Esso Australia, a subsidiary of Exxonmobil Australia, has entered into an agreement with Helix Energy Solutions to charter the Helix Q7000 semisubmersible vessel to support decommissioning activity across the Gippsland Basin.

Esso Australia, a subsidiary of Exxonmobil Australia, has entered into an agreement with Helix Energy Solutions to charter the Helix Q7000 semisubmersible vessel to support decommissioning activity across the Gippsland Basin.

The vessel will join Esso Australia’s growing fleet, with its roster of mobile offshore assets now including Rig 22, the HWT600 and a DOF Subsea Multi-Purpose Support Vessel.

Dylan Pugh, ExxonMobil Australia’s Chair, said, “The Helix Q7000 is a welcome addition to our extensive fleet of vessels and rigs currently operating across the Gippsland Basin. It is the forth mobile offshore asset we have added to our decommissioning fleet, and marks the first time we will be using a light well intervention vessel for subsea work locally.

“We are committed to sourcing the right assets for the work we are completing, given the variety of fields we have operated for over 50 years. Our priority is to remain safe, whilst using fit for purpose solutions which ensure we are meeting our decommissioning requirements.”

The Helix Q7000 is set to support decommissioning activities in Bass Strait from the end of 2023.

Tirex P&E, a drilling and well intervention services company, has completed the Ikike well drilling and intervention campaign for Total Energies offshore Nigeria.

According to media reports, Tirex P&E is pleased to have participated in such developmental strides that will be of great impact on the growth and capacity of Nigeria, particularly in the promotion of local content by the Federal Government of Nigeria. This milestone will help the West African energy giant revitalise its oil output following a decline in production in the past two years.

The project reportedly commenced in July 2021 on the Ikike Field which is located approximately 20 km off the coast of Nigeria. It was part of the oil mining lease with a total of five wells drilled and completed alongside a 120-day well intervention scope at the Amenam Platform.

Located 20 km off the coast, the Ikike Platform is tied back to the existing Amenam offshore facilities through a 14 km multiphase pipeline and will deliver peak production of more than 50,000 barrels of oil equivalent per day.

As the focus on environmental sustainability has never been more prevalent across all industries than it is right now, the race is on to find long-term renewable solutions to the climate crisis. Operators across the globe are trying to make their innovations in the oil and gas industry as green as possible, but that is not an easy stepping-stone to overcome.

As the focus on environmental sustainability has never been more prevalent across all industries than it is right now, the race is on to find long-term renewable solutions to the climate crisis. Operators across the globe are trying to make their innovations in the oil and gas industry as green as possible, but that is not an easy stepping-stone to overcome.

Geothermal energy could be the answer so many are looking for. It is a method of clean energy which bridges the gap between the oil and gas industry and renewable energy sources in order to reach net zero. The US has already increased federal funding by millions of dollars in 2022 alone to widen the scope of geothermal projects up and down the country, tapping into the underutilized potential beneath our feet.

A key area of interest within the geothermal industry is that of repurposing end-of-life oil and gas wells. Geothermal companies can turn these assets back into active wells, only producing a slightly different end-product, negating the need for decommissioning services and the associated costs. Operators can turn their liabilities into profitable assets at a quarter of the cost while producing green energy.

In spite of the benefits associated with geothermal, there are a number of issues holding the industry back from becoming a mainstream alternative. For one, the extortionate upfront costs associated with starting geothermal projects from scratch prove a wall too vast to climb in most instances, as well as the technological challenges that present themselves when working with temperatures of this calibre.

Nevertheless, advanced methods and technologies are working at mitigating against the challenges posed by geothermal extraction, using expertise from the oil and gas industry to finesse already existing drilling equipment in order to marry the industries together to be able to harness a green energy source born from an oil well.

Claxton, the University of Aberdeen, the National Decommissioning Centre and the Net Zero Technology Centre (which is providing funding and oversight), have continued to move ahead in the delivery of the Underwater Laser Cutting (UWLC) system, an alternative and clean underwater cutting technology ready to take the decommissioning market by storm.

