EnerMech, a global services company specialising in critical asset support across the asset lifecycle, has hired Carl Mook as the Regional Director for Europe and expanded Paul Cockerill’s role to oversee Africa, in addition to his current Middle East and Caspian remit.

The new senior structure will help drive further growth for the firm’s Europe and Africa operations. The business will leverage both leaders’ expertise to span responsibilities focusing on the two continents, as well as scaling up teams when required in the Middle East and Caspian region.

Mook has 30 years of international leadership experience in engineering consultancy and design, asset management, operations and maintenance, inspection services technology and asset integrity. He has held several senior roles in his career, including Executive Vice President at Penspen and Vice President of Process and Pipeline Services at Baker Hughes.

Cockerill has been EnerMech’s Regional Director Middle East and Caspian for almost two years and has been pivotal in the business securing several transformational projects and pre-commissioning campaigns in the region. He has significant experience in Africa, having previously held senior positions at Halliburton in Angola, Congo and Nigeria for 16 years where he was instrumental in increasing market share and developing local workforces.

EnerMech CEO Christian Brown remarked, “The Europe and Africa region has been delivering a solid performance for the business, which is a direct result of our teams in these geographies delivering excellence day in, day out. However, we are not a company to rest on its laurels.

“Paul has delivered exceptional results in the Middle East and Caspian. Widening his portfolio to support our Africa operations, means we can rapidly scale up our teams as more campaigns and megaprojects are won. The wealth of experience and enthusiasm Carl brings to the business will help us to further develop our European operations with a pin-sharp focus on securing new business as well as overseeing existing project work.”

Baker Hughes has announced that it will be acquiring Altus Intervention, a leading international provider of well intervention services and down-hole oil and gas technology, to complement its existing portfolio of oilfield technologies and integrated solutions.

Altus Intervention employs around 1200 people globally and operates across four regions: UK and West Africa; Norway and Denmark; Americas; and Middle East and Asia Pacific.

“The addition of Altus Intervention supports our strategy to transform core oil & gas operations by enhancing technological capabilities and providing customers with higher-efficiency solutions,” commented Maria Claudia Borras, Executive Vice President of Oilfield Services at Baker Hughes. “We value the Altus Intervention team’s deep expertise and look forward to bringing these fully integrated well intervention solutions to our global customer base.”

Åge Landro, CEO of Altus Intervention, added, “Our technology and techniques play a critical role in improving production, well intervention and plug and abandonment, and we believe this agreement with Baker Hughes is the right step forward.

“We are focused on a long-standing vision of making intervention smarter to deliver real change operationally and commercially, and we look forward to leveraging Baker Hughes’ strong network, complementary technology and global infrastructure in the oil and gas industry.”

The transaction is expected to close in the second half of 2022. The acquisition agreement includes all intellectual property, personnel and commercial agreements.

Senergy Wells, a Vysus Group company, has secured 15 new contract wins in wells disciplines globally, stretching from Mexico, through Europe and Africa to southeast Asia.

The contracts, worth more than UK£5mn to the company, include a range of projects with numerous customers, including Energean, Repsol, Shell, Chevron, TAQA and Harbour Energy UK.

To support the breadth of international projects secured, Senergy Wells has embarked upon a recruitment drive to bolster its expertise across services from exploration to decommissioning.

Matt Rothnie, SVP Senergy Wells & ModuSpec, commented, “We are naturally delighted to have secured such a wide range of contracts to deliver projects across the world for a range of customers from energy independents to super majors and NOCs. It’s also encouraging that the type of work covers the complete spectrum of the asset lifecycle from wildcat exploration and front end engineering, through field development, well construction and design, and ultimate decommissioning.

“This positive start to 2022 comes as we bring back the Senergy name. Vysus Group is extremely proud of its heritage and the legacy companies which give us our unique breadth of deep domain expertise. Our experience in the well engineering, operations and project management sector originated within Senergy – and this is a name still instantly recognisable by many in our industry as a service provider and trusted partner for well operators. It’s not just what we do but importantly how we do it, how we show up for our customers. That is why we’re bringing it back.

“The calibre of projects we are supporting this year is fantastic and testament to the proven technical delivery of our team. We look forward to continuing to help our global customer base deliver efficient operations throughout 2022 and beyond.”

Tendeka offers its portfolio of innovative tools and technologies in sub-Saharan Africa to restore production from existing well stocks, reduce gas and water flow and improve production.

The versatile suite of solutions does not require complex interventions and has already brought huge logistical, technical and financial savings to operators in the region.

Intelligent technology

PulseEight dynamic downhole reservoir management system is the world’s first re-deployable wireless completion range. Utilising Fluid Harmonics telemetry, two-way communications to and from a suite of downhole tools can be used to optimise production:

• PulseEight Electronic Ambient Valve (EAV) reinstates wells which were previously closed through loss/lack of a safety valve

• PulseEight Wireless Gauges (WG) provides pressure and temperature data from wells which have lost permanent systems or where these were never installed

• PulseEight Intelligent Valve (ICV) delivers infinite, inline manipulation of flow for choking and shut-off purposes

In addition to PulseEight, the company’s Mature Fields offering includes retrofittable, next generation inflow control technology, to attain a uniform inflow profile for enhanced oil production in new wells or through intervention.

