Europe’s largest provider of well integrity solutions, Unity, is developing a new additive manufactured lightweight gate which can be retrofitted to Christmas Tree gate valves to remediate seal integrity issues in low-pressure wells.

Europe’s largest provider of well integrity solutions, Unity, is developing a new additive manufactured lightweight gate which can be retrofitted to Christmas Tree gate valves to remediate seal integrity issues in low-pressure wells.

The gate has been designed as a solution for late life, depleted and shut-in offshore wells, where the tubing head pressure is too low to effectively seat the gate and seal the well. The patented design reduces the weight of the gate by around 60%, while retaining its intrinsic strength and would save operators around UK£250,000 per well by replacing a single surface component rather than the complete well control package.

The new technology is a result of a collaborative research and development project with Net Zero Technology Centre and Spirit Energy.

Technical Sales Director at Unity, Stuart Slater, explained, “The use of metal additive manufacturing means that we can offer attractive cost-savings and efficiencies to the industry, reducing raw materials, waste and operator investment in stock holding. The delivery of single items is fast and more energy efficient than traditional forgings, with an impressive 90% average reduction in lead times.

“But the real saving in this case is achieved by approaching the problem from a different angle, so rather than replacing the whole surface well control package we can quickly replace just a single small component, which offers huge cost and efficiency benefits.”

According to the most recent ‘Wells Insight Report’ from the UK’s North Sea Transition Authority, the current active UKCS well stock comprises of 2,629 wellbores, 1,661 of which are producing, while the number of shut-in wells rose by 65 to 781 in 2021. Shut-in well stock is now at a historical high, with 30% of all wells being shut in as significant intervention on infrastructure is cited as one of the top three limiting factors.

Unity’s technology is entering the latter stages of development as prototype testing has already been completed on a 2-1/16” gate, with a 5-1/8” gate now in manufacture to qualify the product for commercialisation.

Data and subsea service provider, Reach Subsea ASA, has secured a decommissioning contract for work in the North Sea.

The contract represents about 40 project days for execution in Q1 2023, and will see the utilisation of the Olympic Delta vessel. Reach Subsea have an existing cooperation with Olympic Subsea for the vessel, and both parties have agreed to extend their collaboration for the entirety of 2023.

“The market activity is high, and we are pleased to see that we are able to secure contracts across a range of segments. Continuing the good cooperation with Olympic both on ROV services and joint marketing of vessels, shows that our common service offering has been well perceived by clients,” said Jostein Alendal, CEO of Reach Subsea.

The extended collaboration comprises an additional 150 days of frim work for the two ROVs currently mobilised on the vessel. Reach Subsea is contracted to provide this service to Olympic for the charter duration to a tier 1 oil and gas contractor.

DOF Subsea has been awarded an Engineering, Preparatory works, Removal, Transportation, Recycling and Disposal (EPRD) contract by Norwegian energy giant Equinor Energy AS.

The contract is in relation to the Heimdal subsea decommissioning works and includes the recovery and disposal of approximately 2,000 tons of subsea equipment. The offshore work is scheduled in two main campaigns across three DOF vessels between 2024 and 2028, with project management and engineering work to start immediately. The preliminary work will be delivered by DOF’s expert cessation team based in Bergen, Norway.

Mons S. Aase, Group CEO, DOF, said, “I’m pleased that we are once again trusted to deliver a complex subsea project for Equinor. I look forward to completing the project successfully and safely.”

Heimdal is the Equinor-operated field in the North Sea, which has been operational since 1985. The contract states DOF Subsea are responsible for the removal, dismantling and recycling of the main platform topsides and jacket.

Aker Solutions can now offer operators a Second Life Report on the raw materials a platform contributes to the circular economy as part of its decommissioning offering in light of the fact that 99% of a drilling platform can be recycled.

Aker Solutions can now offer operators a Second Life Report on the raw materials a platform contributes to the circular economy as part of its decommissioning offering in light of the fact that 99% of a drilling platform can be recycled.

The report spotlights the quantity of materials yielded in decommissioning work, and for topsides with heavy lift records, that leads to a lot of valuable raw materials. Maintaining more sustainable economic activity relies heavily on reusing as many materials as possible, as far less energy is used in the recovery of recycled materials than in the production of newer ones. Steel recovered offshore has many unique qualities and uses that can be capitalised on.

