Perenco and Carbon Catalyst Limited (CCL) have been awarded a licence to progress the Poseidon carbon capture and storage (CCS) project following the conclusion of the first competitive carbon storage licence round of the North Sea Transition Authority (NTSA).

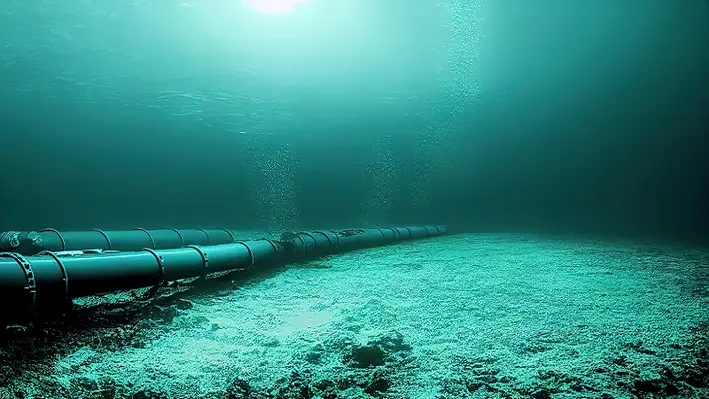

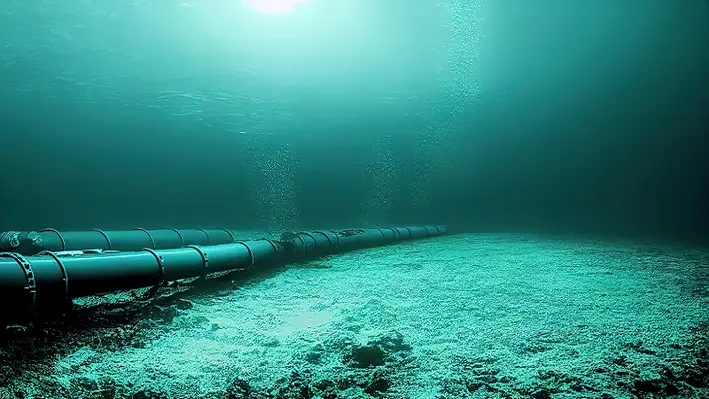

The project encompasses the Leman gas fields, one of the largest geological structures in the southern North Sea sector of the UK Continental Shelf (UKCS) and offers depleted gas reservoirs alongside saline aquifers to permanently store recovered CO2.

According to the companies, the project has the potential to significant decarbonise the East and Southeast of England when it comes online (expected 2029). Leman is connected via pipeline to the Bacton Terminal which will be utilised to receive and process CO2 from various onshore sources. This will then be sent to be injected offshore into reservoir rocks. Initial injection rates will be around 1.5mn tonnes per annum (Mtpa) and could ramp up to 40Mtpa across a 40-year period.

With the licence awarded, the project will now move into further detailed appraisal of storage sites with work commencing to bring the concept to delivery alongside mid-stream and up-stream partners.

Jo White, General Manager Perenco UK, remarked, “This is a fantastic opportunity to leverage Perenco UK’s deep experience of gas operations by developing a project that will help to support the UK’s energy transition, generate highly skilled jobs locally and nationally, and actively facilitate the government’s net-zero targets. We look forward to working with all stakeholders to deliver this strategic project.”

Henry Morris, Executive Director at Carbon Catalyst, added, “Poseidon has the potential to make a very material contribution to the decarbonisation of the UK economy by storing up to 40mn tonnes of CO2 per year into the giant depleted Leman gas field and overlying aquifer system. CCL is looking forward to supporting Perenco as they progress through the appraisal period towards final investment decision, with the ultimate goal of achieving first CO2 injection by 2029.”

Onwards with Orion

In addition to the Poseidon project, the partners have also announced that they have been awarded two further carbon storage licences to progress the Orion CCS project, designed to deliver an initial injection capacity of 1Mtpa.

The project encompasses the decommissioned Amethyst field as well as the West Sole field (currently producing). It will use depleted gas reservoirs for permanent storage. Injection is expected to commence in 2031 and could rise to 6Mtpa.

