GreenFire Energy Inc. (GreenFire) has partnered with Stoic Transitional Resources Inc. (Stoic), to jointly develop geothermal projects through the utilisation of abandoned assets in New Zealand and Western Canada.

GreenFire Energy Inc. (GreenFire) has partnered with Stoic Transitional Resources Inc. (Stoic), to jointly develop geothermal projects through the utilisation of abandoned assets in New Zealand and Western Canada.

GreenFire will utilise its patented closed-loop technology, GreenFire’s GreenLoop, to transform idle oil and gas wells into productive geothermal assets, with Stoic will provide its expertise and access to geothermal resources in New Zealand and oil and gas resources in Western Canada.

GreenLoop is a closed-loop Advanced Geothermal System (AGS) which can economically access the entire spectrum of geothermal and certain oil and gas resources, with the technology enabling operators and developers to retrofit idle wells, expand existing fields with new wells and de-risk the development of new geothermal resources quickly.

Steven Brown, VP Project Development for GreenFire Energy, said, “GreenFire Energy is implementing our patented GreenFire’s GreenLoop technology in geothermal projects across the globe. This partnership has the potential to accelerate geothermal energy developments in New Zealand and Western Canada and expand our reach to bring clean energy and economic vitality to new regions.”

Phil Keele, COO for Stoic’s Calgary branch, commented, “We firmly believe that the alliance between GreenFire Energy and Stoic Transitional Resources encapsulates a transformative energy philosophy that will resonate with the global public. Together, we’re positioned to usher in an era defined by carbon-free, green electricity, that generates gigawatt hours of power while championing environmental stewardship.”