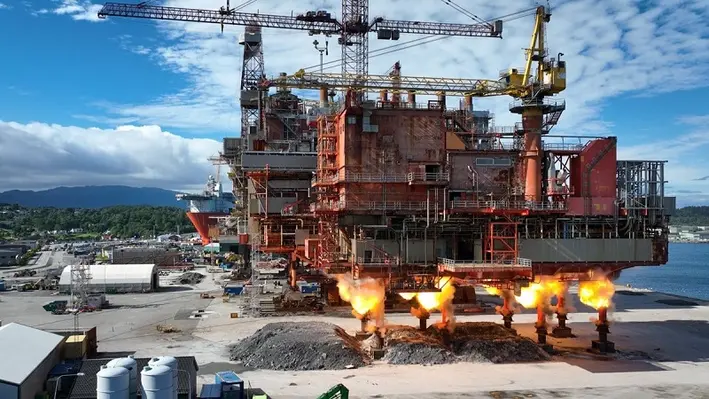

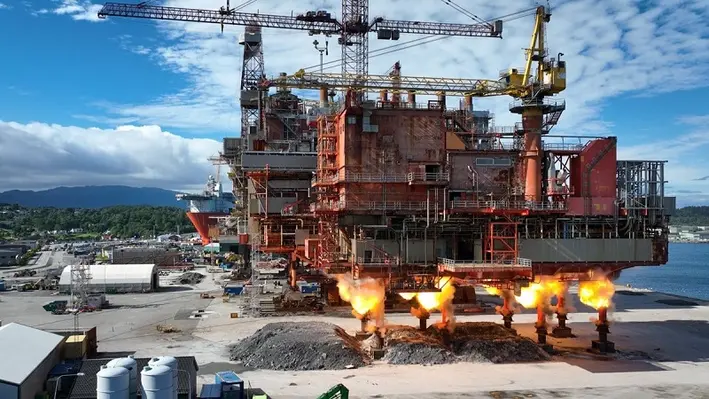

However, the process of rendering these huge structures into salvageable materials can be a brutal endeavour. For example, on its final journey, the drilling platform used in the Norwegian Valhall oil and gas field was carried on the Pioneering Spirit heavy lift vessel only to be left at the Aker Solution’s Stord yard in May 2022 as large machines waited to demolish it. The 6,700 ton platform was first stripped of all hazardous materials and electrical waste before it was levelled by explosives. This process, however, speeds up the demo and makes it safer by bringing down heavy structures to ground level, avoiding the need to work from height.

The original Valhall installations have produced over one billion barrels of oil equivalent since the field entered production in 1982, with two platforms having been recycled at the Stord yard, and a third will be decommissioned later this year. While the original structures will continue on as raw materials, Aker Solutions has aided Aker BP in extending the life of the remaining Valhall centre for an extra 40 years.

Aker Solutions has already accumulated a pipeline of orders for structural teardowns in the North Sea, and already have some 40,000 tons of recovered hulks awaiting dismantling and recycling at the Stord’s yard.

Ocyan, an oil and gas company with a sustainable attitude and knowledge to provide solutions for the industry, has announced that a Solstad Offshore's vessel has arrived in Brazil, ready to perform decommissioning activities.

The Normand Cutter, which is under Ocyan’s management, will perform decommissioning work on Petrobras subsea structures at Campos Basin and Sergipe-Alagoas. The vessel finally arrived earlier in January after the contract was awarded last year.

Normand Cutter is an offshore construction vessel (OCV) of 127.5 m long, equipped with a crane presenting lifting capacity for 300 tons, in addition to a flexible pipe lay system of up to 100 tons and pipe storage of up to 1250 tons. The ship has a crew capacity of 114 people, however Ocyan’s onboard team will be composed of 23 people.

The vessel arrived in Brazil after beginning its journey in Norway. On 12 December 2022, Normand Cutter departed from the country onto Scotland where collection and pipe lay systems were deployed. Now in Brazil, the vessel will perform the first campaign for the collection of equipment at Campos Basin, where it will remain for two weeks to then unload the structures at Vitória (ES). At the end of this first stage, still at Espírito Santo, it will perform the last stage of equipment deployment – rollers and reels for storage of flexible pipes – necessary for the sequence of the project.

André Luiz Magalhães, Executive Manager for Subsea Construction at Ocyan, commented, “This is the first decommissioning contract for offshore production fields in Brazil and we can say that we are at the forefront when it comes to the national production chain. The project will give us experience and a great expertise. This project marks the return of Ocyan to the subsea construction area. We expect a bright future with new opportunities in other companies, including international operators.

