The omens for the offshore decommissioning market are looking positive as the industry prepares for 2023 and all that it has in store.

While a turbulent geopolitical environment has caused market fluctuations over the last few years (with Covid restrictions giving way to war in eastern Europe), a healthy oil price has been enjoyed through most of 2022, which is expected to settle in short- to medium-term. In addition, the pandemic revealed more than ever the pressing concerns around the fragile nature of our environment and has spurred the energy industry to promote sustainable practices wherever possible. In the case of the latter in the offshore world, there has been a renewed focus on decommissioning responsibilities, to ensure operators leave their stomping grounds as tidy and climate-friendly as possible.

Such concerns have been expounded by developments in Australia where the ongoing decommissioning of the Northern Endeavour FPSO (and the controversy around the trailing liabilities attached to it) has pushed this issue even more to the fore. The understanding of the forthcoming decommissioning wave has never been so developed, and the perception that we must get ahead of this, lest we get swept away by it, is sharp. By example, a recent report by Offshore Energies UK indicated that around the UK more than 2,000 North Sea wells are to be decommissioned at a cost of around UK£20bn. OEUK Decommissioning Manager, Ricky Thomson, said, “The UK’s decommissioning sector is snowballing and will continue growing for years to come.”

Fortunately, a healthy oil price and an ever-growing demand for oil and gas is filling the coffers of operators across the globe, making the burden of end-of-life activities easier to bare. Owing to these developments, industry reports are indicating that the global offshore decommissioning market will experience a strong growth in the immediate and long-term future. One report published by Visiongain, for instance, has forecasted that the market (which it valued at US$10.275bn) will grow at a CAGR of 6.5% between 2023 and 2033.

The opportunity to capitalise here is a tantalising one, with Thomson adding that with right government support the decommissioning challenge can be turned into gain, with the potential to create thousands of jobs. Indeed, many in the industry are not ignorant of this opportunity but are making moves to capitalise on this potentially lucrative market. At the end of 2022, for example, Harbour Energy, ConocoPhillips, Spirit Energy and Repsol Sinopec formed a well decommissioning collaborative initiative in conjunction with the Net Zero Technology Centre (NTZC). The initiative will enable new technologies to be trialled and tested in collaborative field trials enabling faster, lower-cost trials and wider industry adoption.

So, while no one knows for certain what 2023 will hold for the decommissioning sector, the strong position it has started the year in is a positive sign for its future growth and development in years to come.

HydraWell has revealed the latest development in its perforation, wash & cement (PWC) technology in the HydraCT which could reportedly signal a major industry shift for the future of P&A activities.

The HydraCT is an advanced PWC system which is specifically designed for coil tubing applications with the potential to cut Co2 emissions by 80% and costs by up to 60%. Last month, it was successfully debuted in Alaska, USA, which was the first project of its kind to use coil tubing, eliminating the need to mobilise a rig to site. By running coil tubing as the deployment method, the rigless HydraCT campaign spanned less than 24 hours.

HydraWell’s Chief Executive Officer, Mark Sørheim, commented, “Our first successful campaign demonstrates there is no doubt the HydraCT technology is an ideal solution for coil tubing applications.

“Our research has shown there is industry demand for more sustainable and cost-effective alternatives in plug and abandonment operations and we will continue to respond to this demand by creating superior solutions which are carefully aligned with the needs of clients and the market.”

“Working without rigs is the next chapter for P&A activities and we will remain at the forefront of guiding how the sector can move away from the need for a rig to pull pipe towards rigless, coiled tubing using HydraCT,” continued Mark. “HydraWell regards sustainability as one of its top priorities as we strive for efficiency gains while minimising our environmental footprint.

“HydraCT is a key component in the path towards rigless P&A and this breakthrough technology has allowed us to make huge strides in supporting our clients’ environmental savings as well as working for the greater good of the industry as a whole.”

