimately bring value and efficiency to operators across the globe.

Ben van Bilderbeek, CEO of Plexus, added, “This new licence agreement is a further validation of Plexus' IP by this leading energy technology company and recognises the contribution our leak-proof POS-GRIP wellhead equipment can make to the oil and gas industry's ESG and NetZero goals. Not only does the agreement further reinforce our growing relationship with SLB, but it also enables Plexus to continue to operate in the surface production wellhead sector on a limited basis, whilst focusing on the 'preventative' aspects of POS-GRIP metal seal technology."

Chevron Corporation has announced that for its fourth quarter 2023 it will be impairing a portion of its US upstream assets due to continuing regulatory challenges.

Primarily in California, the challenges in the state have resulted in lower anticipated future investment levels in its business plans according to the statement. It expects to continue operating the impacted assets for many years to come.

In addition, the company indicated it will be recognising a loss related to abandonment and decommissioning obligations from previously sold assets in the Gulf of Mexico as companies that purchased them have filed for bankruptcy and the company deems it probably and estimable that a portion of the obligations will revert to it. As such, the company expects to undertake decommissioning activities on the assets over the coming decade.

Currently, Chevron is now in the process of finalising the financial impacts of these actions and will likely treat them as special items, excluded from adjusted earnings. These actions are currently estimated to result in non-cash, after-tax charges of US$3.5bn to US$4bn in its fourth quarter results.

Offshore Network’s latest Global Well Intervention Report delves into the highly-prosperous global market and analyses the growth of operators utilising well intervention practices as the focus across the industry is shifting towards end-of-life activities and reaching environmental targets.

Assessments issued by Rystad Energy suggest that 17% of the world’s wells will undergo intervention processes by 2027, accounting for 260,000 wells globally. Spending within this market has already seen a surge and is likely to amount to US$58bn by the end of 2023, representing a significant growth of 20% since 2022. Climate consciousness has played a predominant role aiding the growth as mounting pressure is building across the industry to limit environmental footprints, with global companies seeking to make intervention an integral pillar within their business strategies.

In November 2023, COP28 witnessed Saudi Arabia launch its landmark Oil and Gas Decarbonisation Charter (OGDC) wherein 50 companies who represent 40% of the global oil and gas market thus far have signed up to the global pact to speed up climate action initiatives and are committed to become net-zero by 2050. However, it is not just the call for fast environmental action that is driving the intervention market, but the global increase in energy demand is also playing a vital role. According to the International Energy Agency, annual oil demand is expected to grow from 285.7 mboe/d in 2021 to 351 mboe/d in 2045, with oil set to retain a 29% share in the energy mix.

Increasing production rates is still a major priority across the industry, and a factor that must be balanced with the growing need to minimise carbon footprints. Well intervention practices are proving a key avenue that companies across the globe are turning their heads to, from expediting resources from the more veteran regions like the North Sea and the Gulf of Mexico to introducing more of these practices to ‘newer’ regions such as the Middle East and West Africa.

Offshore Network’s newly released Global Offshore Decommissioning & Abandonment Report tracks the growing need for end-of-life activities that is becoming an increasingly pertinent issue across the world.

While decommissioning has its roots as far back as the 1960’s, it was only towards the end of the century, under mounting environmental sentiment, that national bodies and the community began engaging with the issue more acutely and discerning what this will mean for the industry’s future. Time and resources dedicated here have drawn the curtains further back, and the more that is revealed, the more daunting the decommissioning task has become.

In 2021, IHS Markit predicted that global offshore decommissioning spending could reach around US$100bn between 2021 and 2030, a staggering 200% increase compared to the previous ten-year period. In light of this, the information services provider asked whether the world was entering “a decade of offshore decommissioning” as it reacted to the data that suggested nearly 2,800 fixed platforms and 160 floating platforms could be decommissioned in that period, alongside more than 18,500 wellheads, 2,850 subsea trees and 80,000 km of offshore pipelines and umbilicals. Looking further ahead, the Energy Industries Council further predicted that this cost of decommissioning would continue to rise beyond that, hitting the US$200bn figure within the next 20 years.

Offshore Network’s unique report charts the rise of the decommissioning market across the globe, providing analysis on this within each of the key offshore oil and gas regions from the more mature regions of the North Sea and Gulf of Mexico, to those that are less far along in this journey such as West Africa.

Aker Solutions has secured a significant contract for the dismantling and recycling of a platform topside and jacket in the North Sea.