“After all this trajectory, in February, Normand Cutter will start to operate definitely at Campos Basin, collecting structures of FPSO Cidade do Rio de Janeiro and FPSO Cidade de Rio das Ostras, and in the second semester, it will initiate the work at Sergipe Alagoas Basin, in the area of the FPSO Piranema. All material will be treated and sent for recycling. Offshore services under the contract will last for approximately one and a half years,” explained the executive.

Rafael Guigon, Director for Subsea Construction Contracts at Ocyan, added, “For Ocyan, the presence of the Normand Cutter in its fleet is a strategic point and will provide a window of opportunity for new subsea construction contracts. From now on, we can search for other projects that require this kind of asset as a work tool for activities performed in this area. This vessel will allow the execution of simultaneous projects.”

Decom Engineering (Decom) has kicked of the new year with numerous project wins and work scopes valued in excess of seven figures.

Decom Engineering (Decom) has kicked of the new year with numerous project wins and work scopes valued in excess of seven figures.

The decommissioning specialist has secured new projects in Africa, Norway, Thailand and Singapore, while strengthening existing ties in Malaysia.

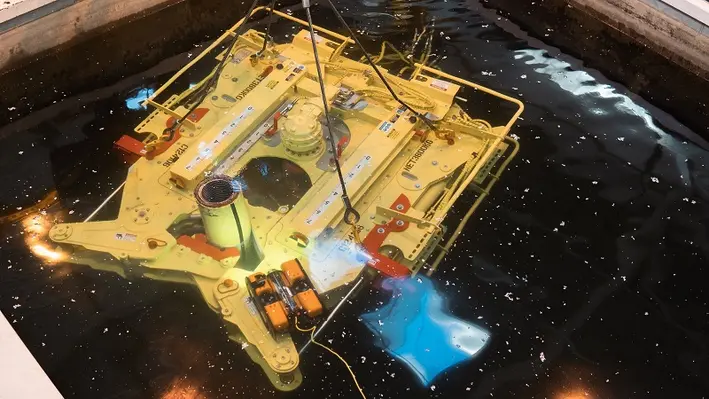

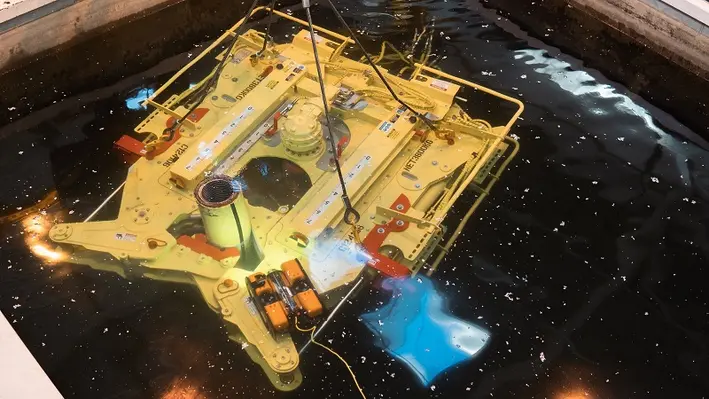

The UK-based company will mobilise chop saws and supporting crews in Q1 2023 to support campaigns in the Gulf of Thailand, and over in the Democratic Republic of the Congo, Decom will provide a C1-24 chop saw with hot slab functionality to assist in the recovery of a production jumper in depths of up to 1,000 m. The acquisition of this work scope came about after Decom was able to successfully prove its technology could success where others had failed.

In Norway, the company will provide support through a tier 1 contractor to a major operator during the summer campaign to cut concrete coated pipelines with its new C1-46 chop saw.

Decom Engineering Managing Director, Sean Conway, commented, “It is an encouraging start to the year to have an array of international work on the books, and it confirms that out chop saws and operational cutting expertise is seen as an integral component of complex subsea asset recovery and decommissioning projects.

“Our strategy is to continue investing in expanding the capabilities of our chop saws to meet the technical challenges faced by clients, and we are in the process of developing a larger chop saw, capable of cutting piping infrastructure up to 46” in diameter.”

Oilenco Norge AS, sister company to well intervention and abandonment company Oilenco Ltd, has appointed Dean Reynolds as Business Development Manager for their Norway operation.

Reynolds will transfer from Oilenco to Oilenco Norge AS after four years with the market-leading company and will be responsible for the growth of the Oilenco brand in Norway.