Perenco, which owns and operates significant gas infrastructure in the Humberside area will evaluate the possibility of reusing existing assets such as Dimlington Terminal for the project.

The recent 'Decommissioning and Abandonment Australia 2023' conference held in Perth saw many insightful presentations from a distinguished list of speakers. On the legal and regulatory side, Ben Adamson, a lawyer from HFW, an international law firm specialising in offshore energy and maritime law, provided a diverse audience with an in-depth dive into Australia’s offshore decommissioning regime.

The recent 'Decommissioning and Abandonment Australia 2023' conference held in Perth saw many insightful presentations from a distinguished list of speakers. On the legal and regulatory side, Ben Adamson, a lawyer from HFW, an international law firm specialising in offshore energy and maritime law, provided a diverse audience with an in-depth dive into Australia’s offshore decommissioning regime.

Ben kicked off his presentation with a briefing on the international framework relevant to decommissioning, which is driven primarily by United Nations Convention of Law of the Sea (UNCLOS) and the International Maritime Organisation (IMO). He then transitioned his presentation to discuss Australian legislation designed to enforce local decommissioning obligations. Of particular interest were his comments comparing and contrasting various national regulatory regimes, which appear to vary significantly between countries and offshore regions.

Ben pointed out that nothing in the Australian offshore oil and gas industry happens in a vacuum. An overlay of international laws and conventions exists that will continue to have a real effect on how Australia regulates the large pipeline of decommissioning work set to take place over the next two decades.

Revamped regime

The most important parts of the Australian offshore decommissioning regime are set out in the Offshore Petroleum and Greenhouse Gas Storage Act 2006 and its various regulations. Parts of the Act relevant to decommissioning underwent a major overhaul in 2021 to make the legislation fit for purpose and to respond, in part, to an unfortunate series of events where the decommissioning of an Australian FPSO and associated offshore field fell at great cost to the Australian taxpayer following the insolvency of the titleholder.

As Ben set out, the Australian government appears anxious to avoid a repeat of such events. The central pillar of the revamped Australian decommissioning regime is that titleholders must maintain and repair all structures, equipment and property brought into a field. Once the structure, equipment or property is no longer in use, titleholders must remove it. If the current titleholder is not available, or is unable or unwilling to undertake decommissioning, the Australian government has the power to bring former titleholders (as well as a range of other parties) back to decommission the offshore asset.

Trailing liability

The most important and topical of the changes to Australia's offshore decommissioning regime is what Ben described as trailing liability. Common in some other offshore jurisdictions around the world, trailing liability means that the government has the power, as a last resort, to 'call back' a past titleholder to remediate the environment or remove property. In that context, Ben raised some pertinent questions such as what would or could occur if at some distant point in the future a plugged well began leaking oil. Who will (or should) be brought back under a trailing liability regime to remediate it? Is it fair to force a former titleholder to decommission a well where that titleholder was at some point operating the field, but was otherwise not responsible for drilling or plugging the well?

In addition, Ben canvassed a number of other as-yet unresolved aspects of Australia's new decommissioning laws that arise from trailing liability. For example, what is the fair approach regarding small-percentage titleholders that form part of a joint venture comprising the titleholder? In the event that a former titleholder must decommission an asset, should they be entitled to tax breaks? Further, as Ben put it, can titleholders ever get a 'clean break' from a field after legitimately divesting their interest, if the spectre of trailing liability exists in perpetuity? As Ben concluded, current Australian decommissioning laws do not fully address these tricky issues, as well as a host of other issues raised by the new regime.

The second important point under the new Australian framework is that surrender of titles can only occur with the consent of the regulator. If a titleholder has not done the necessary decommissioning and the field is nearing the end of its life, Ben pointed out that with the passage of the amendments to the legislation, it will be difficult for the titleholder to transfer title, especially to a more speculative entity attempting to extract profit from an aging field.

In light of the major overhaul to Australia's decommissioning laws, Ben's opinion was that the most interesting aspect of Australia's updated decommissioning regime is how the regulator will manage its growing regulatory burden while upholding Australia's decommissioning obligations under international law. This is a complex and involved area that will evolve over time.

