Vår Energi ASA is set to plug and abandon a well in production licence PL229, northwest of Hammerfest, following the discovery of oil in the operated 7122/8-1S Countach well.

The well was drilled in one of the segments that form the Countach prospect and preliminary estimates place the size of the discovery in the tested segment between 3-13mn bbls of total recoverable oil equivalents. The potential of the Countach prospect, in the undrilled segments, is estimated at up to 23mn bbls of total recoverable oil equivalents.

Following the discovery, the well will now be permanently plugged and abandoned, and the licensees will evaluate drilling an appraisal well in the future.

Rune Oldervoll, EVP Exploration and Production in Vår Energi, said, “Countach reinforces the company’s position as the leading exploration company on the Norwegian shelf. This discovery is yet another in a series of successful exploration wells in the Barents Sea in recent years, including Lupa – the largest discovery on the Norwegian shelf in 2022.

“At the same time, the discovery confirms our exploration strategy and our position in the area. We will consider potential commercial development options and tie-in of the discovery to Goliat FPSO. Due to late arrival of the drilling rig on the field this winter, we have not been able to carry out the planned sidetrack before the environmental drilling restrictions commence on 1 March. We look forward to continuing to explore the area around Goliat at a later point in time.”

The well was drilled to a measured depth of 2,989 metres and oil was encountered in the Realgrunnen and Kobbe formations. With extensive data now collected for further assessment, the well will be permanently plugged and abandoned.

The Asia Pacific oil and gas industry, making use of a period of relative oil price stability and seemingly maintained future demand, is increasingly looking to ramp up production rates which, in light of a rapidly approaching decommissioning wave, is leading to a thriving oilfield services market.

A period of stability is something the oil and gas industry has been yearning for ever since the outbreak of Covid-19 which, in the first quarter of 2020, burst onto the global arena in a devastating manner. But after a period of volatility driven by the pandemic and geopolitical developments in eastern Europe, the oil price has finally stabilised, settling at around US$80 per barrel across most benchmarks. From here, commentators such as Goldman Sachs and Fitch Ratings have predicted prices to maintain stable across 2023 and even hit US$100 by the end of the year.

One of the reasons for this security is a growth in oil demand, driven primarily by the re-opening of China at the start of the year. While the incessant rise of renewables has caused many to doubt the future prospects of fossil fuels as the world strives to its collective net zero ambition, according to OPEC’s 2022 World Oil Outlook 2045 energy demand will increase from 285.7 million barrels of oil equivalent per day (mboe/d) in 2021 to 351 mboe/d in 2045 at an increase of 23%. To meet this, the report suggests renewables will not be sufficient by themselves and oil and gas must continue to be exploited to meet the world’s needs. In view of this, it forecasts that by 2045, oil could retain a 29% share in the energy mix and gas would meet 24% of it. This translates to oil demand rising to 109.8mb/d in 2045 – in this scenario it must also be remembered that the expansion of production rates must also come alongside an extra 5 mb/d being added every year just to maintain current production rates, given an average industry decline rate of around 5%.

This is translating to a solid future for the global oil and gas industry and, in light of this, the Asia Pacific community is looking to increase its production rates – especially as the region consumes 35% of the world’s oil while supplying just 8% of its production. To do so, it is turning to its reliable tool of drilling but also on less-utilised methods such as well intervention. The latter is also being spurred by the region’s offshore oil well stock moving ever-closer to end-of-life with, according to a Wood Mackenzie 2018 report, more than 380 fields expected to cease production in the next decade.