Claxton, the University of Aberdeen, the National Decommissioning Centre and the Net Zero Technology Centre (which is providing funding and oversight), have continued to move ahead in the delivery of the Underwater Laser Cutting (UWLC) system, an alternative and clean underwater cutting technology ready to take the decommissioning market by storm.

UWLC improves efficiency when used for downsizing activity or applicable subsea decommissioning scopes and offers the flexibility of deployment methods in storage ponds, tanks and offshore. It was noted by the partners that the technology has the potential to ‘revolutionise’ subsea cutting.

The initial phase of the partnership, delivered between 2019 and 2021, saw the development of the UWLC system targeted at delivering offshore cutting trials in 70 metres seawater depth. The Net Zero Technology Centre funding supported partners in the development of underwater capable optics; the design and manufacturing of an underwater laser cutting head; procurement and packaging of a 15KW laser generator for offshore operations; and design and manufacture of control system software and hardware suitable for 50 bar hyperbaric conditions.

Successful delivery of this phase was demonstrated through subsea cutting performed at 70 metres seawater depth. This included 250 underwater cuts performed on structural steel up to 120 mm thick; Human Machine Interface (HMI) and 500 metre depth capable electronic control system; the design and manufacture of 500 metre depth rated subsea laser cutting head; and the system verified at technology readiness level 6 and suitable for further development.

The next phase of the partnership is planned for 2023-24 and involved the development of the UWLC system targeted at delivering a cutting tool suitable for real offshore cutting scope. The Net Zero Technology Centre will provide funding once again for this stage and a Tier 1 oil and gas producer and vessel operator will also contribute.

This phase will include a selection of suitable cutting opportunities; the development of the laser cutting head through the incorporation of lessons learned from phase 1; the development of a cutting tool to manipulate the laser cutting head to suit the cutting scope; and the integration of the HMI and electronic control from phase 1 into the intelligent cutting tool to optimise cutting head manipulation and performance.

The success of the second phase will be measured by performance on an actual offshore cutting scope against typical mechanical or abrasive cutting solutions. The objective is to demonstrate the system as a proven cutting technology for suitable applications, with the system being verified at technology readiness level 7 and suitable for further commercialisation.

“It is fantastic to be involved in such a great partnership and work with an inspiring team on this development project,” commented Craig Baxter – Decommissioning Technical Manager, Claxton. “The technology is showing great promise in delivering cross sector decommissioning work scopes. I am looking forward to delivering an offshore decommissioning work scope through 2023 with a view to commercialising the technology and opening it up as a cutting solution available to the oil and gas, nuclear and offshore wind decommissioning market.”

Petrofac has exercised its contracted rig hire option on one further well as well management contractor for the Tullow P&A campaign on PSC-A Banda and PSC-B Tiof wells offshore Mauritania.

The optional well is the Banda-1 subsea exploration well and is estimated to take 20 days to complete Petrofac’s plug and abandonment operations. This means that the total work is now for five well re-entries.

Island Drilling has stated its pleasure in extending its relationship with Petrofac and continuing to add to its backlog for the Island Innovator, a fully equipped semi-submersible drilling unit with a 165 ton active heave compensated crane.

Once completed, the vessel will continue on to UK waters where it will carry out a work programme with Dana Petroleum.

Trendsetter Engineering Inc. has been awarded a contract to support the development of Beacon Offshore Energy LLC’s Shenandoah project in the Gulf of Mexico.

Trendsetter Engineering Inc. has been awarded a contract to support the development of Beacon Offshore Energy LLC’s Shenandoah project in the Gulf of Mexico.

The awarded scope includes a multi-year rental and servicing agreement for the provision of a 20,000 psi Subsea Well Intervention package, with the system delivery expected for Q3 2023.

Trendsetter’s TRIDENT intervention systems provide an innovation solution for subsea well interventions, suitable for offshore mobilisation to a vessel of opportunity and capable of rapid re-configuration to facilitate hydraulic, riser-less light well and risered medium well subsea intervention operations.

“We are excited to extend our partnership with Beacon and support its Shenandoah development,” said Mike Cargol, Vice President of Intervention Solutions, Trendsetter.