Tendeka also offers in-house capability to custom design a range of sealing solutions, from non-standard diameters to unique fluid parameters, ensuring a perfect fit for well projects.

These include SwellStack sealing solutions which are rated to 15,000 psi in gas, reinstating the function of safety valves quickly and effectively; Swellable O-rings to reinstate the function of safety valves quickly and effectively; and SwellRight Side Pocket Mandrel (SPM) Plugs to provide pressure integrity in damaged side pocket mandrel bores.

Following success in Chad to solve sand production issues in water injection wells, Tendeka is working with a local partner in Nigeria to deliver Casacde3 in a multi-well subsea development.

Environment Quality Services (EQS) has successfully assisted in a decommissioning project offshore Angola. Dubai-based EQS deployed their Saab Seaeye Falcon to assess the integrity of the offshore structures via visual inspection and image gathering.

Carlos Rodrigues, CTO, of EQS, commented, The Falcon supports EQS in their aim to fulfil specific works in a safe and cost-effective manner by delivering accurate and relevant information.”

Rodrigues said that the Falcon is an ideal resource for specialist work as it can handle an array of cameras, sensors, tooling and complex data gathering systems that can easily be added or changed thanks to the Falcon iCON intelligent module- focused distributed control architecture.

The Falcon is the top selling robot of its class and its success is attributed to it being a portable, metre-sized, intelligent, powerful highly mahneuverable, easy-to-use vehicle with a depth rated range to 1,000 metres.

It has a reliability record covering more than one million hours underwater, including deep tunnel work. The Falcon can remain stable in turbulent waters and strong currents whilst undertaking both robust and precision tasks.

The structures inspected on the platform offshore Angola included the platform (jacket), well head, protection dome, pipelines and umbilical. EQS helped the offshore energy clients navigate the complex environmental regulatory landscape to achieve compliance as well.

Presenting at the Offshore Well Intervention West Africa 2021 virtual conference, Bhargava Ram Gundemoni, 3M Global Solutions Specialist, explained how better sand control can lead to better productivity and profitability.

Presenting at the Offshore Well Intervention West Africa 2021 virtual conference, Bhargava Ram Gundemoni, 3M Global Solutions Specialist, explained how better sand control can lead to better productivity and profitability.

Traditional practices used for the sand control selection (SCS) process are based on mature technologies and methodologies that fail to meet the key performance drivers. The metallic filter media has erosion limits that constrict the boundary condition of the traditional SCS practices which result in failing to meet the asset productivity demand and the performance drivers not being achieved in many cases.

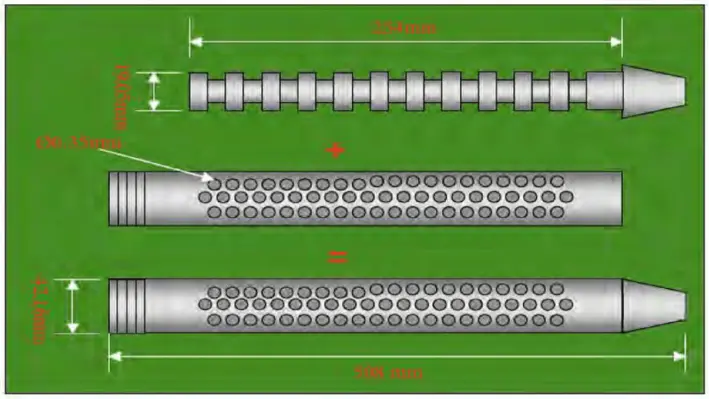

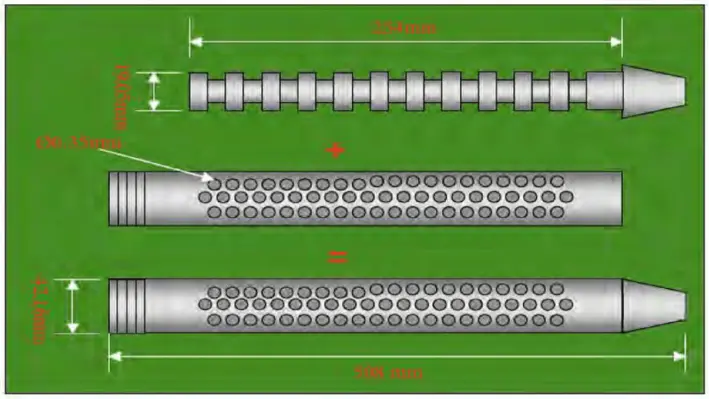

An alternative to the traditional sand control approach

The solution is a change of metallic filter media to ceramic filter media of the screen. 3M’s solution is achieved by integrating a full-body ceramic part in the form of rings on a pre-perforated base pipe on to which ceramic rings are stacked and held with two end caps and with an external shroud on top. The stack of ceramic rings creates a slot opening which is designed for the application spec-in. The ceramic material at the inflow offers higher erosion resistance, therefore mitigating hotspotting potential. This allows the operator a wider operating window of productivity.