Increased accountability from titleholders

In terms of the role the Australian oil and gas regulator plays, the revamped decommissioning regime hands the regulator a new arsenal of powers to enforce titleholders' decommissioning obligations. Broad powers now exist to monitor and if necessary, intervene to stop, changes to the control of a titleholder, and passage of title from one titleholder to another.

Now, a change of ownership at the level of the titleholder is firmly within the regulator's grasp. Ben stated that players in the market can expect the regulator to act should it conclude, for example, that the entities taking control of a titleholder are not suitably resourced or experienced, or do not have the appropriate financial backing to carry out decommissioning. Before concluding his remarks about the new Australian regime, Ben reiterated that the trailing liability laws and powers to intervene in changes to control of the titleholder do not directly apply to contractors, employees, banks or customers.

The second part of Ben's presentation was a practical discussion on what a typical decommissioning contract may look like from a risk management perspective. He prefaced the discussion by setting out the typical options presented to those engaged in work offshore: either transfer risk, or accept it, insure against it, and price it in. Although decommissioning is a highly specialised undertaking, in Ben's view, the major themes and principles underlying contracts typically found in the offshore oil and gas sector would be relevant for offshore decommissioning contracts.

The offshore industry is a unique environment and there have been, over a long period of time, contractual terms developed that deal with the unique risk and liability issues faced in the offshore setting. Ben was clear that the typical knock-for-knock indemnity arrangements so common in the wider offshore and maritime world would likely be retained in decommissioning contracts, because these terms allowed contracting parties to either transfer risk, or assume it and insure against it.

Dealing with waste

Perhaps the biggest difference between typical offshore contracts and decommissioning contracts is how waste is dealt with. This aspect of Ben's presentation was directed to those in the audience who are preparing to deal with the vast volume of waste equipment, assets and material that is expected to be generated over the coming decades as Australia tackles its offshore decommissioning task. The big questions in this space are: what is to be done with the waste (some of it clearly hazardous) and crucially, how risk and title in the waste may be transferred between contracting parties. Ben recounted the difficulty his clients experienced exporting Australian offshore oil and gas waste overseas. As a final parting word, he challenged those present to develop local, home-grown waste disposal alternatives to avoid the issues arising in sending Australia's hazardous waste overseas.

Archer has been awarded a US$165mn decommissioning contract by Repsol Sinopec Resources UK Ltd. for the execution of plug and abandonment (P&A) services in the Fulmar and Halley Fields in the North Sea.

Archer has been awarded a US$165mn decommissioning contract by Repsol Sinopec Resources UK Ltd. for the execution of plug and abandonment (P&A) services in the Fulmar and Halley Fields in the North Sea.

The awarded contract is for a fully integrated P&A project, covering the complete work scope and services of the 30 Fulmar Field wells and the two Halley Field wells.

The Fulmar scope includes the removal of the existing drilling facility and the installation of Archer’s P&A rigs, as well as its full P&A well services offering to reduce time and cost. The work will be carried out using leading digital solutions in collaboration with the company’s partners, and operations are expected to commence in H2 2024.

Dag Skindlo, CEO of Archer, said, “We are delighted that Repsol Sinopec has elected Archer and our fully integrated operational model for this P&A project. The delivery model with integrated drilling and well services, supported by partners, is a step change in how operators permanently plug and abandon oil and gas wells. Archer has worked strategically over several years to develop this fully integrated model and we are excited that Repsol Sinopec has chosen Archer as its partner.

“The permanent plugging and abandonment of oil and gas wells is an essential activity as the world decarbonises on the road to net-zero. Our goal is to industrialise the P&A process and spearhead innovation to cut operators’ P&A costs globally.”

Adam Sheikh, Repsol Sinopec’s VP of Decommissioning and Energy Transition, commented, “We aim to deliver one of the North Sea’s most ambitious decommissioning programmes in the years ahead – including the full decommissioning of our Fulmar Alpha Asset. This contract award represents a significant milestone in our decommissioning journey and my thanks go to the teams for the vast amount of work to get us to this stage. We look forward to working closely with our partner Archer to safely deliver this decommissioning scope of works on our Fulmar Alpha facility."