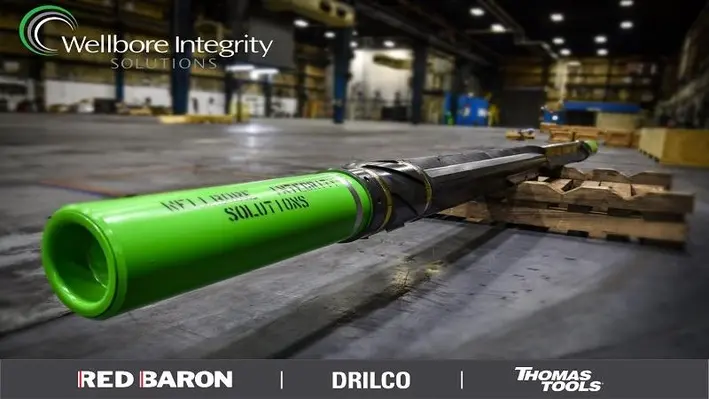

Wellbore Integrity Solutions (WIS) recently presented at the Offshore Well Intervention Gulf of Mexico (OWI GOM) conference, showcasing the service company’s impressive portfolio of well abandonment and debris management solutions with its ProMILL™ technology and Heli-Mag™ , as well as highlighting its success in delivering a project in the Gulf of Mexico.

Wellbore Integrity Solutions (WIS) recently presented at the Offshore Well Intervention Gulf of Mexico (OWI GOM) conference, showcasing the service company’s impressive portfolio of well abandonment and debris management solutions with its ProMILL™ technology and Heli-Mag™ , as well as highlighting its success in delivering a project in the Gulf of Mexico.

With WIS’s extensive knowledge and industry experience of over 75 years, WIS brings together some of the most renowned brand names in wellbore integrity products and services; Red Baron, DRILCO, and Thomas Tools. Each showcases various capabilities from supporting drilling operations and production, to well intervention and well abandonment services. The Red Baron brand focuses primarily on well intervention services, including fishing and remedial for both open and cased hole projects; Wellbore Departure, which consists of sidetracking a wellbore by utilising the TrackMaster Select™ systems; Wellbore Cleanout Tools, which includes equipment such as the Heli-Mag inline magnet, ideal for debris management in multiple applications; Well Abandonment and Slot Recovery services utilising the ProMILL and ProMill Duo™ technologies, and Thru-Tubing Services for various tubular and wellbore projects. DRILCO provides global tubular products and services including field and in-house tubular inspection and repairs, along with manufacturing various drill pipe, whipstocks, fishing and well abandonment equipment. Thomas Tools specialises in rental equipment for special projects or additional assets to rig inventories including blowout preventers (BOPs).

With all the above available in WIS’ arsenal, the company strives to present the broadest portfolio of services across the well lifecycle, a fact that was highlighted during the company’s presentation at OWI GOM, detailing the importance of effective debris management in all projects concerning well intervention. Delaney Olstad, Well Abandonment Manager at WIS Red Baron, discussed how important the practice is, especially in recent years, in regard to making each project as safe and efficient as possible.

“Debris management is absolutely critical in terms of minimising HSE and operational risks. Studies have shown that debris in the wellbore can lead to premature failure of equipment, which can be both costly to the client in terms of downtime and equipment repairs,” stated Olstad.

“I think it's also more prevalent nowadays than it has been in the past because the seriousness of downtime; some of these offshore operations are into the hundreds of thousands of dollars a day. And if there's downtime because you must deal with swarf, an incredible operation can come, basically, to a standstill because you must address the metal debris and shavings.”

To further improve the practice of effective well abandonment, in 2016 the ProMILL technology was created. ProMILL is a single-trip system which allows operators to handle multiple operations, saving on the overall costs. The milling system combines a bridge plug assembly, section mill, and high-ratio underreamer in a single trip solution, which achieves rock-to-rock zonal isolation, and prepares the formation for an uninterrupted abandonment cement barrier.

“The introduction of ProMILL technology enabled rock-to-rock barriers that ensured the integrity of the abandonment process. The ProMILL system is a single trip BHA designed to reduce the number of trips necessary to meet the project and customer requirements,” commented Olstad.

“In the long term, it is obviously essential that wells, which have been abandoned, are abandoned in a way which will prevent future leaks. The ProMILL has played an important part of that safe and reliable abandonment process.”

Olstad also discussed the importance of creating a system which effectively and efficiently eradicates all potential leak paths during the P&A process, as even the tiniest gap can have disastrous and highly expensive consequences.