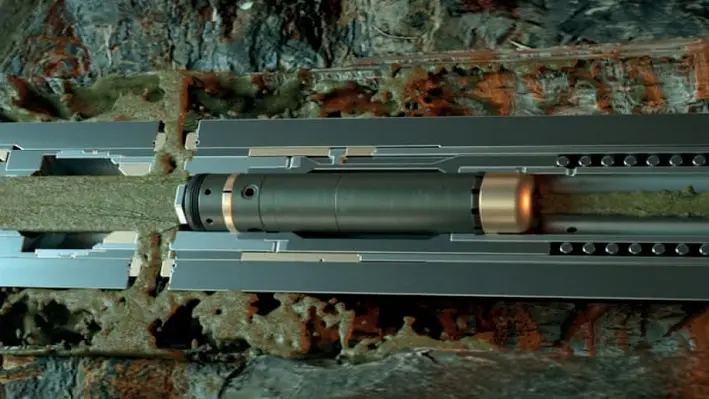

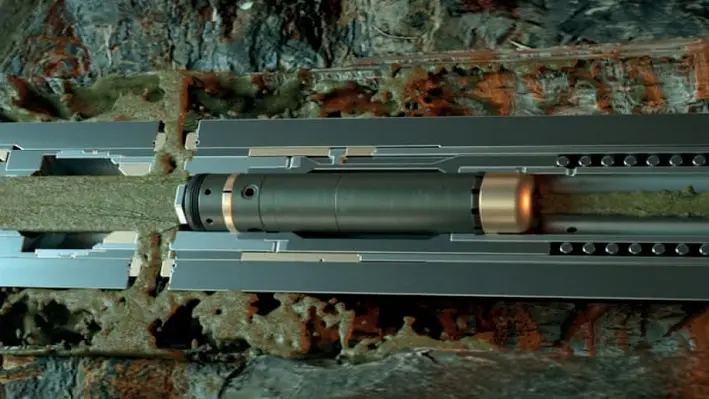

Global leader in well integrity and production optimisation, Coretrax, has successfully delivered its DAV MX circulation sub; a solution which will cool an estimated 400⁰C geothermal well bottom hole temperature by nearly 200⁰C in the US.

Global leader in well integrity and production optimisation, Coretrax, has successfully delivered its DAV MX circulation sub; a solution which will cool an estimated 400⁰C geothermal well bottom hole temperature by nearly 200⁰C in the US.

The solution was deployed during a planned closed-loop geothermal well project by a US operator, where the estimated bottom hole static temperature was 400⁰C. Operating at temperatures this high poses a high threat of equipment failure, so an effective and reliable ‘staging’ method was required in the hole to cool down the temperature-sensitive measurement while drilling (MWD) technology.

Staging is common practice for high temperature wellbores to prevent MED failures which normally involves pumping conventionally through the drill bit to cool the BHA. However, this method can result in the motor rotating the drill bit, causing possible damage in the cased and upper granite section as well as damage to the tech itself, meaning a more reliable method is required.

The application of Coretrax’s DAV MX delivered significant time savings while maintaining well integrity and improving safety. Estimated bottom hole temperatures were reduced from the estimated 400⁰C to 210⁰C. The tool was deployed with the Split Flow Dart, which allowed a limited flow through the motor and drill bit, reducing the rotations per minute while delivering high flow rate to effectively cool the BHA and borehole.

John Fraser, Chief Executive Officer, Coretrax, said, “The geothermal market has experienced significant growth in recent years in response to global environmental objectives and Coretrax already has a tangible track record in supporting these developments globally. Our range of downhole circulation tools are ideally placed to support the high temperatures and complexities of geothermal wells.

“The latest project is a strong example of how technology which has traditionally been applied to oil and gas operations can support this expanding sector to address the most complex well challenges while delivering enhanced reliability and greater efficiencies.”

The downhole circulation tool can be used across a wide range of applications including hole cleaning, displacements, lost circulation material spotting and blowout preventer jetting, among others.