While expressing its excitement and earning the contract with Saipem, Aker noted that the decommissioning market is a growing market and one that is rapidly growing its backlog of orders.

“This award adds to an order backlog that already stretches to 2030, and provides further predictability so that we can continue to develop our facility and execution model, with a strong focus on safe operations and capability to deliver a high degree of recycling,” remarked SVP Decom Thomas Nygård.

Indeed, according to the company, it is knowing how to conduct such operations which won this contract. As per the order, Aker will support the receiving, dismantling, sorting and recycling 19,000 tonnes of topside and a steel jacket weighing 10,000 tonnes. These structures will be delivered mainly as modules by Saipem’s semi-submersible heavy-lift vessel, Saipem 7000 between 2025 and 2027.

Of this, 98% is expected to be recycled, representing a key component of the circular economy.

Global leader in oil and gas well integrity and production optimisation, Coretrax, has appointed Colin Graham as the company’s first Sales and Operations Manager for Africa as it plans for future expansion.

Graham joins the business with more than four decades of experience under his belt, including previous works completed in the North Sea, Middle East and Africa. In his previous role as Business Development Manager for the Middle East and Caspian at TAM international, he was responsible for driving new and existing business across the region, with a particular focus on well intervention, completions and drilling.

His new role will see him play a key role in strengthening Coretrax’ presence in Africa by building on the company’s existing relationships within the region. His appointment follows a number of substantial project wins for Coretrax in western and southern Africa.

Graham said, “I’m very proud to be joining the team at Coretrax to enhance existing operations and actively expand the business’ footprint across Africa. The region is so vast, and no two fields are the same, so the breadth of Coretrax’s technology allows us to support every stage of the well lifecycle for both onshore and offshore projects. I am eager to share the opportunities that these technologies present to the energy industry in Africa and with the companies operating in the region.”

John Fraser, CEO at Coretax, commented, “As we continue to grow our business on a global scale, Colin will be a huge asset to the Coretrax team. His operational experience and expertise in well intervention and integrity will be extremely valuable to our existing customers in Africa and optimise well performance, and actively address operator challenges.

“Africa has been a key focus area for the business, and we have significant experience supporting major projects in Ghana, the Ivory Coast, Mauritania, Tanzania and Angola with a strong aim to increase our operations. We look forward to extending the delivery of our technology and high quality customer service to enable valuable time and cost savings to our customers.”

Leading energy provider Expro has renewed and expanded its agreement with Di Drill Survey Services, a provider of high-end HPHT logging and Gyro survey services for complex abandonment services to both the oil and gas and geothermal sectors.

The strategic partnership agreement strengthens the growing relationship between the two energy service companies who are committed to providing premium well integrity solutions to complex wellbore situations.

Patrick Hanson, Expro’s Senior Geothermal Development Manager, said, “Our ability to partner with such a respected and entrenched company such as Di Drill aligns with our geothermal growth strategy to better serve the industry in regions where we don’t have physical locations or an established well intervention footprint. Di Drill shares the same core principals of safety, quality and integrity as Expro, this partnership was an easy decision.”

Daniel McCall, President of Di Drill Survey Services, commented, “We are honoured to have the ability to continue to grow our relationship with such an esteemed service provider in the energy sector. The ability to extend and offer existing services and additional new technologies to our business partners will allow for seamless operations between multiple services from a single provider. Thank you to the Expro team for trusting us to represent your incredible technology.”

A previous agreement enabled Expro to provide its high temperature Kinley Caliper and downhole camera product lines to Di Drill to service predominantly geothermal operations in western US. The new agreement will also include Expro’s annulus intervention solution, Octopoda, with Di Drill making its gyros available for Expro’s specific call-in work. The agreement also extends joint operations into newer regions such as Oregon, Washington, New Mexico, and across the border into Mexico.

The University of Texas at has received a US$4.9mn grant from the US Department of Energy (DOE) to conduct research on two potential climate change solutions around the Earth’s subsurface: the storage of carbon dioxide and the generation of energy.

A team of UTEP researchers will lead a multi-institutional team in accelerating climate change solutions. Other contributors will come from Florida State University, the University of Utah, Sandia National Laboratories and Alma Energy LLC. Together, they will target solutions for two DOE objectives, reducing carbon dioxide in the atmosphere and enhancing the effectiveness of geothermal energy capture.