“When you abandon a well that means it has reached the end of its lifecycle, so you remove everything from the top side. You might put a marker there to identify the well location and you leave. If after a plurality of time, be it two years, 10 years, 20 years, or more, something changes and a hydrocarbon sneaks out, what do you do?” he said.

“To go back and re-enter the well, and re-abandon the well, is extremely expensive – sometimes 10-to-100 times more expensive – depending on where you are. If you're offshore, where was that well? It might leak and show up a mile and a half away, in any direction. That's why it's unquestionably crucial to do it right the first time and utilise equipment that can do it correctly. Being successful in a single trip is beneficial to everyone involved because it’s less time on the rig and less cost associated with overall operations.

“The WIS Red Baron team focuses on completing our operations in a way which meet both the regulatory and project requirements, so that the well does not leak into our most precious commodities – the water and our environment.”

Not only is WIS creating waves through the industry with its efficiency in eradicating leak paths, it is also making headway with its Wellbore Cleanout Heli-Mag technology; a downhole inline magnet which is used during milling operations to maximise debris recovery. The technology consists of 16 rows of rare earth magnets in a helical configuration which ensure that even the smallest pieces of swarf are removed.

In July 2022, WIS worked with KOSMOS Energy on a project in the Gulf of Mexico which required use of the Heli-Mag inline magnets were used in conjunction with the TrackMaster whipstock system to effectively recover debris as a large volume of cuttings were expected, causing concern about the amount of metal produced during a dual casing exit and having adverse consequences in the wellbore and the BOP stack.

“We ran nine of the Heli-Mag inline magnets close to the milling BHA above the heavyweight drill pipe so that they were in tension to capture all the swarf before it went up hole. But just in case any swarf did by we put one more just below the BOP. And by doing that, we captured 1,600 pounds of swarf on the first day,” said Olstad.

“Overall, the Heli-Mags ended up bringing almost 3,000 pounds of swarf out of the hole. Less than 1% of the total amount of recovered debris, 16 pounds of swarf, made it into the rig’s debris recovery equipment.”

Impressive indeed. Looking to the future, Olstad discussed the importance of having a business emphasis on the significance of integrity within the wellbore, as the industry collectively works harder than ever to protect the environment. As our world becomes more fragile, the big players within the industry, including WIS, are emphasising the importance of making every process as sustainable and as safe as possible.

“This is our world, and we only get one, so it is of paramount importance that we strive to conduct ourselves and our actions as best as possible to preserve it and ensure the longevity of the operations, the environment, and humanity,” Olstad concluded.

As the oil market fluctuated more than it has in over a decade due to the fragile global developments that have occurred over the last few years, decommissioning and abandonment services in the Gulf of Mexico are facing a turbulent future as demand skyrockets.

As the oil market fluctuated more than it has in over a decade due to the fragile global developments that have occurred over the last few years, decommissioning and abandonment services in the Gulf of Mexico are facing a turbulent future as demand skyrockets.

As the restrictions eased after the Covid-19 pandemic, the world opened up again, bringing with it a tidal wave of demand, and due to the tightened restrictions put in place all over the Gulf to meet the needs of a sustainable future, the industry became gridlocked in a chain of bureaucratic laws and the increasing costs of labour and equipment.

Limited crews and equipment are only the tip of the proverbial iceberg as the ‘boomerang’ asset problem has started to cause havoc around the Gulf. With the law stating all operators, past and present, are liable for the decommissioning costs regardless of how long they owned the asset, mixed with the skyrocketing rates of inflation and equipment, the costs presented to operators may be insurmountable. The Fieldwood bankruptcy, which was finalised in 2020, is still sending waves around the Gulf, increasing the scope of work of up to 1,000 additional wells.

It's not all doom-and-gloom however, as opportunities for third party operators to shoulder the costs are becoming more prevalent. Operators who can’t afford the increased costs and scope of work in the given time frame can sell their assets to outsourced organisations who take full responsibility in carrying out decommissioning services. For the next few years, the Gulf is expected to continue riding the decommissioning wave until the spike in demand has dropped significantly.

The scope for decommissioning services in the GOM region is exponential, and is predicted to keep on rising, creating a haven for oil and gas operators. As long as the scope of work doesn’t outweigh the resources available, the Gulf is set to be in a very desirable position in the years to come.