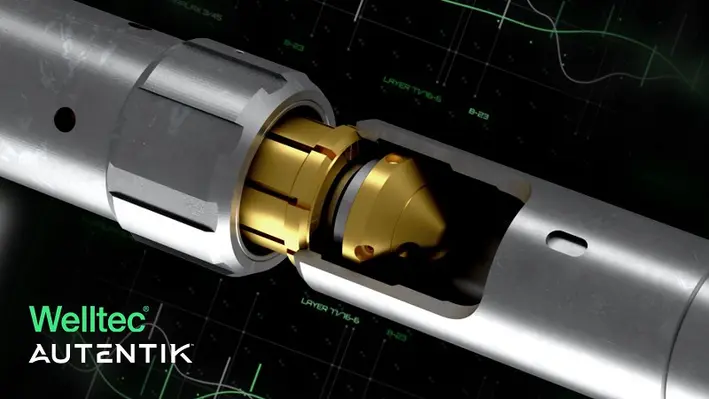

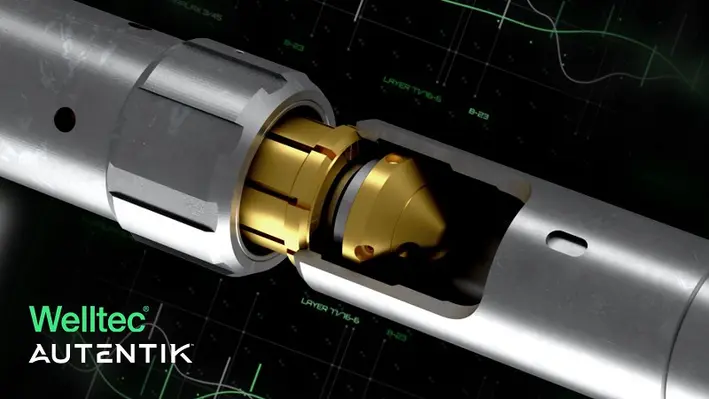

Completion and intervention leader, Welltec A/S, has announced the acquisition of Autentik AS, a niche technology provider which specialises in electric wireline fishing and intervention solutions.

Completion and intervention leader, Welltec A/S, has announced the acquisition of Autentik AS, a niche technology provider which specialises in electric wireline fishing and intervention solutions.

Autentik has a proven track record of delivering innovative solutions to its clients across the North America, Europe, Africa and the Middle East, and its expertise in downhole fishing will complement Welltec’s existing portfolio. With the acquisition, Welltec will be better positioned to serve its clients with the latest surface-controlled technology advancements and solutions. Together with Welltec’s manufacturing capabilities, the acquisition will bring an accelerated technology shift in how to conduct well access operations safely and efficiently.

Tommy Eikeland, CCO Welltec, said, “We are excited to welcome Autentik into the Welltec family. There is a mutual admiration for innovation and understanding of risk-taking which, to a certain level, is required when developing new technology. Together with their interventions expertise, this will add tremendous value and momentum to our organisation and enhance our ability to provide our clients with cutting-edge solutions.”

CEO of Autentik, Roy Kristiansen, commented, “This partnership will bring Autentik’s true passion for innovation and new solutions to transform wireline interventions together with Welltec’s global reach and market leadership in completion and intervention. This is a historic step in the life of Autentik, and a move that will benefit the clients and partners we work with.”

Sval, Storegga and Neptune have formed a partnership to apply for a CO2 storage licence in the Norwegian North Sea for the Trudvang project.

The Trudvang licence, located to the East of the Sleipner field, has the potential to store up to 225mn tonnes of CO2 and comes after the Norwegian Ministry of Petroleum and Energy announced a new area in the North Sea for applications related to injection and storage of CO2.

Truls Olsen-Skåre, Senior Vice President Sustainability & HSEQ in Sval Energi, commented, “Carbon capture and storage (CCS) is a solution that can significantly reduce CO2 emissions. The partners have worked jointly since December 2021 to identify, nominate, and apply for this licence. We have undertaken a substantial amount of work already, including subsurface evaluation of the storage complex, and technical and economic assessment of the CCS value chain. This work has shown that Trudvang can be matured into a commercially viable project with safe and efficient carbon storage.

“We will focus on accelerating all phases of the work programme to be able to start injecting CO2 in 2029, and we will continue our work with existing and new parties to mature the full value chain.”

The Trudvang project envisages the capture of CO2 by multiple industrial emitters in Northern Europe and the UK, the shipping of liquid CO2 from export terminals to an onshore receiving terminal in the south-west of Norway and then transport via a purpose-built pipeline to the Trudvang location for injection and permanent storage.

Nick Cooper, CEO of Storegga, remarked, “CCS is essential, as one of the few technological solutions that can prevent CO2 emitted from industrial operations from entering the atmosphere and worsening climate change. Our Trudvang announcement today builds on Norway’s pioneering progress with the world’s first industrial-scale, multi-user CCS project. We look forward to continuing our work with Sval and Neptune to ensure that the Trudvang Project will have a significant impact on carbon emissions and a positive impact on the Norwegian economy.”

Intelligent Wellhead Systems (IWS), a supplier of digital technologies that improve oil and gas well completion operations, has welcomed Shiblee Hashem to the executive management team as Vice President of Operations.