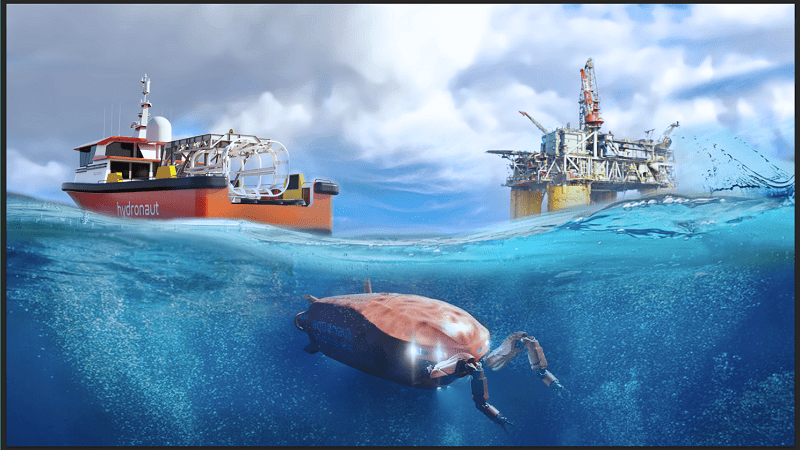

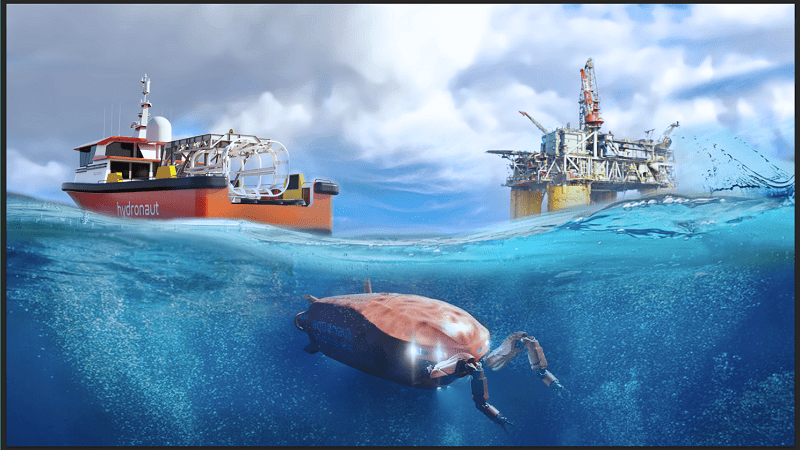

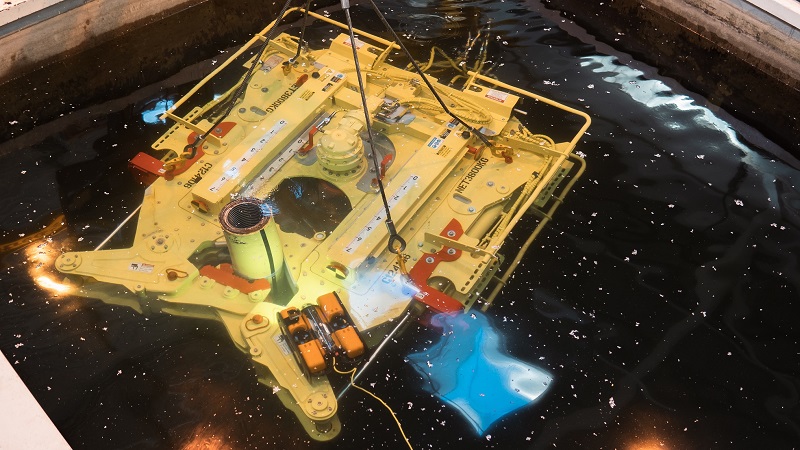

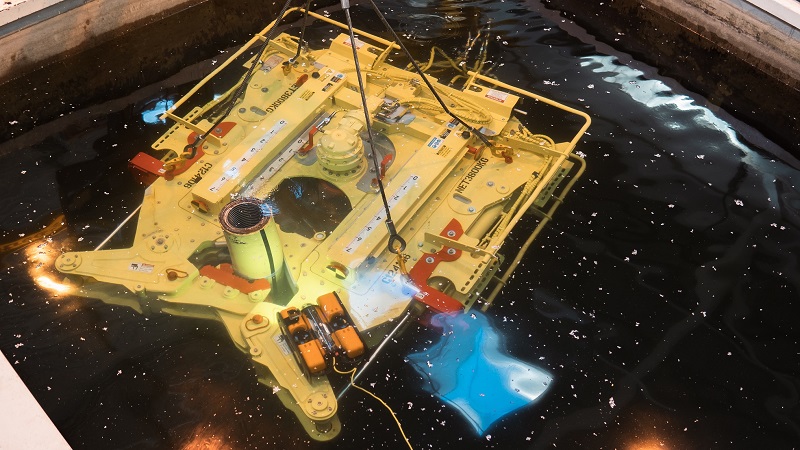

Nauticus Robotics Inc., a developer of autonomous robots for intervention services, has announced it has signed a memorandum of understanding (MoU) with MMA Offshore Limited, a global provider of high-specification vessels and subsea services, for the development of an integrated service offering to provide more cost-effective and environmentally-friendly maintenance to subsea infrastructures in the Asia-Pacific region.

Nauticus Robotics Inc., a developer of autonomous robots for intervention services, has announced it has signed a memorandum of understanding (MoU) with MMA Offshore Limited, a global provider of high-specification vessels and subsea services, for the development of an integrated service offering to provide more cost-effective and environmentally-friendly maintenance to subsea infrastructures in the Asia-Pacific region.

Nauticus’ autonomous subsea robots, Aquanauts, enable the use of smaller service vessels not previously utilised for inspection, maintenance and repair (IMR) work, which MMA owns and operates. By combining their capabilities, the two companies hope to offer a more economical solution to subsea intervention.

Nicolaus Radford, Founder and CEO of Nauticus, said, “This MoU is just one in a series of strategic moves we are making to disrupt autonomous subsea robotics and solidify our place as the industry leader in the field. Aligning with an established industry player, such as MMA Offshore, in multiple offshore markets provides a significant opportunity for Nauticus to continue expanding its reach and international customer base.”

Tom Radic, Executive General Manager Subsea at MMA Offshore, commented, “MMA is excited to have entered into this exclusive partnership with Nauticus Robotics and looks forward to being able to integrate its leading autonomous robotic and AI software technology into its subsea services. This partnership will ensure our clients have access to the latest autonomous and machine learning technology to help meet their subsea requirements.”

Odfjell Technology, an integrated supplier of offshore drilling and well operations, has added wellbore cleaning chemicals to its in-house well services offering in order to streamline supply chain processes.

Previously, wellbore cleaning chemicals were offered to the company’s global customer base via third-party suppliers but the company has sought to streamline this and become more competitive in pricing.

As such, it has launched Ultra-Max Chemical Cleaner and UltraWash Heavy-duty Degreaser as part of its chemical product offering. These are high-performance chemicals designed to quickly and efficiently remove hydrocarbon residues from downhole tubulars, equipment and casing. The non-flammable, non-abrasive and non-caustic formulas eliminate built-up residue on drilling rigs, pumps and equipment.

Cleaner wellbores are crucial to facilitate efficient fluid displacements during hydrocarbon recovery, so they can flow freely.