“This award reaffirms Trendsetter’s commitment to the industry for innovative, safe and cost-effective HPHT well control and well intervention systems, building upon our successes with the 15,000 psi TRIDENT system and multiple 20,000 psi well control response packages delivered in recent years.”

Trendsetter’s involvement with the Shenandoah field projects extends beyond the implementation of the intervention system. Earlier this year, the company was also awarded contracts to deliver components of the subsea production and export equipment, including a six-slot production manifold, subsea valves, and Trendsetter’s own TCS connectors.

Archer Limited has announced the acquisition of P&A specialist company Romar-Abrado, increasing its growth within the well services sector.

Archer Limited has announced the acquisition of P&A specialist company Romar-Abrado, increasing its growth within the well services sector.

The acquisition is based on an enterprise value of US$8mn, plus earn-out pending trading performance over the 2023-2025 period.

“We are pleased to announce the investment in Romar-Abrado, continuing out growth within our well services segment. The acquisition is another value creating investment which expands our capabilities within workover operations and well abandonment,” said CEO of Archer, Dag Skindlo.

“Romar-Abrado fits well with our strategy for brownfield and P&A. We expect activity to increase within these markets going forward as fundamentals and outlook remain strong. In addition, the transaction will contribute to the acceleration of our international expansion within the well services segment.”

Romar-Abrado offers advanced milling and SWARF handling services to the global P&A market, with its combined approach and operator knowledge providing innovative technologies to deliver permanent, emission-free barriers and alternative zonal isolation solutions.

Jason Broussard, CEO, Romar-Abrado, said, “We are happy to join forces with Archer to further develop and broaden our products and services in Romar-Abrado. Archer is a great fit for the Romar-Abrado business with their global footprint and service offering within workover and abandonment.”

Based on the acquisition and current trading levels, Archer’s financial guidance has increased for 2023, lifting to 20-25% above 2022 levels.

This announcement is but further indication of the mounting interest around end-of-life practices as the global well stock continues to age and environmental concerns continue to build. Perhaps nowhere is this more apparent than in the North Sea where the well intervention market is looking increasingly strong for the years ahead.

Despite geopolitical developments such as the fresh Covid-19 wave in China and the outbreak of war in eastern Europe, there are positive indications that an assured oil and gas demand coupled with a stable oil price are setting the stage for a prosperous future for the Middle East’s well intervention industry.

From the explosion of Covid-19 in early 2020 to the Autumn of 2022, global uncertainty unsettled the stability of the oil and gas industry and led to wide fluctuations for the oil price. Within this period, the price ranged from as low as US$21.44 (WTI) to as high as US$122.11 per barrel (WTI) before settling at around the US$80 mark at the end of 2022. As the industry heads deeper into the new year, many commentators are bullish that, partly due to cuts to production by OPEC+, the oil price will stabilise and could even surpass the US$100 mark once again – Morgan Stanley, for instance, has forecasted the Brent oil price to hit as high as US$110. More conservatively, the EIA has suggested the Brent crude oil spot price will average at US$92, which is still a healthy number for those working within the industry.

The EIA has also indicated that while oil demand will remain lacklustre in Q1 2023, it will begin to regain meaningful momentum in Q2 2023 and is likely to go beyond 2019 levels in the process. From a longer-term perspective, OPEC’s 2022 World Outlook 2045 has identified fossil fuel’s continued prominent role within the energy industry for the next two decades and forecasts oil retaining a 29% share in the global energy mix by 2045 with gas holding 24%.

These trends spell happy reading for the oil and gas companies operating within the Middle East and North African region who will have to continue working to increase oil production over the years to meet blossoming demand. However, the environmental concerns have not passed them by and most operators within the region are also incorporating stringent climate objectives to help mitigate their emission output.

So how will these organisations balance the tightrope of greater production and less climate impact? Well, while a number of initiatives are being pursued to help reduce emissions to justify further drilling, one answer lies in well intervention which offers production rate enhancement without the need for further wells to come online. Indeed, with the oil price looking so healthy, there is expectations that the region’s intervention market will rapidly grow over the short- to medium-term as operators have the cash to explore the option. There are more than 10,000 offshore wells throughout the region (on top of the onshore well count that is much higher), according to Rystad, and these have an average well life of 16-21 years, above the global average of 10-15 years. Well intervention, which offers the opportunity to revamp the production rates of ageing, flagging wells, is therefore emerging as an attractive solution to tick all boxes.