Erosion constraint on the metallic filter media limits the well operating limits, limiting the productivity potential and the application envelope of applying a standalone screen system.

Using a ceramic filter media operators have proven in green fields and brown fields to shift the boundary conditions of applying stand-alone screens as demonstrated in the below picture, and achieved reduced risk to erosion failure and increase productivity. 3M Ceramic Sand Screens offers operational simplicity, reduced HSE risk to unlock production potential with faster return on investment by enabling standalone screen deployment as a simple sand control tool to address in a wider range of reservoir conditions

Standardised field-wide approach

Ceramic Sand Screens unlocks the operator methodology to achieve a simplified and standardised sand control approach in wide range of reservoir conditions and well architecture as downhole sand control system in OH, cased hole on a rig or through tubing rigless applications. Ceramic Sand Screens have been deployed and delivered success in 120+ applications with homogenous, heterogeneous, well-sorted to poorly sorted, low to high fines reservoir of sand properties.

To emphasis the effectiveness of the solution Ram presented three case studies from different regions across the globe.

Remedial sand control in a subsea re-perforated well intervention vessel in the North Sea

Customer challenge: The oil well was not operational due to depletion with a gas cap identified shallower to main zone. The operator intended to cost-effectively exploit the gas cap using rigless deployment method to add additional revenue from the existing asset. The project also needed to run a stand-alone sand screen in the open sea and through a subsea lubricator and required sub-sea well (deviated) intervention in harsh deployment conditions. The well downhole environment was extremely erosional and a reliable, robust solution was required to prevent failure at a reasonable cost.

Solution: The operator opted for ceramic sand screen deployment on a light well intervention vessel and run the screen through an e-line wireline system with an expandable packer system through open sea into the sub-sea lubricator.

Results and value creation: The operator was able to achieve production rates of 45 MMSCFD of gas sand-free through the solution. The 3M ceramic sand screen for this project was deployed successfully in April 2016 and was replicated in other wells with the same scope of work.

Marginal gas fields in Indonesia with ceramic sand screens

Customer challenge: The operator had to deal with marginal reserves with stacked reservoirs and was a low-cost environment. High flux velocity expected at sand face due to shallow and low-pressure, short intervals and needed robust and rigless deployable solution to achieve economical sense with heterogenous sand properties being a challenge.

Solution: High erosion and hot spotting resistant ceramic screens enable the operator to set across the perforation zone which are deployed on slickline with one or two pup joints depending on the perforation length.

Value creation: The operator achieved cost savings of up to 70% compared to the previous sand control approach and was able to increase reservoir deliverability by more than 200% of the average cumulative gas produced. The operator can now complete more zones per year and achieving a sand-free higher cumulative production volume, extending as a standardised approach to multiple assets as a primary sand control method.

Ceramic sand screens in high rate oil wells in Azerbaijan

Customer challenge: The operator had no sand control in place. With reservoir maturing and downhole conditions changed over time, sand production increased to a level where production targets are not achieved leading to well shut-in to integrate downhole sand control. Key challenges in selection of sand control are achieving cost-effective sand control approach without needing a rig in well conditions of high Fines, poorly distributed reservoir sand PSD with fluid flow at high flux and impingement velocity

Solution: 3M ceramic sand screens length of 203 ft, were set across 9 ⅝ inch casing perforation using coil tubing deployment method.

Value creation: The operator achieved ROI within five days based on the current oil price and was able to clock a sand-free production rate of 8000 BOPD and 46 MMSCFD gas. The operator also recorded a production gain of 2500 BOPD sand-free. Significant improvement on the PI over time exceeding the expectation of a standalone screen in such reservoir sand distribution with a low cost of deployment at reduced carbon footprint installing sand control mitigating need of a rig.

Solutions to maximise profitability

As of Oct 31 2021, 3M has completed 125 installations for sand control with users consisting of 50% oil producers and 50% gas producers. For general intervention applications 3M has maintained a manufacturing time of 6-12 weeks with variables such as size, quantity and shipping time to location.

3M remarked that the solution can help operators meet future energy policies to reduce carbon intensity for deployment with rigless approach where feasible and reduce the sand control future repairs offering a robust solution. The simple stand-alone screen and faster deployment means reducing HSE, operational risk and mean time between failures.

3M added, “There are a lot of wells globally where operators can unlock production potential from their shut-in wells due to failed primary sand control or from thin-bed reservoirs or reservoirs which have not been exploited because they are deemed un-economic and left behind the casing. 3M’s ceramic sand-screens enables an operator to approach such cases using a rig-less method, without the removal of tubing and requirement of a complex rig sand control solution. 3M has proven this at multiple fields and assets globally.”

With a field track record of 125 successful application, operators in West Africa can find proven results from similar conditions to their reservoirs as reference case study.

To learn more about Ceramic Sand Screens, visit: https://www.3m.com/3M/en_US/oil-and-gas-us/ceramic-sand-screens/

If interested in such a simplified solution to unlock the production potential assets by addressing sand control challenges, contact Bhargava Ram Gundemoni:

Riserless Light Well Intervention (RLWI) is proving to be a cost-effective method of intervening in West Africa’s offshore wells, using suitable support vessels instead of rigs.