According to new research by the North Sea Transition Authority (NSTA), the oil and gas industry in the North Sea spent UK£1.6bn on decommissioning redundant wells and infrastructure last year.

This figure is more than any in the previous five years with UK£8bn spent accumulatively between 2017 and 2022 and will remain high for the years ahead, with UK£2bn expected to be spent per year in the next decade. Of the work associated with the UK North Sea alone, UK suppliers are forecast to take the lion’s share at 70%.

The NSTA was pleased to indicate that the sector appears to be living up to its North Sea Transition Deal Pledge to ensure at least half of decommissioning spending goes to the UK supply chain and that it is meeting legal obligations to clean and remove infrastructure once production ceases. It continued that the industry has now built an impressive track record of carrying out decommissioning projects cost-efficiently and safely due to its willingness to share learnings and date. It is also embracing new technologies' commercial models.

Emerging challenges in recent years – such as a heightening demand for equipment, vessels and services from other regions and sectors – has led to an estimated total decommissioning cost of around UK£40bn that must be footed in the years ahead. However, the NSTA has stated it is confident the industry can overcome associated hurdles, meet cost-efficiency targets and ultimately lower the estimate to around UK£33.3bn by the end of 2028.

To support this, the NSTA is providing ongoing support by introducing new key performance indicators and benchmarks to provide a more complete picture of how well decommissioning projects are being planned and executed. This will help to identify opportunities for industry stakeholders to improve performance and realise further cost-efficiencies.

Pauline Innes, NSTA Director of Supply Chain and Decommissioning, remarked, “The North Sea decommissioning sector is highly active and productive, and the industry is ideally placed to realise the massive UK£21bn opportunity which will come its way over the next 10 years.

“However, operators must redouble their commitment to collaborate with the supply chain and plan even more effectively if they are to overcome challenging market conditions and remain competitive on cost. The NSTA will continue to use its powers and influence to support the industry as it strives for continuous improvement, including through the development of new benchmarks.”

Bob Fennell, DaRT Co-Chair and North Sea Executive Vice President at Harbour Energy, added, “It is critical that North Sea operators work together to ensure that oil and gas assets which, at the end of their production life, cannot be repurposed to support new technologies like carbon capture and storage, are decommissioned safely and in the most cost-effective manner. Collaborating and sharing data is an important first step to providing the supply chain with the visibility and confidence they require to meet UK demand for such works in a timely and cost-competitive way.”