The Ultra product range is globally compliant with industry standards, receiving the GOLD classifications by the Centre for Environment, Fisheries and Aquaculture Science (CEFAS), meaning the chemicals are safe to use in line with global standards and will not harm the environment

Ian Low, Global Product Line Manager, Well Intervention at Odfjell Technology, remarked, “By bringing these high-grade cleaning chemicals into our in-house wellbore clean-up offering, we will unlock opportunities for new business and projects.

“Launching the Ultra product range enables us to be more competitive in pricing, providing our customers with gold-standard wellbore cleaning at an affordable cost. And as we all strive towards more energy efficiency improvements, our world-class tooling and chemicals will assist in enhancing the efficiency of operations, reducing energy waste and optimising processes to decrease emissions.”

The company stated that by taking control of its costs, broadening its service offerings, and unlocking new avenues, it is cementing its position as a leading provider of offshore services that contribute to safe, decarbonised operations.

Silverwell Technology, a global provider of digitally intelligent gas lift production optimisation systems, has secured a contract with a major national oil company (NOC) in Southeast Asia.

The company will install its digital intelligent artificial lift (DIAL) production optimisation system across multiple oil wells across a three-year contract. The technology will be deployed in challenging operating environments in both brown and green field assets.

DIAL integrates in-well monitoring and control of gas lift well performance with surface analytics and automation in order to continually optimise gas-lifted fields, remotely and without intervention. Already utilised by operators around the world (both on and offshore), it is hoped that the successful completion of this contract will encourage more wide-spread adoption of DIAL by other operations in the region. In pursuit of this, Silverwell has expanded its local footprint by recruiting additional operations staff in Malaysia and Indonesia.

Badroel Rizwan Bahar, Regional General Manager Asia Pacific, surmised, “Our latest multi-well contract provides further evidence of the growing confidence among operators in DIAL’s ability to save them millions of dollars.”

Darrell Johnson, Silverwell CEO, added, “This milestone contract for the large-scale adoption of DIAL enhances Silverwell’s presence in an important geographic market. Around the world, sales of DIAL are increasing as operators seek proven methods to reduce operational expenditure while maximizing asset productivity.”

Thunder Cranes, an offshore crane rental and lifting solution provider, has provided a case study where it delivered lifting support for a standalone E-line well intervention offshore Malaysia.

The unnamed client requested Thunder Cranes assistance on an offshore platform as the existing crane had insufficient lifting capacity for loading and positioning the heaviest component of the E-line equipment from the supply boat to the platform main deck.

After accepting the challenge, Thunder Cranes provided a cost-effective lifting support solution in the form of a TC15 Stiff Leg crane which was deployed on the platform. In addition to lifting the components on deck, the Thunder Cranes crew also helped the well intervention team in skidding and repositioning the E-line equipment to multiple wellhead locations throughout the project.

Thunder Cranes reported that the operation was completed in a timely, safe and successful manner adding that, by deploying the TC15 Stiff Leg crane, the client benefitted from a cost-effective lifting solution that was well-suited to the platform size and need of the E-line contractor. It also avoided costly alternatives such as a lift vessel.

Global well integrity specialist Coretrax is planning for future growth following a slew of recent project wins, with company headcounts rising by 20% to 300 people over the last year.

Global well integrity specialist Coretrax is planning for future growth following a slew of recent project wins, with company headcounts rising by 20% to 300 people over the last year.

The business has expanded operational bases in the US, Middle East, and Southeast Asia, with further growth in the pipeline for the Asia Pacific region with the first senior appointments in Australia. The company expects to recruit a further 50 people this year to meet the demand of projects.

Coretrax has also supported carbon capture (CCS) and geothermal campaigns, seeing significant potential to bring its technological expertise to the lower carbon sector.

John Fraser, CEO of Coretrax, said, “We have experienced growth across our operations and are currently running live projects on 250 rigs in the Middle East, with support provided from our teams in the Kingdom of Saudi Arabia and Dubai.

“In the US, our unique expandable technology is being used to bring wells well on stream, delivering cost savings and efficiencies with international orders mounting up for this technology that can add value in one run.

“In the UK, the majority of our work is in wellbore clean up and plugging and abandonment as we help operators to safely decommission their assets.”

Coretrax continues to invest in research and developments, and currently bolsters more than 50 technologies across its four product lines. With a strong engineering focus, the company brings together a range of solutions into an integrated package to provide a full well lifecycle solution.

International well plug and abandonment specialists, Well-Safe Solutions, are expanding into the Asia Pacific region with the appointment of Massimo Delia as General Manager of the newly created Well-Safe Solutions Pty Ltd.

International well plug and abandonment specialists, Well-Safe Solutions, are expanding into the Asia Pacific region with the appointment of Massimo Delia as General Manager of the newly created Well-Safe Solutions Pty Ltd.