Son-Young Yi, Ph.D., an Associate Professor in the Department of Mathematical Sciences, is the grant’s Principal Investigator and forms the UTEP contingency of the team alongside Co-PIs James Kubicki, Ph.D., a Professor in the Department of Earth, Environmental and Resource Sciences and Zhengtao Gan, Ph.D., an Assistant Professor in the Department of Aerospace and Mechanical Engineering.

The researchers will create computational models, using machine learning algorithms, that can help the clean energy industry reduce carbon dioxide in the Earth’s atmosphere and create a reliable means of accessing geothermal energy.

“There is a bevy of interactions taking place underground which influence the amount of energy that can be extracted from a particular location and the rate of production that a particular location will offer over time,” Gan said. “Our team will work with an industry partner to create computational models that can mitigate the exploration risks and help players in this industry identify the best areas for geothermal energy extraction.”

According to the team, the increased efficiency may result in greater quantities of energy extracted and sustained rates of production, which will hopefully translate to a more accessible and affordable way for Americans to power their homes.

“This is an exciting opportunity because crossing scales and putting together a picture of geochemical processes is a grand challenge in subsurface applications,” Kubicki said. “The potential to bring geothermal energy to the El Paso region and to help address carbon dioxide removal from the atmosphere is a dream come true.”

One method being researched for storing excess carbon dioxide is geologic carbon sequestration, which is the injection of the gas in underground geologic formations, such as saline aquifers – reservoirs of salt water that are located deep beneath layers of rock. A drawback to this approach is the possibility for the gas to seep, or leak, back to the surface and re-enter the atmosphere, Yi said.

“Our computational models will analyze the behavior of carbon dioxide across different scales, from the microscale to the macro scale, so that we can simulate and predict how long carbon dioxide will stay in the underground rock formations,” Yi said. “The work is ambitious as no model exists yet that has been able to link data about carbon dioxide’s behavior across scales, but if we’re successful, our models will help the clean energy industry understand the long-term evolution of the injected carbon dioxide and better identify optimal locations for carbon dioxide injection with respect to minimizing leakage.”

Serica Energy has provided an organisation and operations update, charting the successful operations it has carried out in the North Sea since September.

The latter half of 2023 has seen Serica successfully carry out the summer shutdowns at both the Bruce and Triton fields. In the former, the shutdown workscope was completed later than planned due to the decision to carry out permanent rather than temporary repairs on the flare tower.

Strong levels of production have been established from both the Bruce and Rhum fields with Serica’s average production entitlement being over 24,000 boe per day during the last four weeks.

Commencing in September, Serica has been conducting its second Light Well Intervention Vessel (LWIV) campaign on the Bruce field. This has involved successfully re-entering three wells to identify areas of scale build-up, perform water shut offs and perforate target intervals. With work on one well still to finish, there has been an uplift in overall production from the re-entered wells of about 2,500 boe per day so far.

Serica has now intervened on five of the subsea wells that form the Western Area Development (WAD) part of the Bruce complex. Since taking over operatorship, Serica has also re-entered fourteen Bruce platform wells. The results have demonstrated the benefits of low cost well interventions and a third LWIV campaign is planned during 2024 which will involve work on both Bruce and Keith wells. The inventory of platform wells on the Bruce field is also being high graded for potential future interventions.

The company is also currently carrying out vessel-based final abandonments of four exploration and appraisal wells on the Keith field and the North Eigg exploration well. This campaign is consistent with the NSTA’s initiative to reduce the number of suspended inactive wells in the UK North Sea. The abandonments are scheduled to be completed in late December 2023.

At Triton, the summer shutdown was completed in September 2023 with the activities carried out including essential fabric maintenance and inspections, a further phase of the control systems upgrade and preparation for the reinstatement of water injection on the Bittern field, which is planned to restart in early 2024. Good production rates are being achieved from all of Serica’s fields in the Triton Area.

During the middle of this year, a rig-based well intervention campaign was carried out on the Guillemot West and North West fields. These were the first such interventions on the fields in over ten years and have resulted in incremental gross daily production of about 1,500 barrels of oil from one well and 12 million cubic feet of gas from another, both of which had been shut-in for lengthy periods.

Mitch Flegg, Chief Executive of Serica, explained, “I am pleased to report the successful conclusion of the planned summer shutdowns on Serica’s Bruce and Triton hubs and the re-establishment of strong levels of production at both. During the last month Serica has been consistently achieving production rates in excess of 50,000 boe per day. Overall production guidance for the year is unchanged reflecting delayed production restarts and slower than expected production ramp-ups after the summer shutdowns.