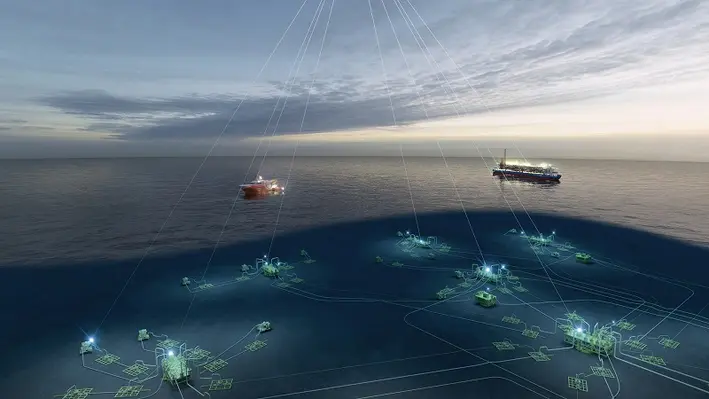

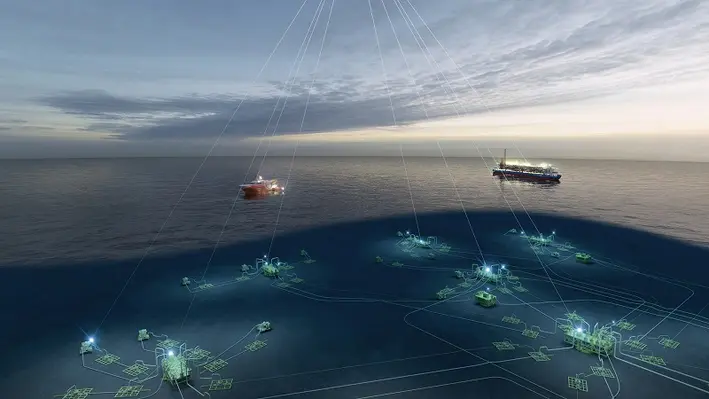

The proposed joint venture between SLB, Subsea7 and Aker Solutions has taken the next step to being realised following regulatory approval by antitrust authorities in Brazil.

With the signing off from the Brazilian authorities, all regulatory approvals and clearances have now been obtained, including those required in Angola, Mozambique, Australia, Norway and US, making the Q4 2023 closing more likely.

The joint venture has been pursued in order to help customers unlock reserves, reduce time to first oil, lower development costs and achieve decarbonisation goals in their projects. The companies will pool their deep reservoir domain and engineering expertise, extensive subsea production and processing technology portfolios, manufacturing scale and capabilities, and comprehensive suite of life-of-field solutions for clients around the world. This has this been described as a “milestone in subsea production economics” by the companies.

Following this announcement, the parties have stated they will continue to work to satisfy the remaining conditions for closing and aim to do so as practicably possible in Q4 2023.

Spirit Energy is celebrating its busiest-year-to-date in regards to decommissioning activities across the Central North Sea (CNS), Southern North Sea (SNS) and East Irish Sea.

Some of the recent work to complete includes the final phase of the campaign to remove the DP3 and DP4 installations in the Morecambe Bay development. Allseas completed the work through the use of Pioneering Spirit, the largest and most versatile offshore construction vessel in the world which is capable of lifting entire topsides of up to 48,000 t and jackets up to 20,000 t in a single piece. For this project in the East Irish Sea, a total of 9,000 t of jacket structures were removed in tandem using the jacket lift system and loaded directly onto the Iron lady. It was then to be transferred to Fife for recycling.

In CNS, a 14 well plug and abandonment campaign is being executed from the Well-Safe Defender vessel across four fields: Chestnut, Birch, Larch and Sycamore. Chestnnut’s decommissioning has now been completed.

“The Chestnut campaign has been delivered with exemplary safety and operational performance; this was our ultimate aim when we set out to select our partners for the CNS abandonment campaign. With this first milestone achieved we look forward to the remainder of the campaign,” remarked Nicholas Riley, Well Operations Manager, Spirit Energy.

Meanwhile, in SNS, Heerema Marine Contractors has successfully removed three topsides and three jackets with SSCV Thialf crane vessel. DeepOcean are set to recover subsea infrastructure from six assets later this year. The recycling of the all the structures will be conducted by Thompsons of Prudhoe in the Port of Blyth.

Head of Decommissioning and projects at Spirit Energy, Donald Martin, commented, “Combining decommissioning programmes and supply chain opportunities at portfolio level has created significant economies of scale with our partners leveraging the capability of their assets. This has also helped create opportunities to share campaign management responsibilities, leading to a lean and agile team. The recent successful completion of the removals of the DP3 and DP4 jackets marks a significant milestone towards our longer-term transition plan for the Morecambe hub being converted into a world-class carbon storage cluster.”

Spirit Energy, CEO, Neil McCulloch, concluded, “We are very proud of our efforts and achievements in decommissioning carried out by a first-class team of Spirit employees working collaboratively with the supply chain. Our team has thought strategically and formed long-term, high-value and high-trust relationships with our supply chain partners and we are very pleased to have achieved such a high level of local content and repeat business with UK and Netherlands based firms where our core business lies. Of course, we are also pleased to continually deliver industry leading decommissioning cost performance in line with our stewardship obligations from our regulators.”

The global offshore well intervention market is set for a period of extended growth in light of stable oil prices forecast in the short-term, maintained oil demand in the medium- and possibly long-term, and ever-increasing environmental pressures.