Reynolds, who has more than 20 years’ experience in the oil and gas industry, commented, “Oilenco is an innovative company bringing together bespoke design engineering expertise and custom manufacturing services to support clients with the most demanding of challenges. In my new role as Business Development Manager for Oilenco Norge, I will be responsible for developing client relationships, raising awareness of Oilenco products and capabilities, whilst demonstrating our compliance with the latest industry standards and high-quality service the company provides.

“Over my career I have gained valuable knowledge and experience from the front end, working offshore, understanding the needs of engineers, as well as supporting oil companies to provide a superior service to their customers. I am sincerely grateful to work for a fast paced, forward thinking company like Oilenco and to be given this opportunity to showcase our evolving product range to the Norwegian market.”

Blair McCombie, Operations Director, Oilenco Ltd remarked, “Oilenco have been working alongside oil and gas companies in the Norwegian sector since 2008, and following the establishment of Oilenco Norge in 2021, it is critical we have a dedicated operation and technical support in region. This appointment strengthens our position and shows commitment to provide a more collaborative service to our clients. As a significant producer of oil and gas, we look forward to supporting the Norwegian sector, bringing efficiencies to their well intervention operations through our design, manufacturing and engineering capabilities. Dean is a great asset to the company and addition to the Oilenco Norge team, and with his technical knowledge and years of experience, is a talented resource to work alongside our client to supply the service they require.”

Pressing climate concerns and an overall healthy oil price across 2022 have set the stage for Australia's decommissioning industry to flourish, according to a new report published by Offshore Network.

Pressing climate concerns and an overall healthy oil price across 2022 have set the stage for Australia's decommissioning industry to flourish, according to a new report published by Offshore Network.

Reports estimating that oil prices through 2027 will stay at a healthy rate of approximately US$90 per barrel bodes well for the decommissioning industry as companies can consider liability expenses even more open-handedly.

The government-backed Northern Endeavour project has triggered a flurry of decommissioning prospects to swing into action; a trend that is expected to continue over the next few years. Because of this, promising engineering companies like Wood and Monadelphous are being shot into the limelight, as the government onboarded them for various roles on the Northern Endeavour decommissioning.

Companies like Santos, Woodside, BHP and Vermillion Energy have signed up for kick-starting end-of-life activities, with ExxonMobil leading the way. Chevron has ongoing decommissioning projects onshore and offshore at Thevenard Island, which was rendered inactive in 2014. NOPSEMA has granted decommissioning approval to companies like Woodside, BHP and Cooper Energy early last year. Decommissioning activities in the Enfield Oil Field are being conducted by Woodside in phases, and is expected to be completed by 2024. Australia is financing research initiatives and organisations are tying up to tackle the challenges of decommissioning through knowledge sharing. Xodus, along with ANSTO, SA Radiation, Total Hazardous Integrated Solutions and Qa3, form the Contaminant Advisory Group that helps operators to work through the government’s OPGGS bill.

This flurry of activity has been prompted by a government determined to ensure that decommissioning responsibilities are carried out. The new Offshore Petroleum and Greenhouse Gas Storage Amendment (Titles Amendment and other Measures) Act 2021, makes sure the entities intending to carry out petroleum or greenhouse gas activities are capable, competent and responsible in proper discharge of obligations under the act.

The Centre of Decommissioning Australia (CODA) has estimated the decommissioning expenses of the Australian oil and gas industry to reach as high as US$40.5bn, considering the nation's significant asset stock. According to a report by Rystad Energy, 890 offshore wells in total were drilled in Australia before 2015, of which 108 have been permanently abandoned. Around 440 wells are P&A candidates, the majority of which are in the Gippsland Basin.

Based on the identified numbers, CODA has come up with a comprehensive liability report, to serve as the go-to manual for operators when it comes to making smart economical choices. Critical to this, as stressed by Francis Norman, CEO and Managing Director of CODA, is the importance of collaborative campaigning and in-situ decommissioning as effective cost-cutting measures.

Players like CODA are guiding the Australian decommissioning industry through the climate conundrum through strikingly innovative approaches. One of them is the rig-to-reef concept, which involves a special combination of materials that resulted in the Exmouth Integrated Artificial Reef, better known as the 'King Reef' in the Exmouth community. It combined 49 purpose-built concrete modules with six steel structures from a BHP-operated field that is no longer in use, providing home to 27,000 cu/m of new marine habitat. As incredible as that sounds, operators must have clarity about the risks involved as well, so that they can keep pushing barriers through innovation.