In his new role, Hashem will lead the growing operations team, including the regional managers and US facilities teams, and work closely with the COO to drive the company’s transformational strategies to meet financial goals.

Hashem brings more than 25 years of oil and gas consulting and operations management experience and throughout his career, he has worked closely with some of the largest independent and national oil companies in Europe, the Middle East, Asia, North and South America, and North, East and West Africa. Drawing upon this extensive experience, he offers a diverse professional background in both executive and technical management. Prior to joining IWS, he held senior management positions with AccessESP (a Baker Hughes Company) and Halliburton.

The new member of the executive management team belongs to the Project Management Institute (PMI) and the US Gulf Coast Section of the SPE. He is currently serving as the Program Chairperson of the SPE’s Bangladesh Section.

Based in Houston, Hashem reports to Steve Sinclair-Smith, Chief Executive Officer of IWS.

Hashem commented, “Safety and efficiency have always been part of the IWS mission. As the company grows in 2023, our focus is on delivering the highest service quality while maintaining safe and efficient operations.”

In other news, Pason Systems has increased its non-controlling investment in IWS through the acquisition of outstanding common shares of IWS for an aggregate purchase price of US$7.9mn and an agreement to invest up to US$25mn in preferred shares of IWS.

There was also cause for celebration when the company’s inVision Digital Valve Control technology received a Special Meritorious Award for Engineering Innovation (MEA) in the Digitalization category from Hart Energy.

Optime Subsea has signed a long-term framework agreement with Wintershall Dea for use of the company’s remote controlled subsea well completion and intervention systems.

Optime Subsea has signed a long-term framework agreement with Wintershall Dea for use of the company’s remote controlled subsea well completion and intervention systems.

Under the agreement, Wintershall Dea will rent three Remoted Operated Controls System (ROCS) including its universal landing string system (panpipe), and two wireless electric subsea control and intervention systems (eSCILS) from Optime Subsea. The latter will also provide technical service personnel to support Wintershall Dea’s operations.

Jan-Fredrik Carlsen, CEO of Optime Subsea, commented, “This contract manifests our position as the leading global supplier of remote-controlled well completion and intervention systems. Our solutions are tailored to simplify subsea, entailing less equipment offshore, lower weight, less logistics, lower HSE risk, lower emissions and lower costs. We look forward to supporting Wintershall Dea in achieving this.”

The ROCS is a fully battery-powered and umbilical-less system for well completion operations, eliminating the need for the costly and heavy umbilical’s which normally run from topside to seabed, as well as the need for a hydraulic unit. In total, this avoids the mobilisation of approximately 50 tonnes of topside equipment. The eSCILS is also a battery-powered and umbilical-less device, used for subsea well interventions and workover operations. eSCILS is lowered to the seabed next to the well and can connected to any type of subsea tree, requiring only a computer for a topside control system, rather than additional rig equipment, and can be mobilised and demobilised in one day. As a result, operations can be done significantly safer, faster and more cost-effective than conventional solutions.

The agreement is valid for a firm period of three years plus two additional two-year options. If both option periods are exercised, Optime Subsea estimated that the contract could generate total revenues of around NOK500mn.

Rovco has successfully completed a contract awarded by Well-Safe Solutions to support its plug and abandonment and decommissioning operations in the southern North Sea.

Rovco provided Well-Safe Solutions with field survey operations, to ensure the safe and efficient decommissioning of a platform which ceased production in 2015. Last year, Well-Safe Solutions signed an agreement with Ithaca Energy to plug and abandon six wells on the platform and work will continue to be carried out by the company this year.

The project utilised the VOS Star, on charter from Vroon, equipped as standard with Seaeye Leopard work-class ROVs, fitted with multi-beam echo sounders, the highest quality 4K stereo cameras, manipulators, recovery basket and photogrammetry technology to carry out specialist hydrographic surveys and underwater asset inspections.

As part of the project, the company supported the client with debris survey and clearance solutions in water depths of 20 to 30 metres, as well as habitat characterisation surveys to mitigate risk and eliminate uncertainty about seabed conditions prior to the client deploying a jack-up vessel at the site.

Using its innovative SubSLAM X2 technology, Rovco also performed jacket inspection operations, providing the client with highly detailed 3D models of the platform footings to precisely identify any scouring across the structure.