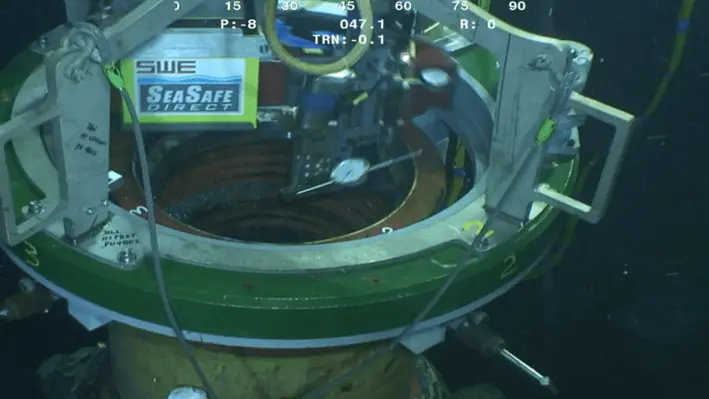

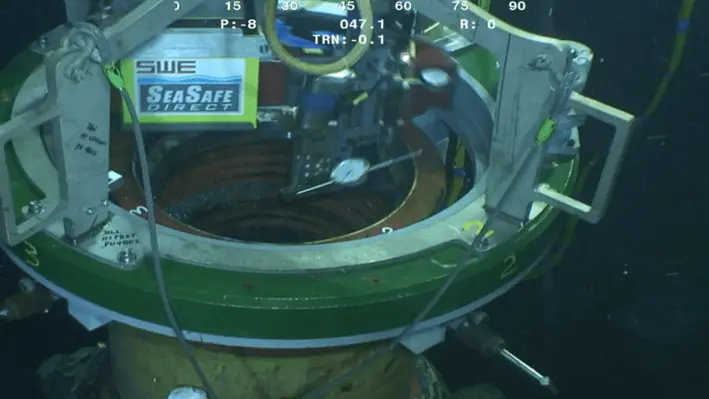

At the recently concluded Offshore Well Intervention Gulf of Mexico conference, representatives from Caltex Oil Tools provided a detailed presentation of a recently concluded damaged wellhead repair project where the company utilised new technology and methodologies to successfully bring a well back online.

Since bursting onto the subsea scene in 2018, Caltex has become an established solutions-focused business which provides rentals, services and bespoke engineering capabilities for subsea operations. In the case of the latter, the company and its affiliates offer a range of services including equipment rental to support vessel and rig-based pre-commissioning, controls, completions, intervention and decommissioning activities; consultancy services with experts specialising in business development, sales, remote technologies, subsea controls, diver and diverless interventions, vessel based IMR operations, and emergency response repairs; as well as engineered solutions where it specialises in unplanned emergency response requests to developing transformative technical solutions.

The project that was presented at OWI GOM began when a major operator contacted Caltex over an offline well which had visible damage to the VX profile, FX profile and isolation sealing surface. Knowing Caltex’s extensive capabilities, the operator sought the company’s immediate help to intervene and bring the well back online. In turn, Caltex responded by developing a custom solution for machining the inner wellhead profile to remove the damaged surfaces.

It was in November 2021 when Caltex first began work on the project, with an initial concept to remove protruding materials and polish damages. According to Carter Kacal, Project Manager at Caltex, it was shortly after this, in January, when the project began to grow and the scope developed from what was originally perceived. After analysis of damage, their plans involved to machine the new ID .25’’ beyond the last damage, increase the ID of the wellhead by 0.125’’ and machine a 30° lead-in bevel at top/bottom of the increased ID.

This involved the development of a tool with the goal to machine a new ID of the damaged wellhead to tight specifications which also incorporated an automated system featuring closed loop controls and independent electronic actuator controls. From January onwards, Caltex swiftly developed Software (in just 15 days) and tested the tool to perform the required work before travelling to the manufacturer of the wellhead to perform an SIT at the beginning of March.

The technology utilised in the solution delivered by Caltex, according to Kacal, included a real mix of field-proven to new technology, resulting in a bespoke solution. It included three electronic actuators, an RPM sensor, subsea control units, a localised subsea power bank and an optical communication link connected through the ROV and controlled from the surface.