Read the full, free-to-read report, including an exploration of the factors shaping business objectives from those operating within the well intervention market.

Neptune Energy, which has a 40% owner share in the Errai project in Norway, has welcomed the announcement from its partner, Horisont Energi, that it has entered into an option agreement on the location of an onshore terminal for the Errai carbon capture and storage project.

The receiving terminal for intermediate onshore storage of CO2 will be located in Gismarvik on the west coast of Norway. From here, carbon would be transported through pipeline to the North Sea, where it would be injected and permanently stored in an offshore reservoir. The option agreement is with Haugaland Næringspark.

Errai is the first commercial CO2 storage project in Norway and could store 4-8mn tonnes of CO2 annually, with the potential to store more in later phases.

Neptune Energy’s Managing Director for Norway and the UK, Odin Estensen, commented, “This is an important step for the development of large-scale carbon capture and storage, and paves the way for a value chain that is crucial for reaching the climate target of net zero emissions by 2050.

“We look forward to leveraging both our oil and gas operations capabilities as well as our significant global experience from operating carbon capture and storage activities."

The Errai project is a key contributor to Neptune's goal of storing more carbon than is emitted from the production and use of its sold product by 2030.

The Errai partners recently submitted an application to the Norwegian Ministry of Petroleum and Energy for storage of CO2 in the announced area on the Norwegian continental shelf. Awards are expected to be announced during the first half of 2023.

Chevron Corporation has announced a joint venture with Baseload Capital to develop geothermal projects in the US.

Chevron Corporation has announced a joint venture with Baseload Capital to develop geothermal projects in the US.

Through its Chevron New Energies business, the two companies will collaborate on driving geothermal opportunities, including identifying locations with the best prospect for development and streamlining the next generation of geothermal technologies from conception to commercialisation. The agreement will allow the two companies to highlight the importance of geothermal energy and raise awareness on the criticality of it as a supply option.

Chevron and Baseload Capital believe the answer to reaching a low-carbon future is through the utilisation of all energy forms working together, and geothermal will provide a reliable source of baseload power which will be a critical element in developing future energy systems. The joint venture will leverage the two companies’ operational experience, combined with core competencies from the oil and gas sector, particularly surrounding subsurface, wells, drilling and completions to advance geothermal technologies.

The first project site has already been identified as Weepah Hills, Nevada. Previous geothermal research and exploration projects already exist in Esmerelda County, and the two companies will pursue development of these going forward.

Barbara Harrison, Vice President, Offsets and Emerging, Chevron New Energies, said, “We believe that to make the geothermal ecosystem a reality, we must take these important steps through collaboration and partnership, and this example with Baseload Capital is a great start towards pursuing our lower carbon goals for the future.”

CEO of Baseload Capital, Alexander Helling, commented, “It is time for the geothermal industry to take its place as an obvious part of the energy mix. Right now, everything is in the industry’s favour to move from niche to mainstream.

“We have no time to waste and no excuse for not picking up the pace here and now. Together with Chevron, we believe that the transition to a greener planet, with the help of geothermal, is going to be much faster.”

Technology firm BeyonC has been selected to join Chevron Technology Ventures’ (CTV) Catalyst Programme, an initiative to help start-up companies enhance their technologies in order to benefit the energy sector.

Technology firm BeyonC has been selected to join Chevron Technology Ventures’ (CTV) Catalyst Programme, an initiative to help start-up companies enhance their technologies in order to benefit the energy sector.