Globally, spending on well intervention is on the rise with Rystad Energy predicting an increase by almost 20% in 2023 to take the total tally to US$58bn. This is just the start of a forthcoming surge with 17% of wells predicted to go through the intervention process by 2027.

North America accounts for 64% of the total wells ready for intervention by 2027, according to Rystad, giving rise to the dramatic potential of the market in the Gulf of Mexico. According to BSEE, there are approximately 1,885 active production platforms on the OCS with more than 60% older than 25 years.

This is leaving operators grappling with the need to maintain production rates while also dealing with ever-ageing infrastructure, with mounting regulatory pressure increasing the need to address decommissioning obligations. In facing this conundrum, an increasing amount of well intervention activity is highlighting the importance of this service as a means to address both sides.

As new technological innovations become more viable and the understanding around methods such as light well intervention build, the market will only advance in stature, suggesting it will finally meet the potential it has promised for so long, creating a tantalising future for the crowd of service and equipment providers offering their assistance.

Reflex Marine's STORM-WORK suspended work basket was successfully employed in its 100th offshore project in October 2020.

Reflex Marine's STORM-WORK suspended work basket was successfully employed in its 100th offshore project in October 2020.

The STORM-WORK was designed specifically for offshore industrial work activities and was very well received by offshore operators across industries – heavylift, decommissioning, oil & gas, and offshore wind. ConocoPhillips in Australia is using the customised enlarged version of STORMWORK while the standard units have been employed in multiple projects throughout Europe, among others, with Seaway7.

The design, safeguarding both the workers inside the basket and the assets worked on thanks to the soft-touch features and contoured shape, is praised by users worldwide. The small footprint and light weight allow for improved manoeuvring, while the highly durable, low-maintenance materials used ensure long unit lifespan.

“The unit is excellent for accessing areas with obstacles and tight landing spaces," comments a STORM-WORK user from Boskalis. Reflex Marine’s innovative work basket design has been recognised by industrial engineering body LEEA with an award in the Safety category confirming the outstanding crew protection features and safety benefits.

STORM-WORK is available for purchase and hire and can be customised to meet the required size and capacity.

C-Kore Systems has announced the successful completion of a decommissioning campaign offshore Western Australia.

C-Kore Systems has announced the successful completion of a decommissioning campaign offshore Western Australia.

The campaign was completed using C-Kore Sensor Monitor units to interrogate the wellhead pressure and temperature sensors on the oilfield. With their automated test routine, the Sensor Monitor units repeatedly tested and data-logged the information, allowing the operator to complete the campaign swiftly and safely.

Cynthia Pikaar, Sales & Marketing Manager for C-Kore, said, “It is fantastic to be working on this project in Australia. With an increasing number of orders for our Sensor Monitor tools, operators understand the value of our testing tools offer, automating and data-logging results. We look forward to working in Australia again on the next campaign.”

C-Kore Systems has a range of subsea testing tools used globally for decommissioning, fault-finding and new installation campaigns. The tools can be operated without the need for C-Kore personnel to be present, providing rapid feedback. The systems offer significant operational savings to testing campaign with the simple, accurate and reliable deployment.

WSG has announced it has sold its well intervention division and will use the funds to lay the foundation for a period of international expansion for the rebranded WSG Energy Services (WSGES).

WSG has announced it has sold its well intervention division and will use the funds to lay the foundation for a period of international expansion for the rebranded WSG Energy Services (WSGES).

WSGES has diverted its traditional well intervention offerings and will now primarily focus on growing its market share in Process, Pipeline & Industrial Services (PPIS). The business will retain its global footprint with a strong presence in the UK, mainland Europe, Asia and Australia, with its next objective to establish a permanent position in the North American market to capitalise on the success of recent projects.

Proceeds of the well intervention division, which was sold to Excellence Logging (Exlog), a provider of oilfield services, will be used to fund further acquisitions and maintain R&D for refining the company’s emissions management processes and technologies, which are currently in high demand.

Founder Geert Prins will remain an integral part of WSGES’ C-suite as Chairman, while Andrew Burrell continues in the role of CEO.