Riserless Light Well Intervention (RLWI) is proving to be a cost-effective method of intervening in West Africa’s offshore wells, using suitable support vessels instead of rigs.

A panel of industry experts came together at the Offshore Well Intervention West Africa 2021 conference to discuss the risks posed by RLWI and how the industry is perceiving new technologies driving the uptake of such activities.

Chiwuike Amaechi, Principal Subsea Intervention Engineer of SNEPCo, said that value realisation is one of the key risks that need to be considered when picking an intervention method. “Categories for this include production enhancement and well integrity. The economic threats are mainly around the fears of obtaining the projected production gains which would justify the investment into the intervention,” he added.

Elaborating on the challenges related to environmental safety, he said it is difficult to clean out a well in a purely riserless intervention. “How do you ensure that you do not release any hydrocarbons to the environment, particularly in places where there are strict regulatory requirements and organisations that have a zero spill policy? These are some of the roadblocks that we face in the implementation of riserless interventions,” Chiwuike said.

Oladapo Ajayi, Division Geounit Manager of Reservoir Performance in Nigeria and West Africa, Schlumberger, also gave his insights on the topic from a well service company’s perspective. He said they usually look at factors like water depth, climate and most importantly, the commercial aspect. “There’s always the triple constraint – time, cost and quality of the performance. In terms of time, the schedule and planning are important and when we say cost, we mean the budget we are looking at.”

According to Andrea Sbordone, Business Development Manager for TIOS, the risk associated with RLWI does not increase alongside depth. “We see RLWI as a better option from an environmental perspective, as the impact is significantly lower and the number of people needed is less too,” he said, adding that operators who have not used RLWI before have now become much more comfortable after using it once.

Moderator Thomas Angell, Director of Offshore Network, said that the idea of ‘horses for courses’ might have changed in the last 5 to 10 years in the intervention field, and Sbordone opined that flexibility is important, and one should be prepared for surprises. “In the last 15 years, the kind of operations you can do on e-line have been increasing, the gap (with coiled tubing) is reducing slowly.” Agreeing with his co-panelist, Oladapo Ajayi said that indeed the gap has reduced in comparison to previous years.

As new technologies have entered the market, the panelists stressed the idea that these need to be properly tested before they can be utilised. “We do need to see technologies matured somewhere else. It is always good to have seen it work beforehand and find out the success rate as well as what failed for learning,” informed Chiwuike.

Sbordone noted that, in terms of downhole solutions, new technology is released every year which is deployable from a riserless light well intervention vessel such as sealing technologies for example. In terms of conveyance he added there has been big steps taken forward and riserless coil tubing solutions, for instance, are making significant progress to be field-proven.

“Last year, we did a campaign of riserless coiled tubing coring in Norway, in water depths up to 3085 m. We deployed riserless coil tubing 14 times. This confirms that water depth is not an issue for riserless coil tubing. Times are changing and people are becoming more adaptable to new technologies.

“15 years ago, if you asked a coil tubing provider to put coil tubing through open water as a pumping downline in 2,000 m, they would be apprehensive to agree. However, slowly the industry started doing it and now it is pretty much the standard,” he added. There has not been a change in the technology used, what has changed is its acceptance and the operators’ confidence in using it.

Stressing on the need for true competency and integration for achieving efficiency, Sbordone said crew integration is important. “This integration is not just for equipment but also for people. The crew working on different parts of the operation should know each other’s work and coordinate the activities to achieve high efficiency.” Chiwuike agreed, highlighting there are significant benefits in efficiency and cost that service providers have been able to bring by offering an integrated solution with vessels that incorporate a complete light well intervention package executed by a core crew that have developed experience through various campaigns.

He added the appetite for RLWI is increasing in West Africa, noting that there were three RLWI campaigns ongoing in West Africa in 2019 in three different countries for three different operators, with three different suppliers. “We believe intervention activity is increasing and will continue to do so.”

Oladapo Ajayi said, “Light intervention is the way, in terms of the efficiency that we gain. There is a full appetite for this kind of work and, for me, technology is the main thing to drive this. Digital can open a new horizon of growth in offshore intervention business and help identify candidate wells, provide a complete portfolio of intervention options to select the optimum solution as well as being able to ensure a predicable successful outcome.”

“The advancement in the digital space provides opportunities for the ability to better risk assess operations and, therefore, make calls on probability of success during the planning stages. Thus, more digital operations ahead of time can be utilised to better improve efficiency of the actual operations. In addition, better planning and utilisation of assets should result in cost reduction. All of this is only possible based upon information sharing between operators and service providers being the key,” he continued.

Angell concluded, “There is now a real understanding of the difference between cost and price and value. These are three things we understand really well known when it comes to complex well programmes.

“The providers out there are the right ones to make this a reality. It would be great to return next year for this conference and listen to some of the projects that everyone has done in that window.”