Powered by sister company Vaarst, SubSLAM X2 produces 3D reconstructions of underwater assets in real-time, from which users can take measurements with sub-millimetric accuracy. Mounted on an ROV, travelling dynamically at general visual inspection speed, SubSLAM’s ability to zoom in, rotate and fly means that it can provide full coverage of a structure from all angles, as well as the seabed and surrounding environment.

Simon Miller, Chief Revenue Officer at Rovco, commented, “Being awarded a second contract with Well-Safe Solutions underlines their confidence in Rovco’s proven track-record.

“Accurate data sets from subsea surveys and inspections is key to the safety and efficiency of their operations and they know they can rely on our people and our technology to provide the highest quality data in real-time.”

“We’re pleased to be able to play a continuing role in decommissioning and the energy transition in the North Sea, supporting Well-Safe Solutions in its quest to safely and cost-efficiently plug and abandon wells in the Southern North Sea.”

This is the second contract that Rovco has secured with Well-Safe Solutions, having previously performed survey work on an abandoned subsea wellhead in UK waters in 2021.

As sanctions against Russia increase by the day, Europe has been thrust into a position of vulnerability as supply disruptions become a threat to the region’s oil market. However, as West Africa ramps up its production numbers, especially within Nigeria, the region may be the saving grace needed for European imports. Accordingly, Nigeria alone is expected to capitalise on its 37 billion barrels of crude oil reserves in order to expand its exports into Europe.

As sanctions against Russia increase by the day, Europe has been thrust into a position of vulnerability as supply disruptions become a threat to the region’s oil market. However, as West Africa ramps up its production numbers, especially within Nigeria, the region may be the saving grace needed for European imports. Accordingly, Nigeria alone is expected to capitalise on its 37 billion barrels of crude oil reserves in order to expand its exports into Europe.

It is no secret that the global oil market hasn’t experienced a notion of stability over the last couple of years, as both the Covid-19 pandemic and the geopolitical situation across eastern Europe tipped the proverbial scales from one extreme to another in quick succession. In a two-year period, the price of oil ranged from the historic lows of US$21.87 (WTI) to the staggering heights of US$122.11 (WTI). Thankfully, the price has now plateaued to remain in the region of a healthy US$80, but given the turbulence of the last few years, the future remains uncertain.

What is certain, however, is that even with the increased vigour placed on alternative energy sources and supporting the energy transition, renewable energy still has a long way to go until it can meet the global energy demand, meaning that at least for the next few decades, oil and gas is here to stay. As the demand for energy continues to soar, the gauntlet falls to individual regions increasing their production levels and making their own stamp on the global oil market. This change in focus gives the West African region a prime opportunity to take its place among the big hitters, especially as focus has turned into using marginal fields to up production. In 2020, 57 marginal fields became accessible for local companies to start production work on, tapping into the reported one billion barrels of oil that lie within.

With increased production, however, comes an increased demand for vessels to complete the scope of work. Once the pandemic neared its end and production returned in full force, the demand for vessels grew tenfold, creating a bottleneck in supply. It wasn’t only the demand for vessels which grew exponentially, but extreme inflation levels of up to 21% in Nigeria meant the cost of the vessels grew as well. It became not only a situation of sourcing a vessel, but sourcing an affordable one. Even with the strong presence of service providers Helix and TechnipFMC in the region, there is still a huge backlog of projects awaiting attention.

What has become apparent in the region is that collaboration between sectors is a necessity. As the Nigerian Oil and Gas Industry Content Development Act (the ‘Local Content Act’) highlights the importance of self-sufficiency in the global oil landscape, priority of the marginal wells is now given to indigenous companies as opposed to international/multinational operators. With that in mind, local companies will need to rely on the expertise presented in other sectors to fully exploit the potential in these wells if they want to utilise the resources to their fullest.

The OWI EU 2023 conference is just around the corner, coming to Abderdeen from April 25-26, and looks to be back bigger and better than ever in order to capitalise on the breadth of opportunities being presented by companies across the entire well lifecycle.

The OWI EU 2023 conference is just around the corner, coming to Abderdeen from April 25-26, and looks to be back bigger and better than ever in order to capitalise on the breadth of opportunities being presented by companies across the entire well lifecycle.

Building on the success of last year’s first face-to-face format after the pandemic, Offshore Network’s flagship conference has undergone a complete revamp to maximise its offerings to its clients in order to promote the most valuable elements OWI EU has to show.