With every stakeholder working in tandem and taking onboard lessons from other more developed regions, the Australian industry can ensure that the forthcoming decommissioning wave can be weathered.

Saipem, an advanced technological and engineering platform for the design, construction and operation of infrastructures and plants, has worked with MCS, an underwater technical and digital solutions company, to launch a new asset integrity management system.

As per the announcement on social media, ‘The PALM Suite’ (which stands for Platform for Asset Lean Management) is designed to support offshore energy operators with asset data management, risk assessment and inspections planning of offshore infrastructure across oil and gas, renewables, power and data networks.

According to Saipem, The PALM Suite unlock a new layer of service-oriented capabilities and leverages advanced features such as 3D reconstruction for subsea dimensional control and IoT data gathering. The collaboration brings together Saipem’s extended asset integrity expertise and subsea robotics portfolio with MCS’ data science and software competencies.

BiSN, a leading supplier of downhole sealing solutions and technology to the global oil and gas industry, has been awarded a key contract by a major oil and gas operator in the North Sea.

The three-year contract (which features two one-year extensions) requires BiSN to use its proprietary Wel-lok alloy barrier technology to safely and efficiently plug and abandon oil and gas wells in the North Sea. The technology is a cost-effective and environmentally-driven solution that provides a permanent well-barrier and gas-tight seal in single and multiple annuli.

The scope of work includes providing BiSN Wel-lok alloy plug barrier technology, which ensures a permanent plugging and abandonment of oil and gas wells so that they are securely and reliably sealed, vastly reducing corporate liability and potential environmental impact. BiSN's alloy plugs are a superior solution compared with conventional technology that uses cement, elastomers, resin, or others as sealing elements that deteriorate over time, particularly in harsh environments.

Paul Carragher, Founder and CEO of BiSN, commented, “We are pleased and very excited that BiSN has been awarded this major contract. This is another step forward in the execution of our company mission to provide unique barrier solutions that protect the earth’s natural resources. Our strategic objectives, which include providing our novel technology and best-in-class services, focus on working collaboratively with our customers to support and exceed their well abandonment objectives.”

Mark Nicol, BiSN Regional Business Development Manager – UK, Europe & Africa, added, “This award recognises BiSN’s differentiating technology and capabilities to deliver a permanent well barrier in challenging offshore oil and gas wells. We look forward to collaborating with this operator and all associated stakeholders to successfully complete this project.”

T7 Global Berhad, an energy solutions provider, has secured two contracts worth approximately RM100mn (around US$23mn) from PTTEP Group of Companies and Hibiscus Oil & Gas Malaysia Limited.

The work with PTTEP includes the provision of headhunting and recruitment services while the second letter of award, from Hibiscus, is for the provision of facilities decommissioning services for South Angsi Alpha.

T7 Global Group Chief Executive Officer, Tan Kay Zhuin, commented, “The Hibiscus award marks an important milestone for the Company to execute offshore facility decommissioning projects of such scale. There is initiative for rig-to-reef by converting the structures into artificial reef to enhance the marine habitat at the intended location. We see this as a sustainable approach for oil & gas operators moving forward which can contribute to their Environmental, Social and Governance (ESG) agenda. Over the next few years, we will be on the lookout for more ESG related projects in the region.”

TechnipFMC, a global oil and gas company that provides complete project life cycle services for the energy industry, has been awarded a substantial master services agreement (MSA) for subsea services offshore Brazil.

The three-year contract, awarded by state-owned Petrobras, has an option to extend for a further two years. TechnipFMC will provide life-of-field services to support its installed base offshore Brazil.

The contract – worth between US$250mn-US$500mn as per TechnipFMC’s definition of a ‘substantial contract’ – covers installation, intervention, and maintenance of both equipment and tooling, as well as technical support for subsea umblicals, risers and flowlines.

The agreement succeeds a previous MSA and supports Petrobras’s increased volume of operations. Services will be supplied from TechnipFMC’s base in Macaé, Brazil.

Jonathan Landes, President, Subsea at TechnipFMC, commented, “This new MSA continues our enduring partnership with Petrobras. We are delighted to continue this relationship through this direct award. For 40 years, we have provided services from Macaé, demonstrating the strength of our commitment to delivering services using our in-country workforce.”

Page 74 of 118