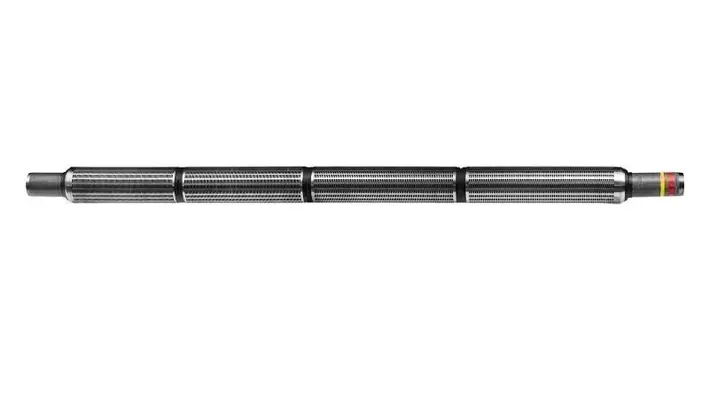

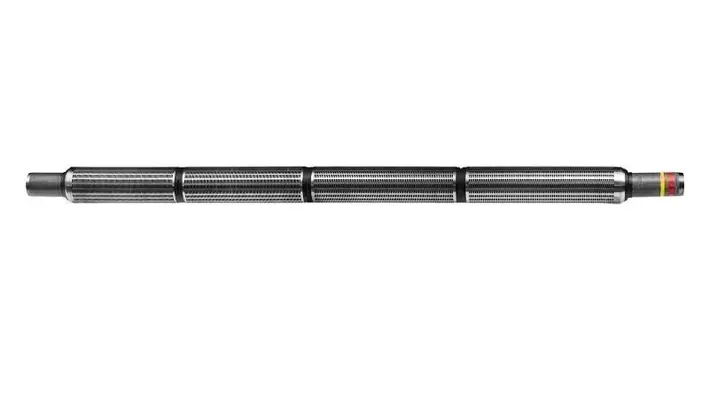

Neil Greig, Sales Manager at Helix Well Ops, presented at the Offshore Well Intervention West Africa 2021 conference to showcase the Helix Q7000 DP Class 3 semisubmersible vessel which has continued to prove its capabilities across multiple campaigns in West Africa.

Greig noted that Helix has accrued a lot of experience with well access and has successfully entered more than 1500 wells globally. The company has an impressive fleet featuring the Q4000, Q5000, Siem Helix 1 and the Siem Helix 2 vessels all of which are capable of a wide variety of applications. It is through their practice with these vessels that Helix has been able to launch themselves effectively into campaigns in West Africa with the Q7000 (which has similar topside equipment to its siblings) and has achieved efficiency from the start.

Greig explained that the newest vessel was delivered as part of the Subsea Services Alliance between Helix and Schlumberger and so benefits from the expertise of both companies. By leveraging their combined knowledge, they have been able to reduce the crew size from wireline and slickline from 14 down to 8 and have reduced the coil tubing crew by 5. If an arbitrary figure of US$1000 per person per day is taken for crew cost this translates to savings of at least US$1mn per 100 day campaign. This is not too mention the cost savings of reduced crew changes, helicopter transfers and bed spaces etc.

The Q7000 is suited to deepwater applications down to 3,000 metres but is also designed to work in shallower water with an 80 metre range. The Intervention Riser System (IRS) on board enables access to both convention and horizontal subsea trees in depths down to 10,000 feet and is capable of applications including coiled tubing, electric line, slickline, cementing, well abandonment and tree change outs.

The story so far

Greig explained that so far the Q7000 has performed three campaigns with Exxon Mobil, Total and Chevron (all in Nigeria) and is currently in the field under contract from SNEPCo.

In the first project, the vessel successfully delivered a five well campaign with scopes of work including the acquisition of reservoir data, water shut offs / zonal isolations, hydrate milling / CT clean up, and remedial safety valve operations. This was performed some 65 miles from Nigeria in more than 1000 metre depths.

At certain points of the campaign instead of fully recovering the IRS it was lifted free of the well and then the vessel moved to the next location with the IRS held at depth, this reduced time for deployment recovery operation significantly.

The campaign had a number of challenging ‘firsts’ for Helix involving a Nigerian crew with a bran new system and an untried IRS. Greig was happy to report that all the personnel and equipment involved performed flawlessly and at a time when Covid-19 was disrupting travel.

The highlights of this project included:

• First deployment of the new IRS, which was left in the water for 70 days straight.

• Five wells in a single IRS deployment.

• Project executed in 25 days less than planned.

• 96.86% uptime (1,752 hours or 73 days).

• Four subsea well hops.

• Zero LTI, walk to work, no lifts across deck.

• First coiled tubing hydrate milling in Nigeria.

• Zero delays in mobilisation of tools and personnel.

For the second project early in 2021 Helix was tasked with performing work on five wells across two fields. The scope of work included TRSSSSV lockout and WRSSV install on three wells, acid stimulation on CT across screens and acid stimulation on CT across screens followed by well clean up (flaring). These were conducted in ultra deep water down to 1560 metres, 90 miles off the coast of Nigeria.

Once again all involved performed exceptionally well with highlights including:

• >98% uptime.

• Three subsea well hops.