Kacal commented, “The results of the SIT were extremely positive, better than we could have expected, and well within the specifications we needed to be which is shown in the table.”

“We needed to be within 0.005'' concentricity and we achieved 0.002'' which was great. And then the surface finish that was well below what it needed to be as well. The goal (measured in Ra) was to be 111 Ra or lower. And so you can see there the average of the three numbers [on the table] is around 46. The only thing missing there is the results on the bevel cut. So we needed to cut a bevel as well as machine new diameter. We needed to be 30°, we were at 26°. This was a little steeper than we needed to be, but still successful nonetheless. From that everyone was happy to go offshore and we felt comfortable as well.”

Indeed, little time was wasted in doing so as, by the middle of March, the tool was offshore and ready to perform. Kacal continued, “We had a timely mobilisation with no downtime for the tool. We performed the operation in five days (from mobilisation to demobilisation) which included less than 24 hours operation of the tool itself. Then, once we pulled it off and actually tested the wellhead, everything was successful and eventually the well was able to be brought back online.”

For a job that began in November and had to contend with workscope changes along the way, it was a remarkably quick turnaround for the company which was ultimately successful. Kacal remarked that, alongside the timeliness of the operation, what worked very well was the automated system with closed loop controls alongside the performance of the tungsten carbide tool tip. He added that given slightly more time they could have spent more time developing and optimising the tool, however this did not overtly affect the performance and it has given the company confidence that they could deliver another project of similar scope and time effectively again.

“If there's ever an opportunity, we'd love to be able to try our hand at it again because we've proved it, we've developed it. At the moment I would say many people just don’t really know that is out there and no one really discusses if they have a damaged wellhead or not. So we want to show, with this example, that this technology is available and we have the ability to remediate the wellhead with a less invasive strategy than what is currently out there. At OWI GOM we had some interested discussions around this and people seemed definitely interested so we shall see what the future holds.”

Global well integrity company, Coretrax, has collaborated with Lee Energy Systems (LES) to deliver a one-trip solution for a major North Sea operator for its P&A campaign.

Global well integrity company, Coretrax, has collaborated with Lee Energy Systems (LES) to deliver a one-trip solution for a major North Sea operator for its P&A campaign.

The collaboration aims to maximise operational efficiencies for the creation of solutions for remedial annular cementing and plug cementing. Coretrax’s CX-2 bridge plug and CX-RTP (retrievable test packer) were deployed with LES’ GATOR Hydromechanical Perforator in order to provide a single-trip system which successfully placed environmental caps across eight wells.

The combined technologies will save operators a total of seven hours in downhole trips.

“As essential decommissioning projects continue to take place across the North Sea, the campaign is a clear example of how our suite of technology, with support from our skilled partners, can service all aspects of the plugging and abandonment process to deliver a full turn-key service,” said John Fraser, Chief Executive Officer, Coretrax.

“In the current economic climate, reducing rig time can save operators considerable expenditure while also reducing project carbon emissions, working closely with Lee Energy Systems and the operator on this project we were thrilled to be able to develop a solution which delivered such significant efficiencies.”

Owner of LES, Paul Lee, commented, “On behalf of the entire Lee Energy System’s team, I would like to thank John Fraser and all the Coretrax team for their commitment and professionalism in seeing these operations through to fruition.

“LES is delighted with its technical relationship with Coretrax where it focuses on its best-in-class solutions as well as ourselves and bring the combination of these teams together. Continuing to improve on these solutions and innovations will continue to be the focus of our two companies. Our goal is to provide industry-leading solutions to this challenging, costly and most important end of well life cycle decom operations.”

Island Offshore, which owns an extensive fleet of offshore service vessels with a range of capacities, has indicated that their 2023 light well intervention work programme is filling up with several clients planning to increase the use of their service.

The company provided this information in a social media post where it suggested that utilisation is looking to improve further from 2022 levels. It added that the Island Wellserver vessel will be fully utilised in 2023 working on the Norwegian Continental Shelf and will, in December, be dry-docked at Ulstein Yard for class renewal.

The Island Constructor is currently trading outside the North Sea but will return to the region in February to undertake multi-client LWI work throughout 2023.

Continuing, the company explained that its riserless well intervention units are part of a cost-effective and flexible service alternative to rig-based interventions with a value proposition that has shown to be appealing to customers. The subsea well services include diagnostics, stimulation, monitoring, zonal isolation, and mechanical repairs.