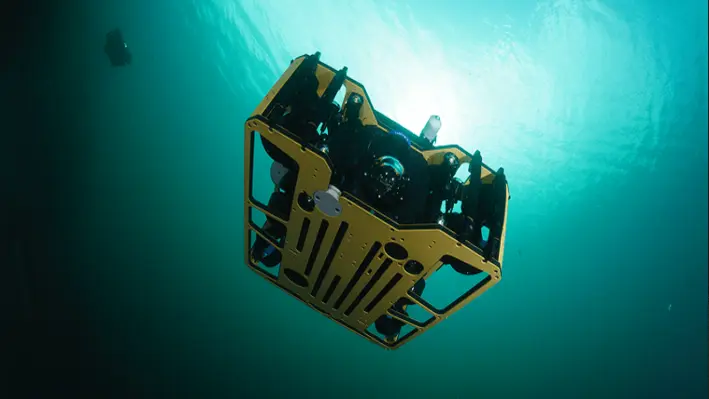

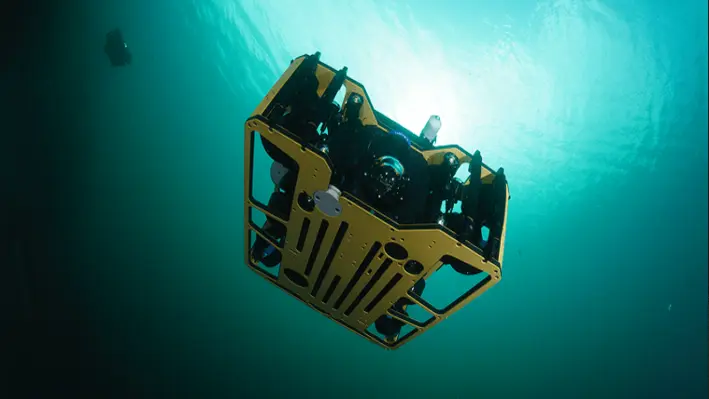

The programme acts as an incentive for BeyonC to further develop its proprietary technology designed to improve the safety of subsea inspections all the while reducing carbon emissions, improving asset reliability and reducing costs.

The BeyonC technology platform has been shown to dramatically reduce CO2 footprints with its mini-ROVs (Remotely Operated Vehicles) when it comes to providing asset integrity data, as opposed to surveys carried out by large offshore vessels. The technology supplies CP status and visual surveys for offshore installations, mapping the integrity status for offshore facilities and providing operators with decision-data.

With its patent-pending technology, BeyonC will target oil and gas pipelines and plans to deliver the first offshore wind integrity survey in 2023.

From its launch in 2017, the CTV Catalyst Programme aims to accerlate the maturation of early-stage companies which show promise in creating technologies that will prove beneficla to the energy industry. By joining the programme and meeting the milestones head on, BeyonC will be presented the opportunity to have its technology commercialised and complete trials with global operators.

Thomas Sperle, Chief Executive Officer, BeyonC, said, “We are proud and excited to join the CTV Catalyst programme. This is a major recognition from the industry that we expect will enable BeyonC to accelerate development and commercialisation of our propriety and unique technology. We are delighted that out technology-focused approach has been recognised by Chevron Technology Ventures and we look forward to counting collaborations in the next phase of our growth and development.”

Transocean has announced contract awards and extensions totalling US$488mn of firm backlog.

The contracts include a range of work from different fields across the globe. Deepwater Invictus, an ultra-deepwater drillship, was awarded a new three-well contract in the Gulf of Mexico with an independent operator. The contract will contribute an estimated US$43mn in backlog and is expected to commence in direct continuation of the rig’s current programme.

Transocean Barents, a harsh environment semi-submersible, was awarded a new one-well contract with an estimated 110-day duration in the North Sea with a major operator. The contract contributes an estimated US$34mn in backlog and is expected to commence in Q1 of 2023.

In Norway, certain previously disclosed options under the Transocean Norge contract with Wintershall DEA and OMV have now been added to backlog. The incremental term is expected to last 773 days and contribute an estimated US$331mn to backlog.

TotalEnergies exercised a one-well option on its contract with Development Driller III, an ultra-deepwater semi-submersible, working in Suriname. The incremental well is expected to last 90 days and contribute an estimated US$32mn in backlog.

Finally, Harbour Energy exercised the third option on its North Sea, UK, contract with Paul B. Loyd, Jr., a harsh environment semi-submersible, for eight P&A wells, adding an estimated US$48mn in backlog. The additional term is expected to last 275 days and extends the contract to Q3 of 2024.

Page 75 of 118