• Zero LTI walk to work and no lifts across deck.

• First well clean up test on Q7000.

• Zero delays in mobilisation of tools and personnel.

• Improvements in vessel efficiencies.

Greig concluded, “The Q7000 is something between a rig and a light well intervention vessel. It can’t drill a new well, it is not sized for that, but it is sized for more efficient heavier intervention campaigns. With rigs, when they go into intervention mode you need to get the associated equipment brought on. The Q7000 achieves huge efficiency advantages by having the equipment already there and bunny hopping between wells also saves time and money. Additionally, being able to swap between services is also a real benefit.

“There is nothing specific I can share for work in the future involving this vessel, but ‘build it and they shall come’ mentality seems to be working. There is currently a huge appetite to go after oil and if you have an asset in the field to do that its going to make sense people will wan to use it. We are certainly seeing an increase in work and this is great for everyone involved.”

In March 2021 a panel of industry experts met to discuss the challenges and opportunities of riserless light well intervention (RLWI) in sub-Saharan African (SSA) and, half a year on from that spirited debate, as part of the Offshore Well Intervention West Africa 2021 conference the party reconvened to discern if anything has changed.

In March 2021 a panel of industry experts met to discuss the challenges and opportunities of riserless light well intervention (RLWI) in sub-Saharan African (SSA) and, half a year on from that spirited debate, as part of the Offshore Well Intervention West Africa 2021 conference the party reconvened to discern if anything has changed.

Sola Adekunle, CEO, Cranium Engineering reprised his role as host and began by outlining some global changes to the oil and gas market in this time. He noted that in November 2020 oil prices were sat at US$37 per barrel, rising to US$63 on 1 March. At this time, boarders were still more or less closed, lockdown restrictions were still in place and generally Covid-19 was having a huge impact on business.

Six months on, the pandemic is still here but with the distribution of vaccines in full flow the world has opened up, industries are recovering and, as of 4 October, oil prices had climbed to US$82.95 per barrel.

RLWI in a recovering market

During the last session the panellists explored the benefits of RLWI by commenting that operators can achieve the majority of their objectives at a much lower cost and this presented a significant opportunity to capture the low hanging fruits of oil production. Since then, Adekunle asked, has this been recognised in SSA? And has the region adopted this method of well intervention to alleviate it’s rapidly ageing well stock.

New member of the panel Paul Stein, Commercial Director of Baker Hughes, said, “Globally it is a bit mixed in terms of RLWI despite the oil price going up. We are certainly seeing more tendering and early engagement with clients in this space but there is a split in customers. Tried and tested customers have RLWI in their core business and some are consistently undertaking such campaigns.”

“However, particularly in West Africa there is a delay in operations taking place which is maybe a reflection on the downturn of capability and knowledge within untested companies. It is also a significant investment for operators to pitch internally and many companies do not have that pot of money set aside for interventions. Now is the time to support clients to realise the production gains that can be achieved; particularly in West Africa which has an ageing well stock. I believe RLWI has a big place in the region.”

While there has been hesitation to undertake RLWI campaigns, this has not been the case with BP. Matthew Vick, Senior Subsea Wells Engineer, BP, explained that his company had continued with these operations and had just wrapped up a campaign in Angola. For the future it had already started the leg work for another campaign in the future alongside major campaigns in the Gulf of Mexico and the North Sea. For his company, “Light well intervention has become a routine operation at this point.”

Feyisola Okungbowa, Executive Director, Baker Hughes, added that there was definitely a lot more upfront activity but this was not, as yet, really translating into actual business in the region.

She said, “We do have some operators in SSA executing currently but with the ageing stock that we spoke about last time the coverage is still not there compared to other regions. With the improved oil price we are having discussions on more oil creation and yet I am still wondering why we are not seeing the market use light well intervention ‒ a low hanging fruit which can be used to boost production.”

The panellists noted that perhaps there was an unrealistic expectation for this uptake to happen quickly and, in reality, senior executives need more time to truly understand the benefits of light well intervention. This education journey has not been helped by the long pause of operations during Covid-19.

Encouraging RLWI

With the challenges listed the panellists then turned to discussing how they can be mitigated to encourage more campaigns of this nature in the region. Picking up on education, Vick noted that the benefits of RLWI can be conveyed by communication within the industry. He said, “We love sharing out lessons and we like it when other operators share theirs. The more something is used the more efficient it becomes and this will drive uptake.”

In this vein, collaboration is also high on the list. Intervention campaigns can be very costly for less developed regions such as West Africa as often specialised equipment must be brought in and this might prove not economically viable if only a few wells are targeted. However, the panellists explained, this expenditure can be cut if split between several operators partnering on the same campaign. This would also result in longer campaigns which would, the longer they go on, drive efficiency and thus capture more value: Vick noted that the biggest return on value is usually achieved on the 5th/6th well onwards when engineers start to work through the kinks.

To achieve this, contracting strategies are paramount. Another new member, Vidar Sten-Halvorsen, Subject Matter Expert-Well Intervention at Havfram, noted, “It is important to have a clear agreement up front on who is doing what and how they are going to work together. Agree on contractual issues early and then everyone is in the same boat with the same agenda.”