One of the biggest changes to the conference this year is that of the technology showcase hall, where the largest expo in the event’s history will be held, doubling in size to allow the most diverse technologies and services on the market to be demonstrated. This makes way for exhibitors such as Helix, TechnipFMC and Welltec to have the opportunity to showcase their innovations to regional, major and independent European operators.

Another key highlight at OWI EU 2023 is the new ‘Consult an Operator’ feature, where organisations can hear about a current challenge Shell and BP are facing, and then have the chance to book a closed-door appointment with the operators to pitch a solution. As well as there, there are ample opportunities for networking across the 10 sessions which are incorporated into the agenda, especially as 35% of the registered delegates are major, independent or national operators. These session also include a dedicated drinks reception, courtesy of IWCF and in celebration of Offshore Network’s 10th birthday party.

With this year’s tagline ‘Evolving the industry: Unlock the value of your well stock by utilising revolutionary production enhancement, well integrity and P&A tech in line with regulatory guidance and current market dynamics to exceed goals’ – OWI EU 2023 is set on aiding the necessary steps forward into implementing a more efficient and sustainable roadmap for transformation within the industry.

For more information and session details, the full brochure can be downloaded here. Any questions regarding the conference please reach out to Isobel Singh at

This year’s OWI Middle East and North Africa (OWI MENA 2023) conference promises to be grand affair as sights are set to broaden the format and shine the spotlight towards operators in the Gulf and North Africa equally.

This year’s OWI Middle East and North Africa (OWI MENA 2023) conference promises to be grand affair as sights are set to broaden the format and shine the spotlight towards operators in the Gulf and North Africa equally.

With the tagline of this year’s conference being ‘future-proof your intervention projects to exceed environmental targets and optimise well programmes by utilising transformative digital and downhole technologies’, OWI MENA is the only place to offer key learnings to the well intervention community in order to the build the best roadmap for future growth.

Constantly evolving and growing, OWI MENA 2023 boasts the largest roster of speakers to date, with 20 operator speakers set to lead discussions on key topics such as market status, sustainable well programmes, well integrity, innovative technologies and end of life. Speakers include representatives from ADNOC, Shell, bp, Aramco, and many more.

After taking on board client feedback, there is a huge appetite within the community to hear from North African operators, and this year there is a dedicated spotlight session for the region. OWI MENA 2023 will also exhibit two networking sessions, three breakout workshops and more than 12 demos in the Innovative Technology Showcase Hall in order to further promote collaboration between delegates. 40% of attendance will be from major, independent or national operators, as well as 35 % from expert technology providers, meaning there is ample opportunity to expand individual networks.

For more information and session details, the full brochure can be downloaded here. Any questions regarding the conference please reach out to Rachael Brand at

Well-Safe Solutions has signed a multi-year framework agreement with Apache Corporation (now a subsidiary of APA Corporation) to decommission wells in the North Sea, as part of the company’s Plug and Abandonment Club offering.

Well-Safe Solutions has signed a multi-year framework agreement with Apache Corporation (now a subsidiary of APA Corporation) to decommission wells in the North Sea, as part of the company’s Plug and Abandonment Club offering.

The deal will provide Apache with access to the specialist decommissioning assets Well-Safe Defender and Well-Safe Guardia to complete the P&A work on its well stock.

Chris Hay, Director of Strategy and Business Development, Well-Safe Solutions, said, “We are ready to assist Apache with its well decommissioning requirements, affording it the flexibility to book its wells into our campaigns when required.

“Our multi-well, multi-operator P&A Clubs give our clients cost certainty and leverage the cumulative experience gained by our specialist decommissioning teams on both assets across hundreds of wells to date.”

Separate from the frame agreement, Apache has secured a slot for Well-Safe Solutions to plug and abandon subsea wells in the UK Continental Shelf. This work is expected to begin in 2024 as part of a continuous campaign, enabling Well-Safe Solutions to maximise schedule flexibility and improve efficiencies for the member companies within the campaign.

The P&A Club’s focus on operational and cost efficiency aligns with the industry regulator, the North Sea Transition Authority’s, target to reduce the cost of decommissioning upstream oil and gas infrastructure in the UKCS by 35% by the end of 2022.

Page 73 of 118