“I am also pleased to report successful well campaigns on the Bruce and Guillemot fields during 2023. These are further proof of the benefits to be had from low cost, short cycle investments in our existing asset portfolio. The full impact on production of the well work carried out this year is expected to be felt in 2024, aided by the work on the Bruce facilities deferring the need for another major shutdown until 2025.

“The LWIV vessel used on Bruce is already booked for a third campaign in 2024, which will target wells on both the Bruce and Keith fields. We are also looking forward to the start of a four well drilling campaign in the Triton area, with the first well on the Bittern field scheduled to begin around the middle of the first quarter. 2024 is anticipated to be a very busy and impactful year of investments in Serica's North Sea portfolio.”

BiSN, a provider of permanent downhole sealing solutions, has opened a manufacturing facility in Perth, Australia in order to increase its operational capacity in the Asia-Pacific region as well as creating several local jobs.

The decision to make the investment was driven by the growing demand for Wel-lok technology in the region. According to Paul Carragher, founder and CEO of the company, it is another step in its global expansion and builds on successful campaigns with operators in Australia and the wider region. Carragher added, “The Perth facility is one part of our commitment to rapidly support operators, allowing them to deploy Wel-lok technology for all intervention and P&A sealing applications.”

The Perth facility features full heater and bismuth-based alloy production, two major components of Wel-lok technology, as well as final assembly. It also provides a focus for regional business development and a field operations base. It will also boast a demonstration room to allow operators to view and get hands-on with Wel-lok and other technologies offered by BiSN. This will facilitate a collaborative environment for planning P&A, intervention and completion solutions.

The opening of the facility will remove the barrier of lead times due to shipping from the US or UK which can be prohibitive for operators and their intervention needs. “By opening a facility in Perth, it allows us to be more responsive to the needs of operators in Australia,” said Adrian Weiss, BiSN Senior Vice President of Operations. “The new facility is a continuation of BiSN’s commitment to increasing our global capability. We have listened to our clients in this region, and we are responding to help them seal safer and protect forever.”

The announcement follows the appointment of a new Regional Business Development Advisor in the Australian city, revealed earlier this year. Andy Vigor, the new appointment, boasts extensive experience in the industry having held roles in the Middle East and Asia Pacific regions. Now with BiSN, he is supporting customers both in Australasia and throughout the wider region.

Vigor surmised, “With the geographical size of the Australasia and the Asia Pacific region, response time and the ever-increasing cost of logistics is critical to our customers. We can now provide customized, engineered products and solutions locally, which will assist BiSN in its efforts to achieve service excellence for all of our regional customers.”

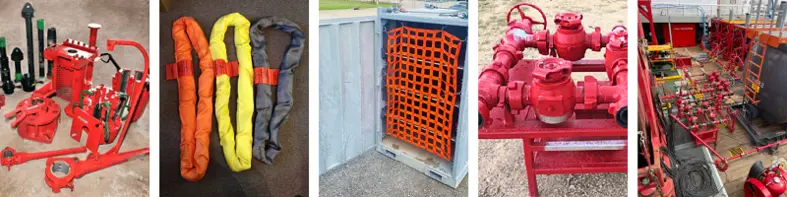

Gulfstream Services Inc. (GSI), an oilfield rental services company, has formed a partnership with Kontinental Energy Services (KES) to provide rental tool equipment and services for jobs in the African oil and gas industry.

Bobby Bond, GSI Chief Executive Officer, remarked, “We are excited about being aligned with the management of KES and bringing quality equipment and solutions to the African continent. Our 45 years of industry experience, solid reputation and solutions-based approach is something we feel will ensure our success going forward.”

The partnership will facilitate a more robust approach for providing the right tools to get jobs completed to the highest level of quality, safety and performance for energy services companies and international, major, national and independent oil and gas companies across the continent.

Bond added, “We believe the growth potential in the Eastern Hemisphere will be robust for many years. This partnership, along with our recent expansions into Asia Pacific and the Middle East show our commitment to this part of the world.”

The suite of rental tools and equipment include (but not limited to):

• A complete line of high-pressure standard services, H2S Services Chiksan Equipment;

• Low pressure piping and hoses;

• Cargo boxes, baskets and custom designed racks for operators and services companies;

• Restraint system to restrict movement of temporary flow iron in the event of an unplanned release of pressure;

• Full-service 3rd party iron management programme that helps keep customer-owned asset pumping at peak performance;

• Cementing, coil-tubing; HWO and flowback support packages;

• Spool & gate valves.