Vick added, “A one-team mentality is critical and having that formally defined is very important. Make sure everyone is on the same page, has their relationships clearly defined and agree to it up front.”

Stein commented that Baker Hughes has a great track record in SSA with countries such as Ghana and is capable of conducting operations in other waters across the region as well. He noted that his company is more than happy to work with other service companies in order to unlock the RLWI commercial potential that SSA holds.

Okungbowa added that their local content strategy is second to none after spending the last three years training up local engineers. Because of this they have a great foundation from which to execute operations cheaper and faster, avoiding the need to bring in too many external personnel.

Finally, the panellists explained that with so many energy companies placing climate concerns high up on their agenda, light well intervention has the potential to help operators maintain production at a reduced carbon footprint.

Sten-Halvorsen said, “This is becoming more and more important from an operator point of view ‒ the footprint left behind after operations. Lighter vessels have lower fuel consumption and it is something that is really favouring this approach over the use of heavier units.”

A brighter future ahead?

Despite not as much uptake in the last six months as was expected, the panellists remained positive about the future of RLWI in SSA.

Sten-Halvorsen concluded, “Africa is the next big thing for well intervention and there is a huge price to win here going after intervention in West Africa.”

Stein added, “My aspiration is to be in a position to conduct multi-well campaigns in West Africa utilising the potential of light well intervention. The region could go from a place not really using this method to one that is driving. It has the potential to do that.”

Concluding another insightful session, Adekunle simply said, “It is the way to go. It is the future.”

At the Offshore Well Intervention West Africa 2021 conference, Ejimofor Agbo, Senior Completions Engineer at Newcross Exploration and Production, presented a case study outlining his company’s new approach to wax removal.

Ejimofor began by commenting that wax production presents one of the most challenging flow assurance issues when not addressed in the well completion design stage. The problem occurs when paraffins precipitate when the production system temperate falls below the wax appearance temperature (WAT). The resulting wax deposits that form can cause blockages which reduce production rate and flowing tubing head pressure and, in some cases, can take production from 2,000 barrels down to zero.

There are three conventional methods of solving wax problems, but each has inherent issues:

-Mechanical: Utilises wax cutters and scrapers for cutting the wax and also scraping it off the metal surfaces of the tubing. This is widely used and is cost effective initially but over time it can be needed at more frequent intervals which increases the cost and risk.

-Thermal: Downhole electric heaters are used to improve the heat retention capability of the crude so that its temperature remains above the WAT. A useful solution however there is a number of associated challenges such as availability of power sources offshore, the heating up of tubulars and formation damage.

-Chemical: Utilises chemical solvents to dissolve the wax molecules and allow the crude to be flowed to the surface. The problem with this solution is it has to be treated on a case-by-case basis which means information about the reservoir must be known and it can be costly overtime. There are also issues around availability of chemicals and initial completion design to accommodate for chemical injection valve

These are the standard wax removal methods but, Agbo continued, there are alternative approaches to wax removal, you just need to be able to think outside of the box.

An alternative approach

This is how Ejimofor and the team approached one of their wells suffering from acute issues with wax deposits which he presented to the OWI WA attendees in an informative case study.

The AK-40 Well, located in an ageing field, was completed in 1992 in two non-waxy reservoirs. However in 2005 the well was recompleted as the only drainage point in X1.0 reservoir containing waxy crudes with no provisions taken to cater for wax deposition. When the well was opened in 2006 it had an oil production rate of 1,142 BOPD but subsequent production gave 1,100 BOPD with intermittent wax cutting required every six months. The start-up rate post-wax cutting activity continued to drop and the duration of production dropped from six months to three months and continued until it only lasted for a month after wax cutting intervention.

Ejimofor said, “This called for a more effective wax mitigation strategy. We needed to do something different and think outside the box to resolve this issue.”

This began with laboratory analysis by which they discovered that a solution of 60% xylene and 40% diesel was the most effective at dissolving the wax with 98% dissolution achieved. Additionally, through an oil sample, they discovered the WAT was around 91.4⁰F while a dynamic model indicated the WAT was between 94⁰F and 95⁰F. Finally, through a bottom hole pressure and temperature survey they found that the estimated depth of wax precipitation was established at 3,300 ft which corroborates with breakthrough depth in previous wax cutting interventions.

With this information, the company then turned to deciding which alternative wax removal methods they should utilise, with two available.

The first was the Wax Inhibition Tool (WIT) comprising of nine dissimilar metals combined to form an alloy. This tool acts as a catalyst which enables a change in the electrostatic potential of the fluid. It changes the electrostatic potential and produces a polarisation effect at the electron level of the molecules which prevents scale formation, corrosion of metal and paraffin wax deposition. Crude is sucked into the holes in the tool and when in contact with the alloys to break up the long chain hydrocarbon molecules thereby making the oil ‘slicker’ and flow better.

Ejimofor added in some places they call it “the wonder tool”.

The other option was a Capillary Injection System which injects chemical solvent downhole to aid in the dissolution of wax molecules and allows the crude to flow to the surface. This can only be internally installed in the tubing string and can be used in various applications including liquid loading, scale control, salt control, corrosion control, and more.