“Under Geert Prins’ stewardship, WSG’s well intervention division evolved into a successful international well services provider to the energy sector and we are confident that business will thrive under its new ownership,” said Burrel.

“WSGES’ wide range of skills sets and our well established commitment to R&D opens up significant opportunities in energy transition, and we know there is industry-wide interest in our innovative emissions management capabilities, which is an area in which we will continue to invest.”

Chairman Geert Prins continued, “This is part of the natural evolution of the business I set up in 2005, and Phase Two of our success story is in the very capable hands of Andrew Burrell and a highly experienced international management team.”

“Diversification into alternative sectors and developing new products which address emissions management – something the energy sector is committed to – will drive future growth and we have some very exciting developments in the pipeline.”

Global well integrity specialist Coretrax is planning for future growth following a slew of recent project wins, with company headcounts rising by 20% to 300 people over the last year.

Global well integrity specialist Coretrax is planning for future growth following a slew of recent project wins, with company headcounts rising by 20% to 300 people over the last year.

The business has expanded operational bases in the US, Middle East, and Southeast Asia, with further growth in the pipeline for the Asia Pacific region with the first senior appointments in Australia. The company expects to recruit a further 50 people this year to meet the demand of projects.

Coretrax has also supported carbon capture (CCS) and geothermal campaigns, seeing significant potential to bring its technological expertise to the lower carbon sector.

John Fraser, CEO of Coretrax, said, “We have experienced growth across our operations and are currently running live projects on 250 rigs in the Middle East, with support provided from our teams in the Kingdom of Saudi Arabia and Dubai.

“In the US, our unique expandable technology is being used to bring wells well on stream, delivering cost savings and efficiencies with international orders mounting up for this technology that can add value in one run.

“In the UK, the majority of our work is in wellbore clean up and plugging and abandonment as we help operators to safely decommission their assets.”

Coretrax continues to invest in research and developments, and currently bolsters more than 50 technologies across its four product lines. With a strong engineering focus, the company brings together a range of solutions into an integrated package to provide a full well lifecycle solution.

SLB, a global technology company, has released its Q2 2023 results revealing the part intervention and stimulation activities are playing in the business growth.

The company reported a revenue of US$8.1bn, representing a 20% increase year-on-year. SLB CEO Olivier Le Peuch commented, “I am very pleased with our second-quarter results, which reflect significant growth in the international markets, particularly in the Middle East & Asia, and offshore. North America revenue also grew sequentially benefiting from our agility across the most resilient basins and market segments, although the rig count in the area declined. As the upcycle continues to unfold, we are excited about the opportunities for our business, with international- and offshore-led growth fueling strong pretax segment operating margin expansion and cash flows as highlighted in this quarter’s results.

“Compared to the same period a year ago, international revenue grew 21%, outpacing North America which increased 14%. Year on year, revenue grew 20% and pretax segment operating margin expanded 240 basis points (bps), representing the tenth straight quarter that we have increased our pretax segment operating margin year on year. This was driven by the international markets, where we posted our highest year-on-year incremental margin in the last three years, demonstrating the earnings power of our operations in these markets.”

Breaking this down, the company noted that reservoir performance revenue grew 9% sequentially due, primarily, to increased intervention, stimulation and evaluation activity internationally. Profitability improved mainly due to higher activity and improved operating leverage across intervention and stimulation with new technology deployment contributing to margin expansion, particularly in Saudia Arabia, Qatar, Europe & Africa and Mexico.

The Middle East & Asia was a particularly strong-performing region for the company with a 10% increase sequentially driven by double-digit revenue growth in Saudi Arabia, Egypt, UAE, Kuwait, China and India. SLB attributed to higher drilling, intervention, stimulation and evaluation activity here, both on land and offshore. Saudi Arabia was a particular hotspot for higher stimulation and intervention activity. Reservoir Performance grew 23% year-on-year, primarily down to higher intervention and stimulation activity led by the Middle East & Asia.

The company also highlighted how it had experienced increased intervention and stimulation activity in Argentina which helped offset the lower revenue recorded in Mexico.

Page 66 of 118