Since 2005, Island Offshore has partnered with TechnipFMC and other alliance partners as first moves to complete more than 400 well interventions. The post concluded, “We are proud to be a small but significant player in the market.”

Halliburton Company has completed the installation of the industry's first single trip, electro-hydraulic wet connect in deepwater for Petrobras in Brazil, marking a significant achievement in downhole electric completion technology.

The Halliburton Fuzion EH electro-hydraulic downhole wet-mate connector helps increase well recovery factors by maintaining integrity of Halliburton's SmartWell completion systems throughout the well's lifecycle. It helps further facilitate safer and simpler intervention operations and avoids potential formation damage because of workover operations.

Halliburton plans a future version of a dual trip system Fuzion-EH connector for qualification and implementation by Petrobras in 2023. This system will provide additional benefits in SmartWell system installations while maintaining the benefits of the single trip system.

Mark Dawson, Vice President of Halliburton Completion Technology, Halliburton, commented, “The Fuzion-EH connector is the first step in the fully electric intelligent completion journey and is a product of collaborative development with Petrobras and Shell. This achievement paves the way for us to give customers the autonomous capability to control and manage reservoirs across their wells and assets and deliver on our Future of Completions.”

Olivier Wambersie, General Manager Brazil Technology, Shell, added, “This significant well technology development marks the first single trip, multiple zones, open hole completion. It was a remarkable example of teamwork, partnership and technical collaboration between operators and Halliburton in the Brazilian ecosystem. This technology's first application was enabled using the ANP Levy.”

Celebrations rang through the night last week as the third annual OWI Awards 2022 brought industry giants together to highlight the very best in offshore well intervention.

Celebrations rang through the night last week as the third annual OWI Awards 2022 brought industry giants together to highlight the very best in offshore well intervention.

This year the ceremony was hosted in Aberdeen on 25 November, 2022, and showcased a host of innovative technologies and solutions over the span of eight categories. The judging panel was made up of top operators from around the world ready to find the best of the best in well intervention.

Vaarst kicked off the night by taking home the Digital Transformation Leader trophy for its excellent work on the SubSLAM X2, a trailblazing digital solution which collects real-time intelligent data in order to deliver underwater live 3D point clouds with sub-millimetre precision.

Next up was Expro which was the big winner of the night, claiming victory in two award categories; Champion Integrated Well Service Company and Most Innovative Solution. The company’s integrated subsea intervention package and Octopoda system were recognised by the judging panel for their ingenuity and impact on the outer industry, thus earning the double win.

The award for the Best Example of Collaboration went to AKOFS Offshore in this hotly contested category, for its exemplary work with Equinor, offering the AKOFS Seafarer for integrated services utilising the company’s OneTeam model. The services are provided through four entities – AKOFS Offshore, IKM Subsea, Archer and Welltec – highlighting the integral prosperities of collaborative work within the industry.

Tendeka took to the top spot for the Best Project Outcome award, shining a light on the company’s remedial solution, Filtrex Conformable Sand Screen, which showed huge success restoring sand-free production across a three-well campaign in Indonesia. The remarkable performance earned Tendeka high recognition from the judging panel.

As sustainability is an incredibly hot topic within the industry at the minute, the award for Environmental Sustainability Innovation presented a very strong roster, but ultimately there could only be one winner, and Exceed pipped everyone else to the post. The company is on a mission to be the global leader of intergraded well management for energy transition, and was subsequently rewarded for its work on carbon neutral well operation.

SLB was awarded for its Plug and Abandonment Excellence thanks to its industry-first wireline service, Epilogue Isolation, wherein operators are no longer required to remove the inner pipe to evaluate well integrity, revolutionising conventional operations. The service reduces P&A rig days, minimising costs and reduces carbon footprint, all of which make the company a worthwhile winner in the eyes of the judges.

To end the ceremony, the final award was that of Significant Contribution to the Industry; an award which showcases the impressive portfolios accumulated by the finalists over the span of their respective company life cycles. The winner of the prestigious award was Weatherford for its rig-less framework approach to decommissioning pre-abandoned phase 3 wells.