Based in Perth, Australia, Massimo joins the company with more than 20 years of subsea commercial and engineering experience.

Commenting on his appointment, Massimo said, “I have watched Well-Safe Solutions go from strength to strength in Europe, with the growth of its Subsurface and Well Engineering team capabilities and the mobilisation of all three well plug and abandonment assets for the first time in the company’s history being just some of the recent highlights.

“I am eager to play my part in the next chapter of the company’s growth and look forward to collaborating with my colleagues, clients and stakeholders in the UK and Australia.”

Phil Milton, Chief Executive Officer of Well-Safe Solutions, said, “Working in tandem with the wider Well-Safe Solutions team, Massimo will be instrumental in leveraging our capabilities and track record to partner with operations and stakeholders throughout Australia and Asia.

“We’re looking forward to undertaking offshore and onshore well decommissioning projects with the input of the highly experiences engineering sector and supply chain already present within the region.”

In the initial assessment of Australia’s offshore oil and gas decommissioning liabilities, the Centre of Decommissioning Australia (CODA) has identified more than US$50bn worth of work ahead – with well P&A and pipeline removal the majority of the estimated spend. This includes the abandonment of more than 1,000 offshore wells, in addition to a significant onshore market.

With more than 400 wells worldwide featuring Well-Safe Solutions’ engineering expertise and more than 70 wells either decommissioned or to be decommissioned by the business in the North Sea alone, the company is well-placed to deliver on its mission to provide safe, efficient and collaborative well plug and abandonment operations in the Asia Pacific region.

While the oil and gas industry in Southeast Asia is looking ahead to an impressive array of merger and acquisition deals, the region cannot forget its ever-growing decommissioning and abandonment (D&A) liabilities. Approximately 200 offshore fields in Southeast Asia, comprising more than 1,500 platforms and 7,000 plus wells, are likely to stop producing by 2030.

While the oil and gas industry in Southeast Asia is looking ahead to an impressive array of merger and acquisition deals, the region cannot forget its ever-growing decommissioning and abandonment (D&A) liabilities. Approximately 200 offshore fields in Southeast Asia, comprising more than 1,500 platforms and 7,000 plus wells, are likely to stop producing by 2030.

Sustainable D&A practices now stand more relevant than ever as a recently released IEA report predicts that high prices and security of supply concerns highlighted by the global energy crisis is hastening the shift towards cleaner energy technologies. Circumstances have led analysts from Goldman Sachs to revise its bullish prediction of the Brent crude price hitting US$100 by mid-2023 to finish as low as US$86 this year. Such waning confidence in the future oil price and demand in the face of the growing energy transition especially calls for serious consideration of end-of-life responsibilities by operators.

To navigate the elaborate and often complicated process of D&A, operators must follow clear regulatory regime, which is the only way to understand their liabilities. To establish an effective regulatory framework, it may help Southeast Asia to play catch-up with foolproof guidelines and processes already in place elsewhere, such as the UK or the Gulf of Mexico. Chevron and Shell are currently collaborating with Thai and Bruneian regulators respectively through knowledge transfer and pilot project initiatives.

While Southeast Asia is following international conventions such as the International Maritime Organisation Guidelines (IMO) and the United Nations Convention on the Law of the Sea (UNCLOS), it has also adopted new clauses along with these to make them region-specific. For example, the area of ‘pipelines’ is an addition by the ASEAN Council of Petroleum – otherwise absent in the global frameworks – to allow export pipelines to be left in situ, provided that there is no history of pipeline spanning, or movement of the seabed.

A cheap alternative to the costly affair of decommissioning, the Rigs to Reefs programme has the potential to benefit marine life as well. The rig-to-reef way of D&A can spare companies a significant capital. In the Asia-Pacific region, an average 6,000-ton oil platform will cost approximately US$35mn to completely remove, notes an Asia-focused research website. However, D&A via the rigs-to-reefs approach would cut that amount in half, with an average saving of up to nearly US$22mn per platform decommissioned, according to decommissioning expert Brian G Twomey.

InterMoor, a brand in Acteon’s engineering, moorings and foundations division, has been awarded a decommissioning contract by Chevron Thailand Exploration and Production (CTEP).

Following InterMoor’s completion of Phase 1 decommissioning work in 2021 in the Gulf of Thailand, CTEP has extended InterMoor’s field decommissioning contract by adding more packages for the disconnection and removal of pipelines.

InterMoor’s scope of work after the extension includes project management engineering, procurement and offshore execution; disconnection and removal of pipelines; disconnection and removal of single point mooring (SPM) and associated subsea infrastructure; and topside modifications work.