The company compared the two and, in this application, found that the Capillary Injection System was not as viable as it would require a complex deployment, multiple items would be POOH, there was a high risk of plugging, it required preventative maintenance and there would be a high installation cost.

On the other hand, the WIT had an easy deployment, only one piece would be POOH, it carried a low risk of plug, there was low maintenance required and the cost of installation was lower. It was therefore the clear choice.

Execution and results

With their solution chosen Newcross turned to the next stage and carried out tubing integrity via mechanical wax cutting on slickline followed by wellbore clean up with solvent soak (of the xylene/diesel solution) across the entire wellbore. This ensured that before the WIT was installed the entire wellbore was cleaned of wax deposits. They then ran inhole and installed the WIT at 4,000 ft (600 ft below the WAT depth previously discovered).

Ejimofor commented, “Since we have done that, in the past eight months production has been the same and we have not needed to cut wax in this time. It is flowing on its own and management has been very happy with the results.”

At the Offshore Well Intervention West Africa 2021 conference, Todd Parker, CEO of Blue Spark Energy, explained how his company has developed a technology to utilise rapidly compressed, low-energy pulses to clear impediments in wellbores.

At the Offshore Well Intervention West Africa 2021 conference, Todd Parker, CEO of Blue Spark Energy, explained how his company has developed a technology to utilise rapidly compressed, low-energy pulses to clear impediments in wellbores.

Since its first operation in 2011, Calgary-based Blue Spark Energy has focused on the electrification of intervention processes, including a new wireline tool that utilises compressed energy to generate a pulse for use in well intervention applications.

BlueSpark Technology utilises high-pulsed power by compressing electrical energy to create high power events. Abandoning the traditional use of power in well bore solutions, Blue Spark's solution reduces the amount of time energy is utilised in, thus increasing its output. As energy is further divided among smaller increments of time, power outputs become significantly larger.

The wireline solution utilises apprxoimately 1 kilojoule of energy compressed into a millionth of a second. This means that every time a tool is used, around 200MW is generated in a power pulse- manifested in a shockwave that can clear impediments, scale, organic materials or blockages. As well as impediment clearance, the wireline tool can be used for production stimulation.

Coaxial cables are often used for this application, with an external energy source supplying approximately 1 kilojoule (around two mobile phone batteries worth of power for an entire treatment).

Involving only a coaxial cable and power source, the solution has practically zero environmental impact, and offers a low-cost and low-footprint intervention compared to alternative methods, tackling several downhole challenges in wellbores.

Blue Spark Energy began its first operation in September 2011 and in that time it has been building up a track record to show the market that this is an effective and trustworthy tool which can solve a number of problems in the wellbore. Since 2011, the company has implemented more than 600 operations worldwide for more than 50 different companies.

Parker explained that of these 600 operations the company has acquired data from 267 oil wells. Of these, there was an average oil production increase of 262%. BlueSpark also collected data for 45 injection and disposal wells and the average change in production was a staggering increase of 413%.

In addition to being an effective tool for any type of well (including some applications within the geothermal space) Parker noted they have been working with some companies in their decommissioning operations. In this regard, the BlueSpark tool can be used for cleaning the casing prior to setting a barrier to improve the chance of it setting and sealing. This can reduce well abandonment costs by as much as 60% in complex cases and at least 20% in simpler cases.

Parker noted, “We are continuing to innovate and improve this technology. We think it is an excellent technology. This is a go-to solution and has a high degree of reliability in removing impediments affecting wellbore performance. We are now accepting more and more orders for it and we have multiple projects on the go today.”

VAALCO Energy, Inc. (VAALCO) has completed two workovers at the Etame field offshore Gabon and added a total of approximately 1,050 gross barrels of crude oil per day.

As part of the campaign, VAALCO’s hydraulic workover unit (purchased in early 2021) was utilitied to rapidly mobilise and replace electrical submersible pump units. It was able to do this more efficiently than a drilling rig, which had cost saving benefits.

The longest producing ESP unit at Etame was replaced and upgraded in the workover of EEBOM-2H which increased production from about 500 gross BOPD (255 BOPD net) to approximately 1,400 gross BOPD (715 BOPD net).

Additionally both the upper and lower ESP units at the ET-12H well were replaced and the ESP design was configured at the same well. This restored production to 1,800 gross BOPD (920 BOPD net), an increase of approximately 150 gross BOPD (80 BODP net) compared to the average rate prior to the workover.

George Maxwell, VAALCO’s Chief Executive Officer, commented, “We are pleased with the results from these workovers, in particular, the 1,050 gross BOPD of additional production. We purchased the mobile hydraulic workover unit earlier this year to allow us to quickly and efficiently react to ESP failures and to proactively prevent ESP failures as we deemed necessary.

“This allows us to maximise production and even incrementally increase production, which is particularly attractive in the current price environment. We will continue to efficiently operate at Etame which generates strong cash flow to fund our accretive strategic initiatives.”

Page 7 of 9

Copyright © 2026 Offshore Network