Overall, the ceremony was a cause for celebration for not only the winners, but for all the finalists for all the hard work and dedication each operator has put into making the well intervention industry be the best it can be.

Energy services provider, Expro, has announced a US$50mn contract with North Sea operator, Apache Corporation.

Energy services provider, Expro, has announced a US$50mn contract with North Sea operator, Apache Corporation.

The contract is for fully integrated well intervention and integrity services across all of Apache’s North Sea projects, including its Beryl and Forties assets, with a primary term of three years, and two one-year extension options.

Expro will provide services including slickline, e-line, cased hole, and pressure pumping across Apache’s assets, as well as several of the company’s own innovative technologies, including Octopoda, CoilHose and Distributed Fiber Optic Sensing (DFOS) Slickline.

Expro’s Regional Vice President of Europe and sub-Sahara Africa, Colin Mackenzie, said, “We are delighted to receive this award, which demonstrates the continuation of our longstanding relationship with Apache and long-term investment in the UK sector of the North Sea.”

“Expro have worked with Apache for two decades. We are committed to providing safe, efficient, and environmentally responsible services. We look forward to adding further value to Apache with the introduction of our latest well intervention technologies.”

The project is due to commence in Q4 2022.

Harbour Energy, ConocoPhillips, Spirit Energy and Repsol Sinopec has formed a well decommissioning collaborative initiative in conjunction with the Net Zero Technology Centre (NTZC).

Harbour Energy, ConocoPhillips, Spirit Energy and Repsol Sinopec has formed a well decommissioning collaborative initiative in conjunction with the Net Zero Technology Centre (NTZC).

The initiative will enable new technologies to be trialled and tested in collaborative field trials – both offshore in the UK and onshore in several international locations – enabling faster, lower-cost trials and wider industry adoption. The initiative will have a total of up to UK£1.5mn annual funding to test innovative well decommissioning technologies.

The multi-operator led initiative will aim to fund up to five technologies per year and support a minimum of three field trials for each. By year four, the goal is to have a minimum of six technologies successfully qualified and adopted.

Rebecca Allinson, Head of Emissions Reduction, Net Zero Technology Centre, said, “This collaborative approach is a real game changer for well decommissioning technology development realised through the proactive attitude and willingness of our existing members to collaborate and share information.

“It is a unique multi-operator approach that will deliver the pace of technology development required to meet the industry commitment to reach a minimum of 35% cost reduction and 50% emissions reduction in well decommissioning by 2035.”

Vice President, Decommissioning and Energy Technology, Repsol Sinopec, Adam Sheikh, commented, “We look forward to working closely with the NZTC, other operators and technology developers to accelerate the pace of well decommissioning technology development and acceptance to the end that we, along with other operators within the UKCS, can realise the savings new technology can offer in a timely manner.”

FEBUS Optics, a French developer of Distributed Fibre Optic Sensing (DFOS) devices, and LYTT, a UK-based sensor fusion analytics platform provider, has announced they have signed a collaboration agreement in order to offer a powerful solution for well monitoring.

FEBUS Optics, a French developer of Distributed Fibre Optic Sensing (DFOS) devices, and LYTT, a UK-based sensor fusion analytics platform provider, has announced they have signed a collaboration agreement in order to offer a powerful solution for well monitoring.

The DFOS market is growing quickly and is set to continue to expand over the next few years. This collaboration will provide continuous and distributed monitoring of assets which are more straightforward to implement, less expensive than traditional methods, and provide temperature and strain information.

The collaboration presents an opportunity to combine FEBUS’ hardware and LYTT’s software expertise to offer an innovative and powerful well monitoring solution which will visualise real-time insights, as well as enable operators to make quick and informed decisions.

FEBUS Optics CEO, Etienne Almoric, said, “With this agreement, we deliver to our customer a fully integrated solution for well monitoring by combining the best of FEBUS and LYTT. The objective is to make the life of our customers easier while extracting data that helps to enhance the performance and the efficiency of well management.”

Tim Morrish, Sales Director at LYTT, commented, “Energy companies are increasingly turning to innovative DFOS technologies that deliver well monitoring solutions addressing their unique operational needs. Our partnership with FEBUS Optics enables further flexibility in monitoring design architecture for the O&G market.”

Page 76 of 118