InterMoor will use cutting tools provided by its sister company, Claxton. Aquatic will provide subsea umbilicals, risers and flowlines (SURF) recovery equipment and UTEC plans to provide the survey spread.

The Asia Pacific oil and gas industry, making use of a period of relative oil price stability and seemingly maintained future demand, is increasingly looking to ramp up production rates which, in light of a rapidly approaching decommissioning wave, is leading to a thriving oilfield services market.

A period of stability is something the oil and gas industry has been yearning for ever since the outbreak of Covid-19 which, in the first quarter of 2020, burst onto the global arena in a devastating manner. But after a period of volatility driven by the pandemic and geopolitical developments in eastern Europe, the oil price has finally stabilised, settling at around US$80 per barrel across most benchmarks. From here, commentators such as Goldman Sachs and Fitch Ratings have predicted prices to maintain stable across 2023 and even hit US$100 by the end of the year.

One of the reasons for this security is a growth in oil demand, driven primarily by the re-opening of China at the start of the year. While the incessant rise of renewables has caused many to doubt the future prospects of fossil fuels as the world strives to its collective net zero ambition, according to OPEC’s 2022 World Oil Outlook 2045 energy demand will increase from 285.7 million barrels of oil equivalent per day (mboe/d) in 2021 to 351 mboe/d in 2045 at an increase of 23%. To meet this, the report suggests renewables will not be sufficient by themselves and oil and gas must continue to be exploited to meet the world’s needs. In view of this, it forecasts that by 2045, oil could retain a 29% share in the energy mix and gas would meet 24% of it. This translates to oil demand rising to 109.8mb/d in 2045 – in this scenario it must also be remembered that the expansion of production rates must also come alongside an extra 5 mb/d being added every year just to maintain current production rates, given an average industry decline rate of around 5%.

This is translating to a solid future for the global oil and gas industry and, in light of this, the Asia Pacific community is looking to increase its production rates – especially as the region consumes 35% of the world’s oil while supplying just 8% of its production. To do so, it is turning to its reliable tool of drilling but also on less-utilised methods such as well intervention. The latter is also being spurred by the region’s offshore oil well stock moving ever-closer to end-of-life with, according to a Wood Mackenzie 2018 report, more than 380 fields expected to cease production in the next decade.

Decom Engineering (Decom) has kicked of the new year with numerous project wins and work scopes valued in excess of seven figures.

Decom Engineering (Decom) has kicked of the new year with numerous project wins and work scopes valued in excess of seven figures.

The decommissioning specialist has secured new projects in Africa, Norway, Thailand and Singapore, while strengthening existing ties in Malaysia.

The UK-based company will mobilise chop saws and supporting crews in Q1 2023 to support campaigns in the Gulf of Thailand, and over in the Democratic Republic of the Congo, Decom will provide a C1-24 chop saw with hot slab functionality to assist in the recovery of a production jumper in depths of up to 1,000 m. The acquisition of this work scope came about after Decom was able to successfully prove its technology could success where others had failed.

In Norway, the company will provide support through a tier 1 contractor to a major operator during the summer campaign to cut concrete coated pipelines with its new C1-46 chop saw.

Decom Engineering Managing Director, Sean Conway, commented, “It is an encouraging start to the year to have an array of international work on the books, and it confirms that out chop saws and operational cutting expertise is seen as an integral component of complex subsea asset recovery and decommissioning projects.

“Our strategy is to continue investing in expanding the capabilities of our chop saws to meet the technical challenges faced by clients, and we are in the process of developing a larger chop saw, capable of cutting piping infrastructure up to 46” in diameter.”

T7 Global Berhad, an energy solutions provider, has secured two contracts worth approximately RM100mn (around US$23mn) from PTTEP Group of Companies and Hibiscus Oil & Gas Malaysia Limited.

The work with PTTEP includes the provision of headhunting and recruitment services while the second letter of award, from Hibiscus, is for the provision of facilities decommissioning services for South Angsi Alpha.

T7 Global Group Chief Executive Officer, Tan Kay Zhuin, commented, “The Hibiscus award marks an important milestone for the Company to execute offshore facility decommissioning projects of such scale. There is initiative for rig-to-reef by converting the structures into artificial reef to enhance the marine habitat at the intended location. We see this as a sustainable approach for oil & gas operators moving forward which can contribute to their Environmental, Social and Governance (ESG) agenda. Over the next few years, we will be on the lookout for more ESG related projects in the region.”

Page 6 of 11

Copyright © 2025 Offshore Network