KES and GSI are also planning to build workstation hubs in Africa for proactive maintenance of equipment and training of all service technicians in respective countries. The first of these will be built in Congo/Angola and will support activities in the nations as well as in Namibia, South Africa, Gabon and Equatorial Guinea.

"We are confident in the partnership with KES to expand our footprint in Africa, and we anticipate GSI to bring much innovation and technology to service operators throughout those areas with our full array of rental services and equipment," concluded Bond.

An enormous congratulations to the OWI Global Awards 2023 winners who were crowned in Aberdeen last week during a night filled with fun, food and festivities, where the offshore well intervention community gathered to cap the year of with a bang!

At the annual celebration, a panel of expert judges acknowledged the very best in global well intervention excellence and were tasked with picking out the best from a competitive field of submissions. However, for going above and beyond, there were some who stood out slightly higher from the crowd and were recognised for their achievements.

The winners for 2023 included:

Intervention Champion of the Year: Expro, for taking the crown after celebrating 40 years of its Subsea Test Tree Assemblies operations, delivering more than 3,000 deployments in subsea Exploration and Appraisal completion and intervention applications, and expanding its capabilities to offer a complete subsea well access portfolio!

Energy Transition Pioneer of the Year: Expro, for pioneering to the top with its 50-year legacy supporting the UK oil and gas industry and, last year, investing more than 50% of its development budget into lowering clients’ carbon emissions!

Best Example of Diversity and Inclusion: TechnipFMC, after being names one of the World’s Top 400 Female-Friendly Companies by Forbes and participating in a full roster of events aimed at supporting inclusion in every form!

Best Example of Subsea Intervention: Welltec, after demonstrating huge success with its ultra-slim e-line intervention tools last year!

Best Example of Platform Intervention: 3M, for its impressive achievement in helping to deliver successful sand control remediation through coil tubing deployment to allow the asset to achieve production goals!

Best Example of Downhole Innovation: DarkVision, claiming the top spot for its HADES downhole inspection platform that provides a comprehensive evaluation of the entire well in 3D in a single pass!

Market Intelligence Platform of the Year: Energy Industries Council, as one of the world’s largest energy trade associations for companies to supply goods and services to energy industries worldwide since 1943!

Best Project Outcome: TechnipFMC, securing the accolade with its successful RWLI campaign in ultra-deepwater Angola which included water shut-off and acid stimulation operations for three wells in just 27 days!

Best Example of Collaboration: WellBarrier – a SLB technology & Equinor. The WellBarrier solution was successfully deployed at scale across Equinor’s organisation in support of replacing manual tasks with digital solutions. This solution is estimated to have engineering effort savings of around 10,000 hours during the first year.

Best Example of Digital Innovation: Evoilve, for the excellent work that has come from Evoilve’s COLLABWELLS Well Integrity Management software which has ushered in a new era of efficiency, collaboration and automation within the oil and gas industry.

Best Example of Well Integrity Innovation: EV, prevailing as champion through its award-winning innovation that is the world’s only integrated array video and phased array ultrasound scanning tool.

Best Example of Decom Innovation: Oceaneering, which took home the crown for designing, building and operating an ROV-based annular access methodology based on multi-string hot tapping to mitigate against annular gas and avoid HSE risk in a wellhead severance campaign for a major operator in Southeast Asia.

OWI Global Awards: Significant Contribution to the Industry: Jørgen Hallundbæk, accepted by Cristian Kruger. After our community bid a sad farewell to an individual who has contributed so much towards its progression, the final iteration of this award was presented to Jørgen Hallundbæk, a worthy winner whose legacy will continue to shine through his formidable work and family and friends. To honour his impact, this year saw the first presentation of the ‘Jørgen Hallundbæk Lifetime Achievement’ award which will continue to honour visionaries within the industry.

Jørgen Hallundbæk Lifetime Achievement: Tom Brighton, claiming the prestigious accolade for his 37 years of service and dedication. With an unrivalled portfolio, Tom Brighton has imparted the best practice methods and increased operation standards to the well discipline across the globe and was a worthy winner of the new award!

Thank you to everyone for attending and we look forward to another year of seeing our network push the boundaries of engineering excellence and driving the wider offshore community forward!

Page 61 of 118